During the 22nd Annual International AML and Financial Crime Conference, ACAMS asked its members numerous polling questions on various pertinent AML/CTF topics. Here is what members had to say.

Monday: Regulatory Roundtable

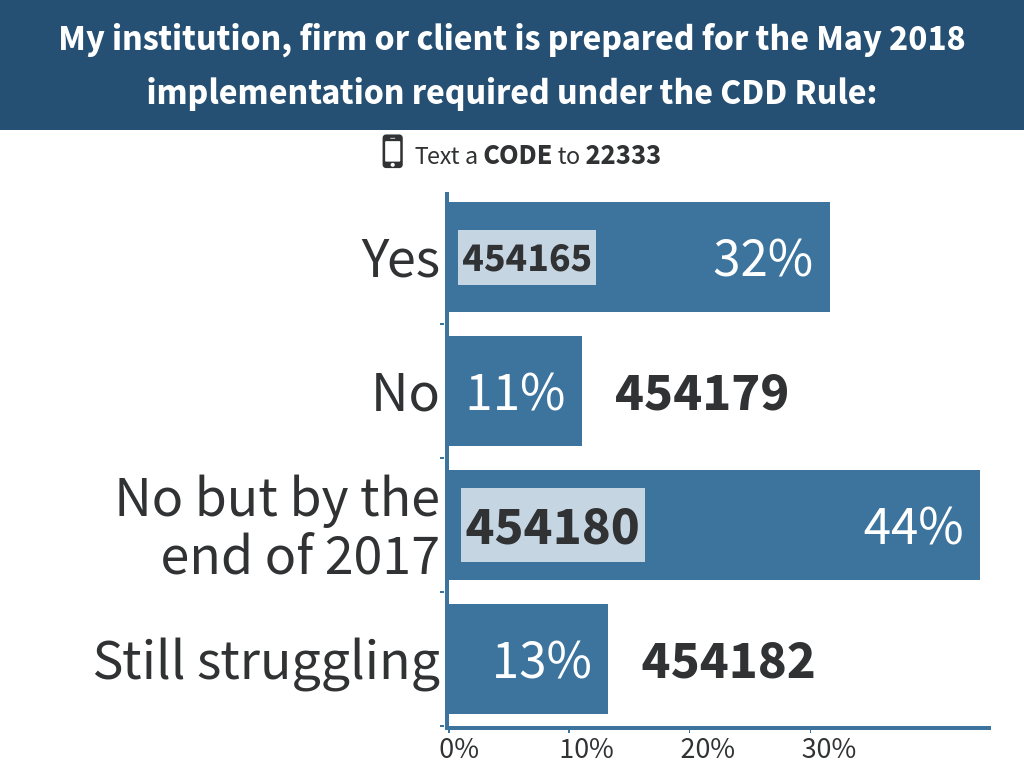

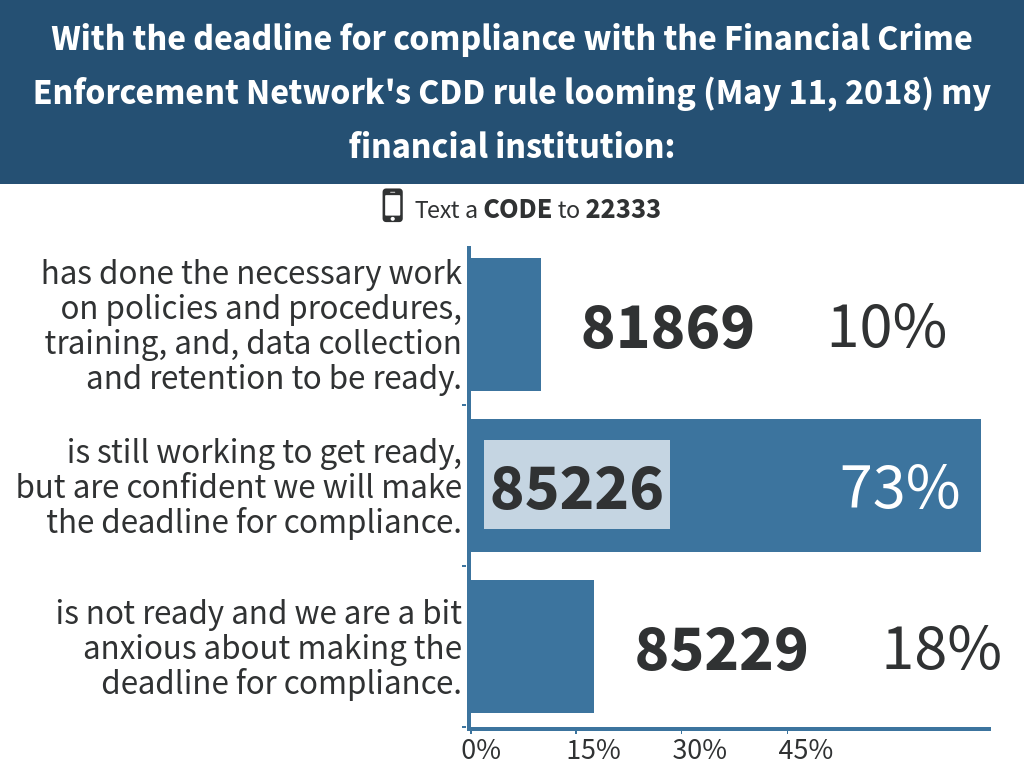

During the Regulatory Roundtable on recent U.S. and global compliance efforts and rule changes that affect anti-money laundering (AML) coverage, members were asked the following two questions. The most notable poll results were from the first question, which showed that 44 percent of the audience would be ready by the end of 2017 for the May 2018 implementation under the CDD Rule.

