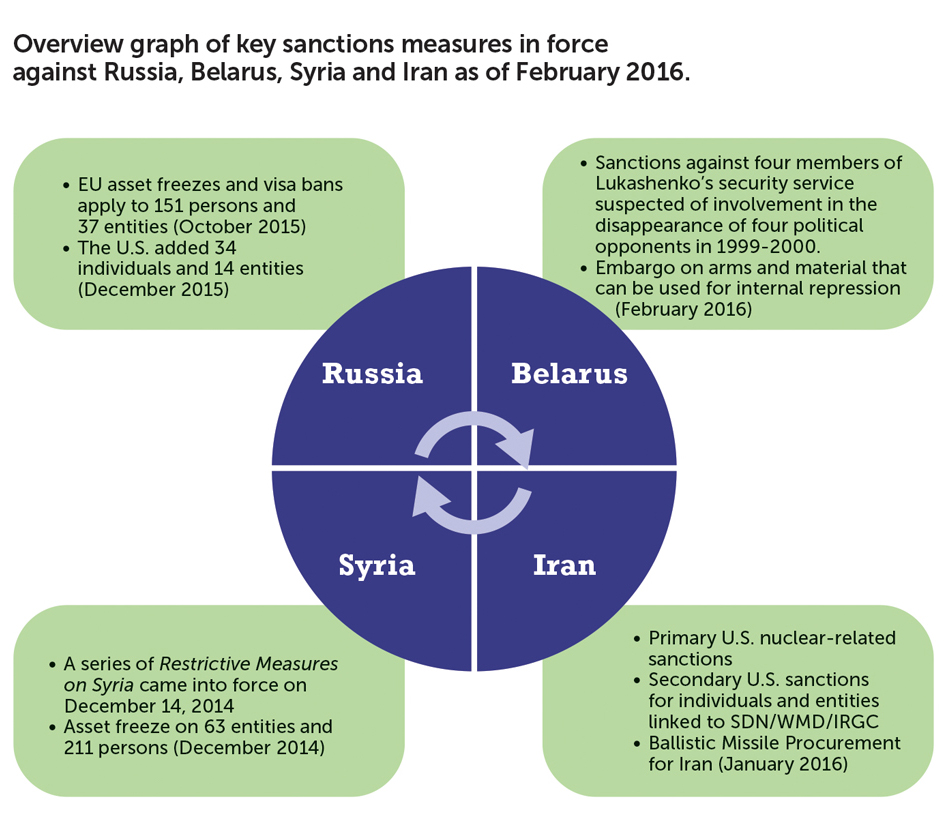

The following article elaborates on the sanctions in force against Russia, Syria and Iran as well as those recently lifted against Belarus in March 2016, and highlights the link to exposure faced by institutions in this regard in relation to anti-money laundering and counter-terrorist financing (AML/CTF).

In particular, this article focuses on the changes to the Iran sanctions regime following Implementation Day on January 16, 2016, and the challenges attached to mastering the exemptions to the overall alleviations, which continue to remain in force.

Finally, the risk of AML/CTF exposure in dealing with sanctioned countries and the necessary vigilance delivers some takeaways in relation to risk assessment and enhanced due diligence (EDD) requirements.

Recent High Profile European Cases

Failure to meet sanctions obligations has seen German, French and U.K. banks implicated in large-scale investigations, which resulted in significant fines. Below are examples of these failures.

- March 2015—Commerzbank agreed to pay $1.45 billion in relation to failures in its sanctions and money laundering programs, making it the third largest case in Europe. France's BNP Paribas SA agreed to pay nearly $9 billion in June 2014 and the U.K.'s HSBC PLC put down nearly $2 billion in late 2012 on the grounds of similar allegations.1

- October 2015—France's largest retail bank paid $787 million to U.S. authorities to avoid criminal and civil charges that it violated economic sanctions and state record keeping rules. Over the course of five years, Crédit Agricole SA and its subsidiary Crédit Agricole Corporate and Investment Bank, which until 2010 operated under the name "Calyon," moved approximately $312 million through the U.S. financial system on behalf of blacklisted entities in Sudan, Iran, Myanmar and Cuba, according to federal and state regulators.

- November 2015—Deutsche Bank agreed to pay the U.S. state and federal regulators $258 million to resolve allegations that its Manhattan branch knowingly processed billions of dollars of banned transactions for banks and parties in Iran, Libya, Syria, Myanmar and Sudan, despite sanctions designations by the U.S. Treasury Department's Office of Foreign Assets Control (OFAC).