Monday: Financial Inclusion and De-Risking

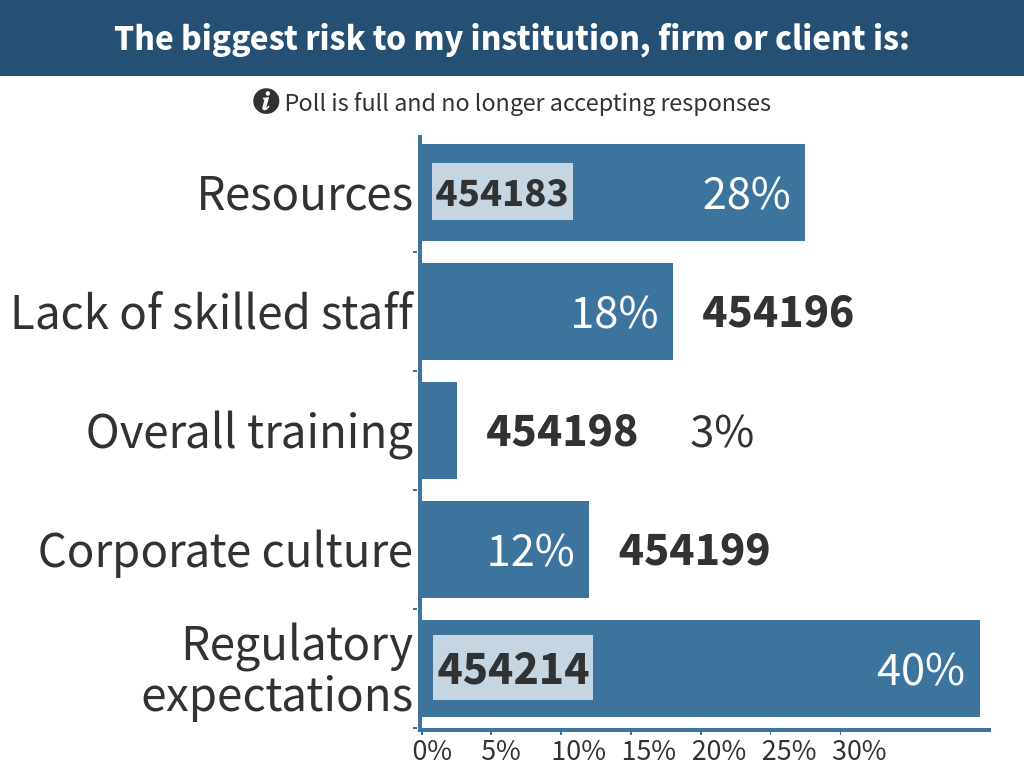

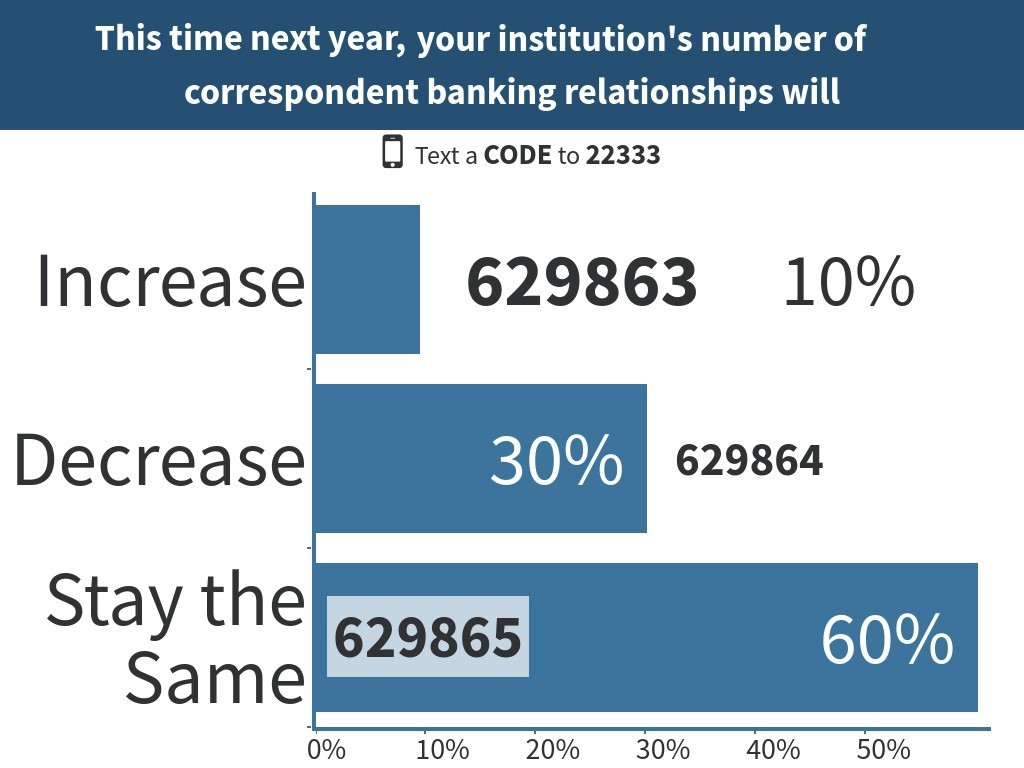

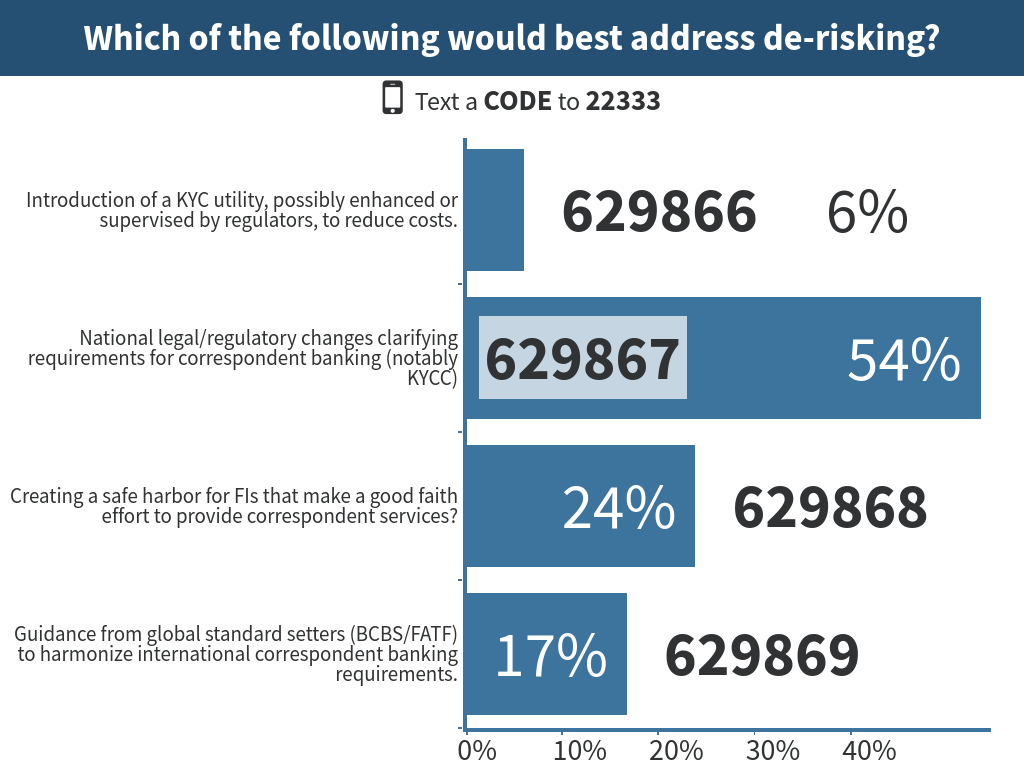

The next session on financial inclusion and de-risking, clarified the current regulatory guidance on risk and how to adjust it to AML models. The most notable response received was for the second question, where 54 percent of participants said that national legal/regulatory changes clarifying requirements for correspondent banking would best address de-risking.

Monday: Hot Topics in AML and Financial Crime

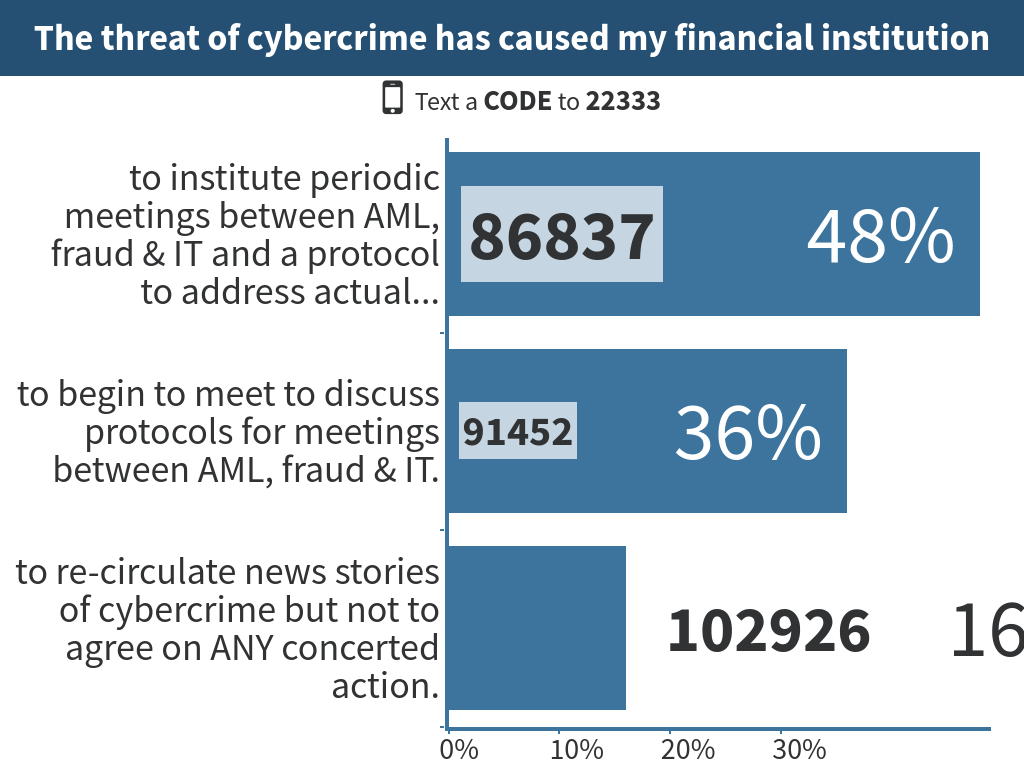

Later in the afternoon, a select team of experts, who discussed specific issues involving compliance, AML and financial crime asked members what their financial institutions have done as a result of cybercrime threats—48 percent said their financial institution instituted periodic meetings between AML, fraud and IT.

Monday: Personal Liability

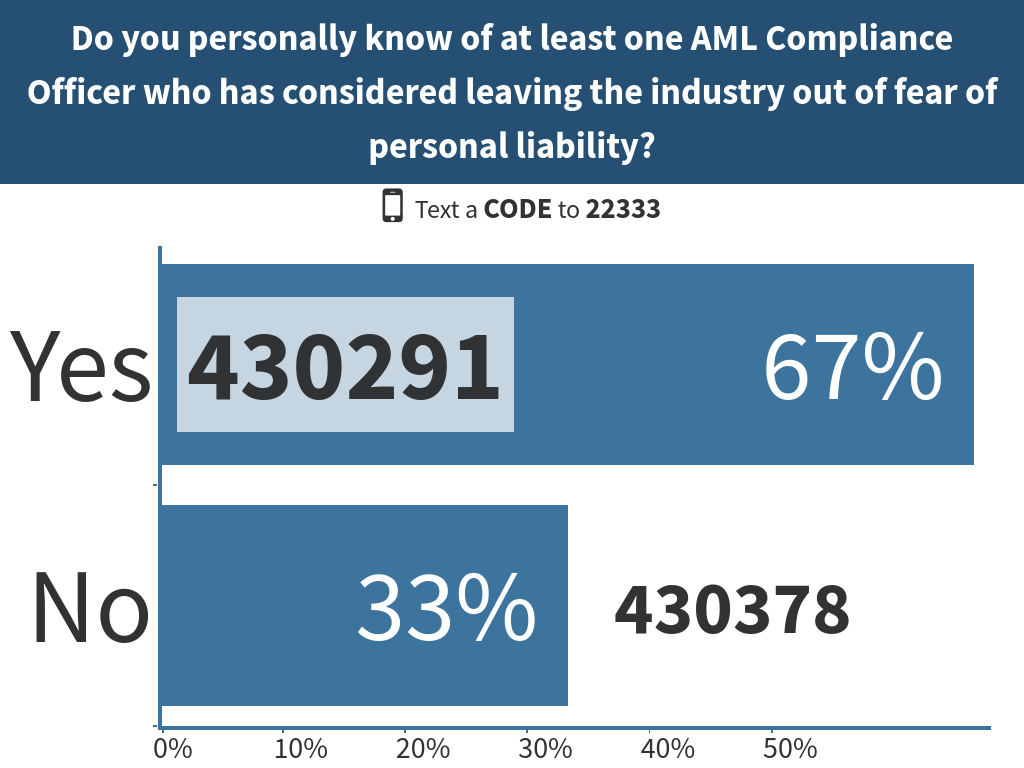

During one of the last sessions on Monday titled “It Could Happen to You: Guarding Against Potential Personal Liability,” 67 percent of participants said they know of at least one AML compliance officer who has considered leaving the industry out of fear of personal liability.