Not least due to these cases, the topic of sanctions has been at the top of the agenda for financial institutions for well over a year now and also as a result of the political conflicts in Eastern Europe and the Middle East.

The most complicated sanctions facing European institutions and organizations relate to the Russia/Ukraine sanctions and sanctions regimes across the Middle East. The sanctions are far-reaching but also very targeted which makes know your customer measures necessary to meet sanctions requirements complicated. This often requires in-depth investigations in order to manage the risks.

The greatest risk in relation to sanctions breaches is the use of intermediaries and other means to hide the ultimate customer or use of a product. Thus, transactions whereby a transfer of ownership takes place and more than one party is involved may be used to disguise the true reason behind a transaction.2 Trade finance transactions are well-suited to these types of activities.

Russian Sanctions

In response to the annexation of Crimea and the destabilization of a neighboring sovereign country, the EU and U.S. imposed restrictive measures against the Russian Federation. The sanctions are very comprehensive and targeted. On February 16, 2015, the EU increased its sanctions list to cover 151 individuals and 37 entities and the U.S. expanded their list to include an additional 34 individuals and 14 entities3 on December 22, 2015.4

Following the attacks in Paris in November 2015 and Russia's declared support in combating the Islamic State of Iraq and the Levant (ISIL), some media reports are already raising the question as to whether this new common ground with the U.S. and the EU on fighting international terrorism may help remove sanctions against Russia going forward. In November 2015, Forbes even went so far as to say that, "Under such dire circumstances, it will be hard to see European leaders agreeing to continue sanctions on Russia beyond July 2016. Russia has gone from foe, to friend."5 The same article quoted the Bretton Woods Research founder, Vladimir Signorelli, who added, "While January is likely too early to see the end of Russian sanctions, which began last year due to Moscow's involvement in supporting separatists in east Ukraine, odds are high that Russia could see a discussion on the rollback of sanctions soon."6 However, in late December, the EU announced that it would extend its sanctions by six months, due to lack of progress on the implementation of the Minsk peace agreement.7

In January 2016, the U.S. was seen by some media sources to be signaling sanctions relief for Russia should Russia take substantial steps to implement the Minsk agreement and quoted the U.S. State Department coordinator for sanctions policy, Daniel Fried, as stating that in the "case of settlement of the conflict in Donbas the United States could remove common sanctions against Russia" whilst keeping the Crimea sanctions in place.8 Some experts remain skeptical.9

Belarus Sanctions

EU sanctions, including travel bans, asset freezes, embargo on arms and material that can be used for internal repression "were first imposed on Belarus in 2004 on the basis that the European Union was concerned by the disappearance of four political activists in 1999 and 2000."10 Categories of individuals and entities targeted by the restrictive measures are:

- Supporters including financiers of the Lukashenko regime as well as companies, entities and subsidiaries associated to him

- Judges and prosecutors who are said to have been involved in human rights violations

- Military commanders believed to be involved in internal repression11

In November 2015, the EU, in what was described as the biggest push yet to improve ties with the Minsk government, suspended a large part of its sanctions against Belarus, including some against Lukashenko (travel ban and asset ban).12

Although some diplomats say they believe the EU is rewarding the Belarus regime prematurely and that neither Lukashenko's human rights record nor his foreign policy approach is likely to shift significantly over time, the decision was taken on February 2016 to not reinstate the sanctions against Belarus.13 The largest part of the sanctions will thus be lifted on March 1, 2016.14

As of this writing, the EU had maintained the arms embargo against Belarus. Sanctions against four members of Lukashenko's security service suspected of involvement in the disappearance of four political opponents in 1999-2000 also remain in place.15

Syria Sanctions

The U.S. State Department designated Syria as a State Sponsor of Terrorism in December 1979. In 2004, the Office of Foreign Assets Control (OFAC) implemented its Syria sanctions program. The U.S. restrictive measures respond to the Syrian government's apparent support for terrorists groups and its intent to pursue weapons of mass destruction (WMD) and missile programs amongst others. In response to the continued violence and human rights violations ongoing in Syria since March 2011, the sanctions program has been expanded making the Syria sanctions program one of OFAC's most comprehensive sanctions programs. However, in 2013, relief actions were undertaken in order to provide support to the Syrian opposition and the Syrian population.16