Tuesday: Choreographies of Corruption

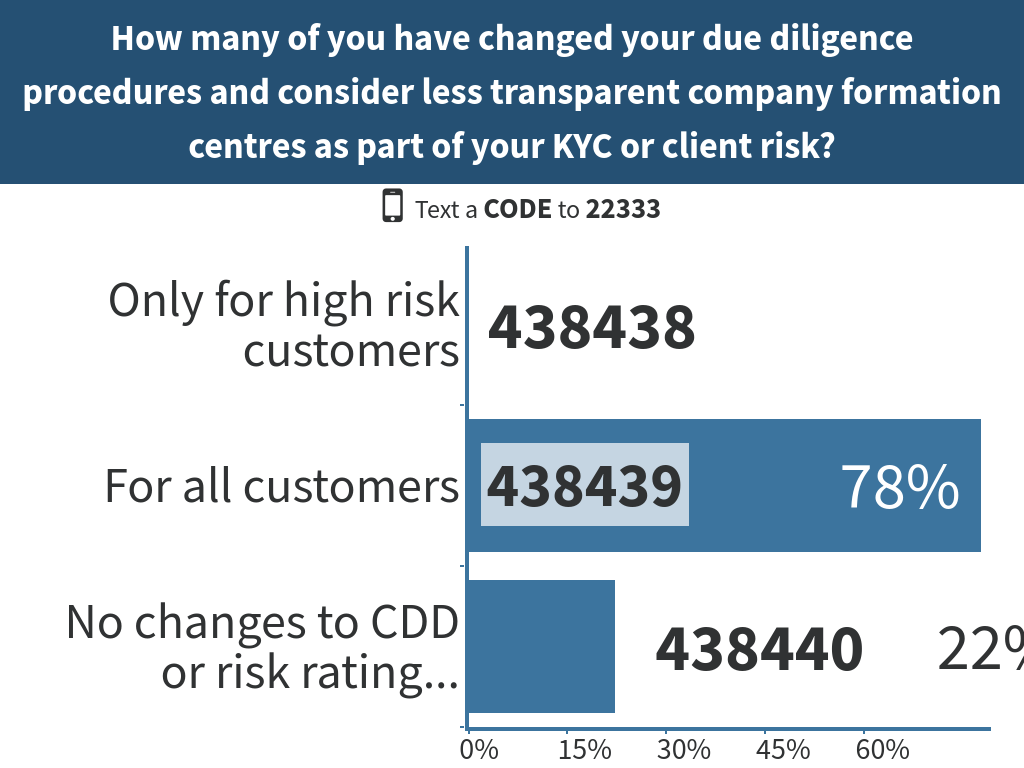

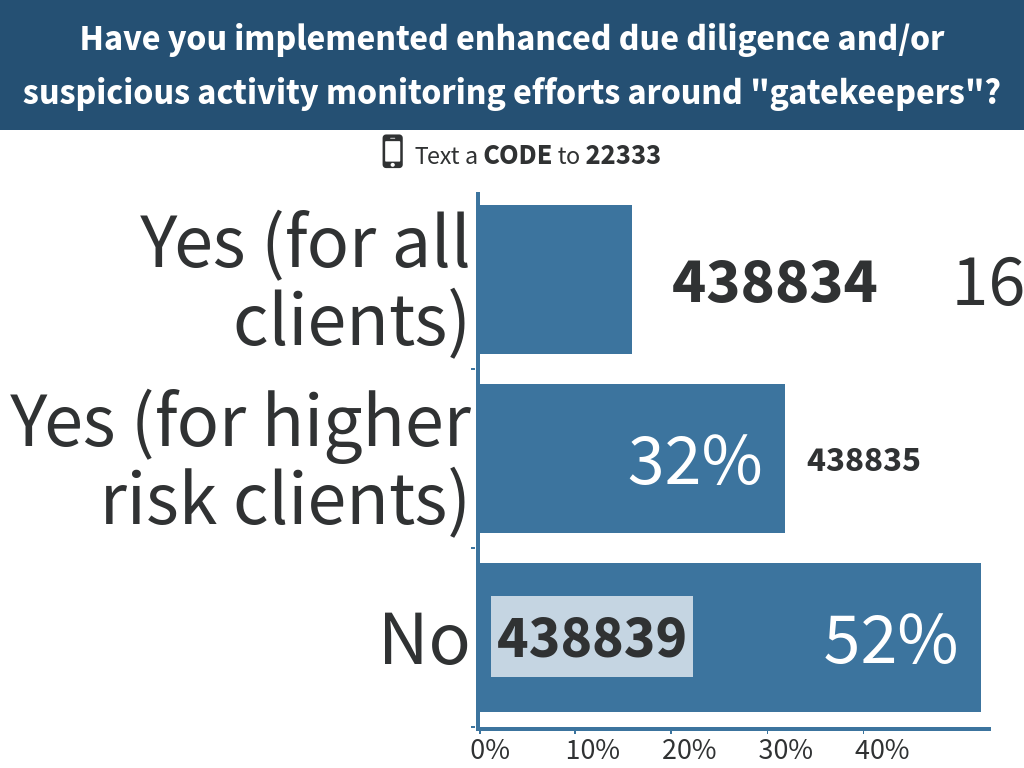

The conference on Tuesday kicked off with a panel discussion on the Panama Papers, the Bahama Papers and FIFA. Three polling questions were asked during the panel. The most interesting response came from the gatekeeper poll question where 52 percent of participants said that they have not implemented EDD and/or any suspicious activity monitoring efforts around gatekeepers.

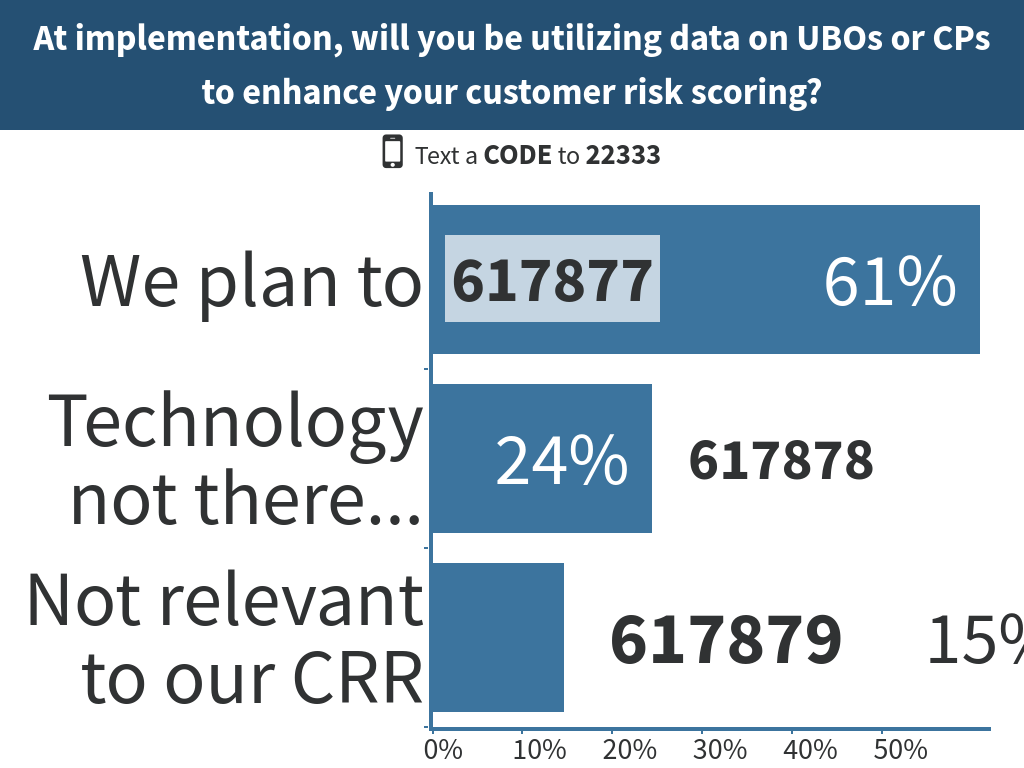

Tuesday: Taking Ownership of Determining Ultimate Beneficial Ownership

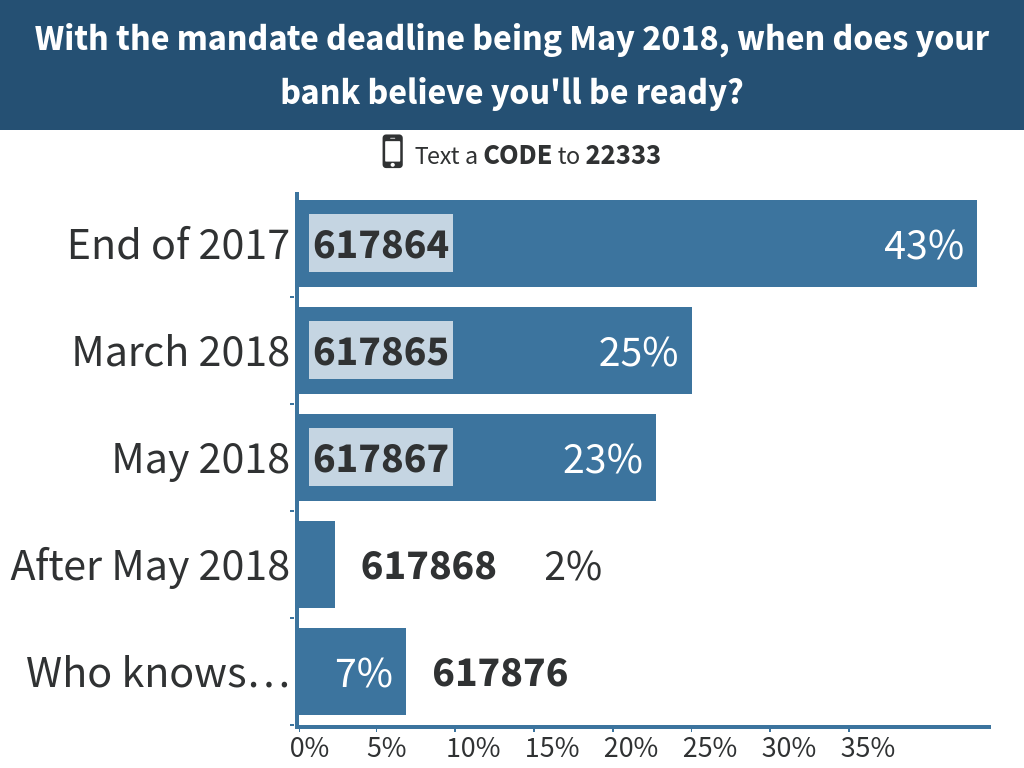

With discussion surrounding FinCEN’s Final CDD Rule and ultimate beneficial ownership, 23 to 25 percent of participants said their financial institutions will be ready to meet the May 2018 mandate deadline by March or May 2018 and 43 percent of participants said they will be ready by the end of this year.