However, following the outbreak of the civil war in Syria, a series of restrictive measures on Syria came into force on December 14, 2014, including trade and finance sanctions, travel bans and asset freezes. Asset freezes were imposed on 63 entities and 211 persons responsible for or believed to be associated with the human rights violations against the Syrian population and against those thought to be supporters or benefiting from the regime.17

Iran Sanctions

On July 14, 2015, Iran and the P5+1 group of countries comprising the U.S., Russia, China, France and the U.K., plus Germany, signed the Joint Comprehensive Plan of Action (JCPOA) agreement, which offers the relief of sanctions in exchange for guarantees regarding the peaceful nature of Iran's nuclear program. On Implementation Day, January 16, 2016, the day on which the International Atomic Energy Agency verified that Iran implemented its nuclear-related commitments, the EU18 and the U.S.19 took the actions necessary to lift sanctions.

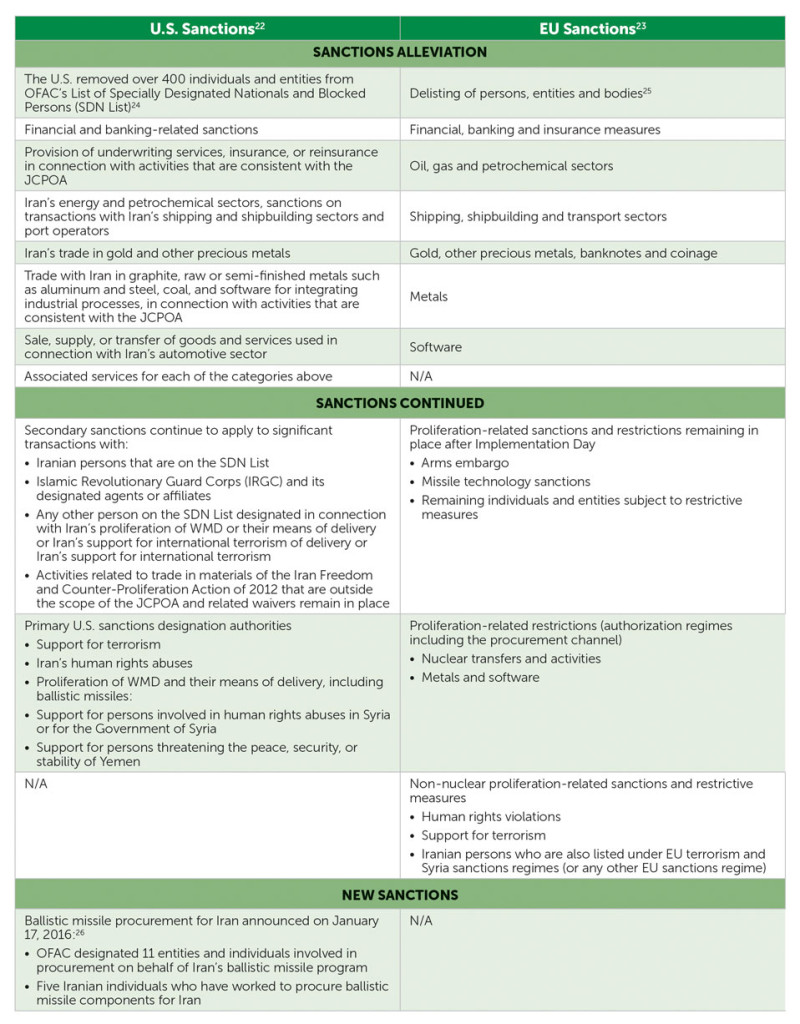

The EU has lifted the largest amount of sanctions

The EU has lifted the largest amount of sanctions with exceptions in certain areas, whereas the U.S. has lifted the largest amount of sanctions only in relation to non-U.S. entities and individuals (secondary U.S. sanctions), keeping in place, however, a number of exemptions (primary U.S. sanctions), which makes the implementation complicated and requiring an assessment on a case-by-case basis in order to ensure that none of the exemptions are being missed and thus increasing the risk of infringing upon the sanctions regime. See the table below for additional details.