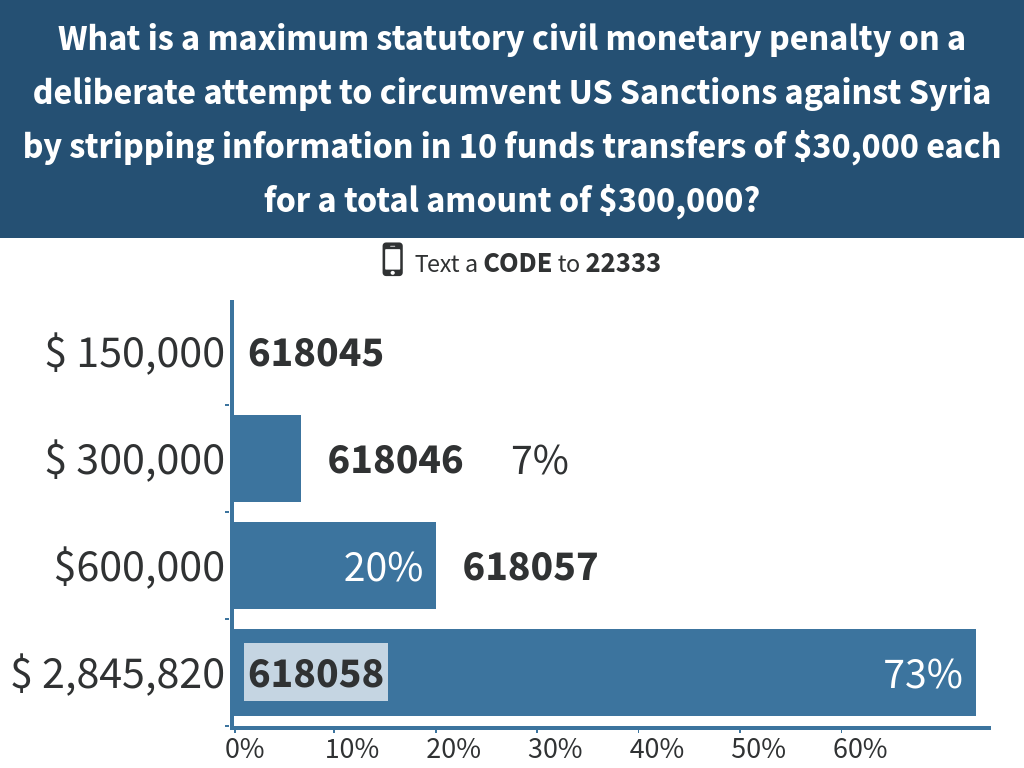

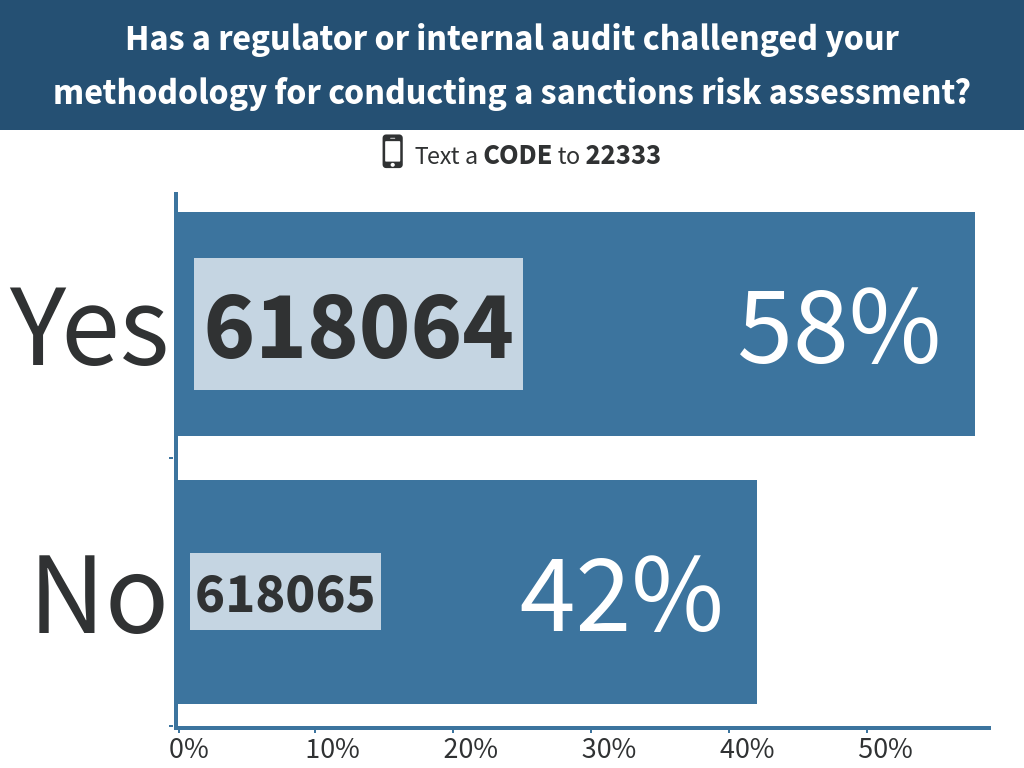

Tuesday: Sanctions Insight

During the Sanctions Insight panel, which discussed risk-based approaches and sanctions-related issues, participants were asked three polling questions. When asked whether their regulator or internal audit has challenged their methodology for conducting a sanctions risk assessment, 58 percent of participants said yes while 42 percent said no.

Wednesday: To Follow That SAR

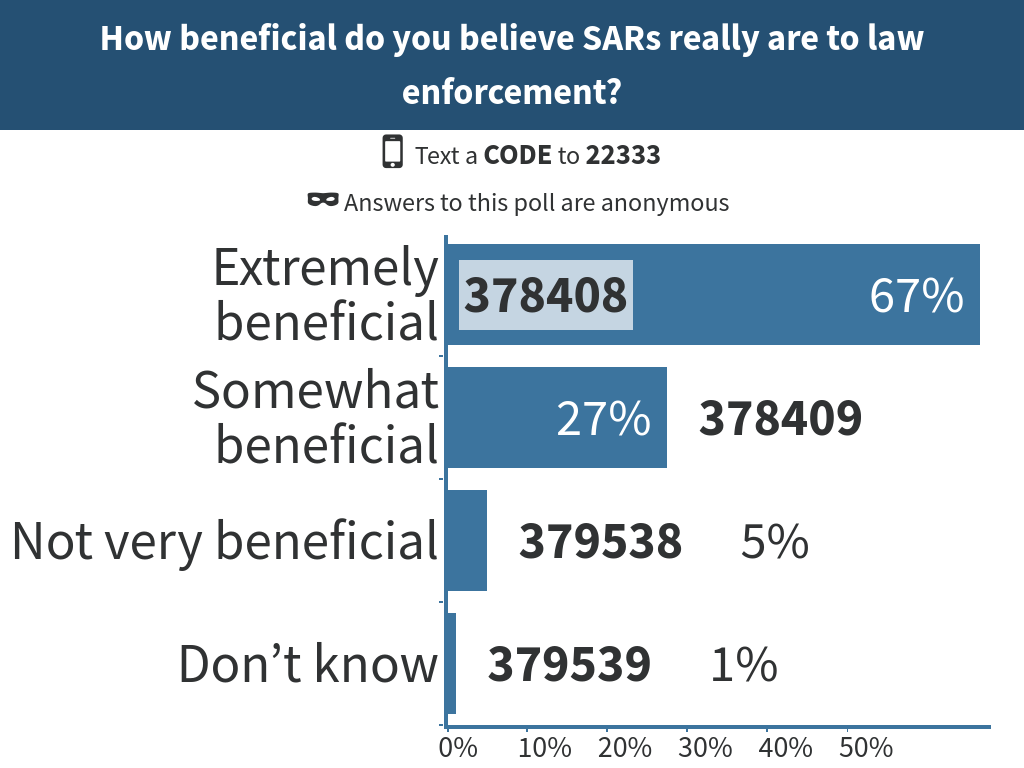

On day three of the Hollywood Conference, presenters during the “To Follow That SAR” panel discussed how to produce a quality SAR narrative to aid regulators and law enforcement investigators. When asked how beneficial participants believe SARs are to law enforcement, 67 percent of the audience said “Extremely beneficial.”

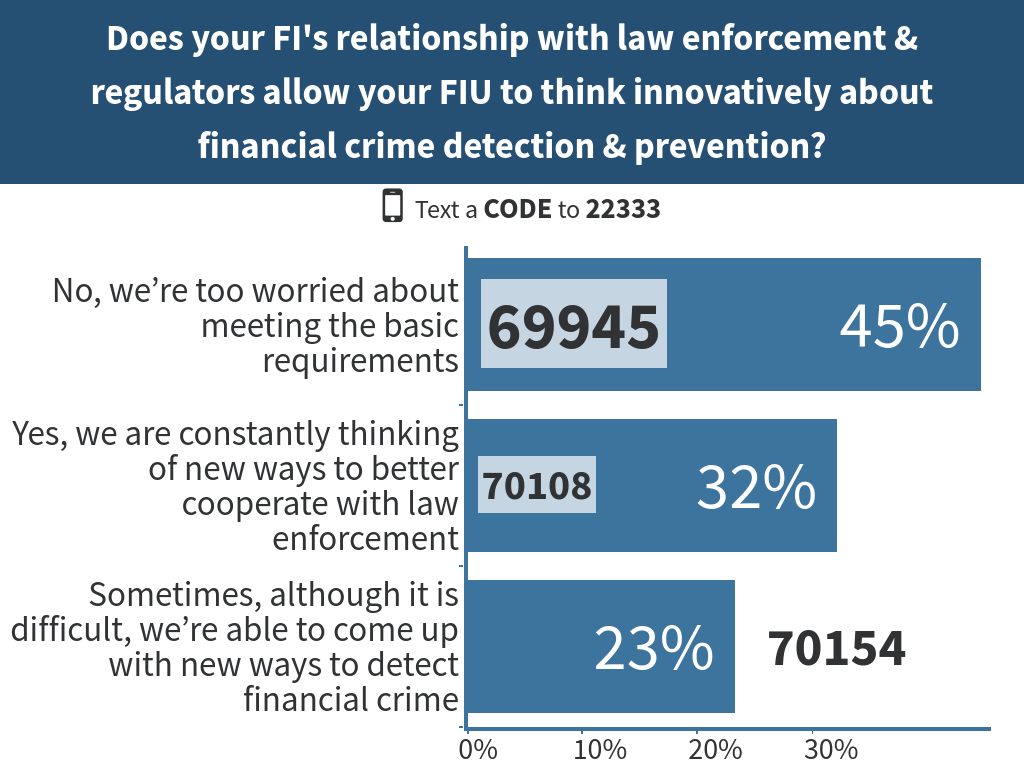

Wednesday: AML’s Future

It is interesting to note one of the last poll questions asked during the session “AML’s Future,” where presenters discussed how to deal with unique AML challenges of innovative businesses, such as crowdfunding, Fintech and internet-based retail operations. When asked whether participants’ relationship with law enforcement and regulators allows their FIU to think innovatively about financial crime detection and prevention, 45 percent of participants said “No, we’re too worried about meeting basic requirements.”