Also, although U.S. individuals and entities which continue to be subject to primary U.S. sanctions and are thus prohibited from engaging in transactions or dealings with Iran or its government, case-by-case licensing applications are possible for certain transactions. Also, and notwithstanding the overall lifting of secondary sanctions, secondary sanctions continue to apply to non-U.S. persons when transacting with some defined 200 SDN-listed Iranian or Iran-related individuals and entities.20

The Iranian government and Iranian financial institutions continue to remain persons whose property and interests in property are blocked. Only a select number of exemptions exist or have been authorized by OFAC. Therefore, in most instances, U.S. persons continue to have an obligation to block the property and interests of the Iranian government and its financial institutions regardless of whether or not the individual or entity has been identified by OFAC.21 New sanctions in relation to the ballistic missile procurement for Iran were introduced by the U.S. on January 17, 2016.

Should Iran fail to fulfill its commitments under the JCPOA and should the EU's Dispute Resolution Mechanism not be successful, the EU claims that it will reintroduce the lifted EU sanctions ("EU snapback").27

Also, given that Iran is, according to the Financial Action Task Force (FATF), highly exposed to money laundering and terrorist financing (ML/FT), Iran remains a high risk country subject to enhanced due diligence requirements. It is likely that the FATF will discuss the topic of Iran at its plenary in February 2016.

The sanctions regimes in Syria and Iran are particularly important also in relation to the current terrorist threats facing the EU as a result of ISIL. The following section outlines some key points as presented in the FATF report Financing of the Terrorist Organisation Islamic State in Iraq and the Levant (ISIL), published in February 2015.28

The ISIL Threat Despite Sanctions Relief

As reported in the FATF report, "ISIL seeks to change the political order primarily in the Middle East through its extremist ideology and terrorist violence, and aims to bring most traditionally Muslim-inhabited regions of the world under its political control, beginning with Iraq and the Levant." The report underlines, that ISIL is "attempting to establish a functioning self-sustaining terrorist state."29

Their "operations are distinct from those of most other terrorist organisations, particularly with respect to how they finance their operations….[M]ost of ISIL's funding is not currently derived from external donations, but is generated within the territory in Iraq and Syria where it currently operates."30

Furthermore, the report states that "ISIL's primary sources of revenue are mainly derived from illicit proceeds from its occupation of territory." These sources reportedly include "bank looting and extortion, control of oil fields and refineries and robbery of economic assets. Other sources include the donors who abuse Non-Profit Organisations (NPOs), Kidnapping for Ransom (KFR) and cash smuggling, to new and emerging typologies, such as the extortion of goods and cash transiting territory where ISIL operates and grass-root funding strategies." ISIL has also been "engaging in energy-related commerce with the Syrian regime, despite claiming otherwise."31

In addition, "ISIL currently derives a relatively small share of its funds from donors (relative to its other revenue sources), and thus does not depend principally on transferring money across international borders," the report stated. The organization is organized and operates, in a similar way to some organized crime groups.32 Thus trade-based financing of terrorism is a serious risk.

The FATF report also noted, that it is "unclear if ISIL's revenue collection through the illicit proceeds it earns from occupation of territory, including extortion and theft, will be sustainable over time" due to ongoing Western military action in the region.33

Conclusion: Managing Sanctions and CTF Risk

Due to the targeted nature of the sanctions and the risks of links to terrorist financing it is important to have in place solid risk assessment frameworks for business activities in or related to sanctioned countries and terrorist financing networks.

Organizations should develop appropriate risk assessment tools in order to identify high-risk customers

Organizations should develop appropriate risk assessment tools in order to identify high-risk customers and then subsequently undertake EDD in order to identify not only the direct but more importantly the indirect links to sanctioned entities and individuals. Finally, based on the results of a risk assessment, the implementation of risk mitigation measures and monitoring procedures to manage and minimize sanctions risks exposure is necessary.

- Samuel Rubenfeld and Eyk Henning, "Commerzbank Settles U.S. Allegations of Sanctions and Money Laundering Violations," Dow Jones News, http://uk.advfn.com/stock-market/TSE/7733/share-news/Commerzbank-Settles-U-S-Allegations-of-Sanctions/65833662

- "The Wolfsberg Trade Finance Principles," The Wolfsberg Group, http://www.slideshare.net/JosephSam/wolfsberg-trade-principles-paper-draft

- "In focus: EU Restrictive Measures in Response to the Crisis in Ukraine," Delegation of the EU to Russia, June 26, 2015, http://eeas.europa.eu/delegations/russia/press_corner/all_news/news/2015/20150219_en.htm

- "Treasury Sanctions Individuals and Entities for Sanctions Evasion and Other Activities Related to Russia and Ukraine," U.S. Department of the Treasury, December 22, 2015, https://www.treasury.gov/press-center/press-releases/Pages/jl0314.aspx

- Kenneth Rapoza, "Putin's 'Strategic Blunder' in Syria May be a Boon for Investors," Forbes, November 16, 2015, http://www.forbes.com/sites/kenrapoza/2015/11/16/paris-changes-everything-putins-strategic-blunder-may-be-a-boon-for-investors/#31f0eeff54b4

- Ibid.

- "Putin: Western Sanctions 'Severely' Harming Russia," Newsmax, January 11, 2016, http://www.newsmax.com/Newsfront/putin-economic-sanctions-hurting/2016/01/11/id/708945/

- "U.S. will lift sanctions against Russia if Minsk accords successful, those with respect to Crimea will remain," Interfax-Ukraine, January 18, 2016, http://en.interfax.com.ua/news/general/318145.html

- https://www.stratfor.com/geopolitical-diary/how-us-can-get-russia-and-turkey-talk

- "Belarus," Law and Practice, http://europeansanctions.com/eu-sanctions-in-force/belarus/

- Ibid.

- Ibid.

- "EU Lifts Most Sanctions Against Belarus Despite Human Rights Concerns," The Guardian, February 15, 2016, http://www.theguardian.com/world/2016/feb/15/eu-lifts-most-sanctions-against-belarus-despite-human-rights-concerns

- Robin Emmott, "Europe Ends Sanctions on Belarus, Seeks Better Ties," Reuters, February 15, 2016, http://www.reuters.com/article/us-belarus-eu-sanctions-idUSKCN0VO1TP

- "EU Lifts Most Sanctions Against Belarus Despite Human Rights Concerns," The Guardian, February 15, 2016, http://www.theguardian.com/world/2016/feb/15/eu-lifts-most-sanctions-against-belarus-despite-human-rights-concerns

- "Syria Sanctions Program, OFAC, August 2, 2013, https://www.treasury.gov/resource-center/sanctions/Programs/Documents/syria.pdf

- "Fact Sheet: The European Union and Syria," European External Action Service, http://eeas.europa.eu/statements/docs/2013/131018_01_en.pdf

- "Iran: Council lifts all nuclear-related economic and financial EU sanctions," The European Council, January 16, 2016, http://www.consilium.europa.eu/en/press/press-releases/2016/01/16-iran-council-lifts-all-nuclear-related-eu-sanctions/

- "Statement elating to the Joint Comprehensive Plan of Action 'Implementation Program," U.S. Department of the Treasury, January 16, 2016, https://www.treasury.gov/resource-center/sanctions/Programs/pages/iran.aspx

- "Frequently Asked Questions Relating to the Lifting of Certian U.S. Scantions Under the JCPOA on Implementation Day," U.S. Department of the Treasury, January 16, 2016, https://www.treasury.gov/resource-center/sanctions/Programs/Documents/jcpoa_faqs.pdf

- Ibid.

- "Guidance Relating to the Lifting of Certain U.S. Sanctions Pursuant to the JCPOA on Implementation Day," U.S. Department of the Treasury, January 16, 2016, https://www.treasury.gov/resource-center/sanctions/Programs/Documents/implement_guide_jcpoa.pdf

- See original EU document for details: http://eeas.europa.eu/top_stories/pdf/iran_implementation/information_note_eu_sanctions_jcpoa_en.pdf

- "OFAC Release: JCPOA Iran-Related Designation Listing Removals," OFAC, January 16, 2016.

- See Consolidated list of persons, groups and entities subject to EU financial sanctions current list here: http://eeas.europa.eu/cfsp/sanctions/consol-list/index_en.htm

- "Treasury Sanctions—Those Involved in Ballistic Missile Procurement for Iran," U.S. Department of the Treasury, January 17, 2016, https://www.treasury.gov/press-center/press-releases/Pages/jl0322.aspx

- "Information Note on EU Sanctions to be Lifted Under the JCPOA," January 16, 2016, http://www.ierc.bia-bg.com/uploads/news/files/news_711334453959ff3cc38b3b8d451d8017.pdf

- "Financing of the Terrorist Organisation Islamic State in Iraq and the Levant," FATF, Februrary 2015, http://www.fatf-gafi.org/media/fatf/documents/reports/Financing-of-the-terrorist-organisation-ISIL.pdf

- Ibid.

- Ibid.

- Ibid.

- Ibid.

- Ibid.