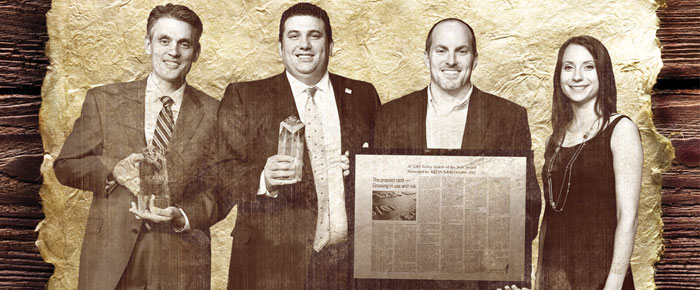

ACAMS is proud of its members and their many accomplishments in the fight against financial crimes. ACAMS annually recognizes a few individuals whose donation of time and talents have significantly impacted the compliance community. In 2012, ACAMS was proud to present awards to four outstanding individuals who through their example and leadership contributed immensely to the betterment of the compliance community. ACAMS Today would like to congratulate Kevin Nash and Dorina Vorincescu, recipients of the ACAMS Today Article of the Year Award; James (Jim) Candelmo, recipient of the ACAMS Professional of the Year Award and Vasilios Chrisos, recipient of the Al Gillum Volunteer of the Year Award.

ACAMS Today spoke with the winners and asked them to share advice, lessons learned and career insight with the ACAMS membership.

Kevin Nash, CAMS is the senior manager for AML Investigations at Capital One Financial Corporation. He leads a team responsible for suspicious activity reporting across Capital One's Credit Card Division, including Capital One's Canada Card, Prepaid Card and Partnership Card businesses. Prior to joining Capital One, Nash spent six years with the Virginia Attorney General's Office as a senior investigator in the White Collar Crime and Medicaid Fraud Control Units. He also has over seven years of law enforcement experience as a patrol officer and detective with the Chesterfield County, Virginia, Police Department.

Dorina Vornicescu started her career at Capital One Financial as an anti-money laundering investigator responsible for a variety of BSA/AML related tasks. She has over four years of experience in banking and compliance and is currently a forensic associate in the advisory practice of KPMG LLP. Vornicescu has conducted several independent assessments of financial institution's BSA/AML compliance programs to assess the overall effectiveness and compliance with regulatory expectations.

ACAMS Today: As a financial crime prevention professional, what would you say is the most rewarding part of your job?

Kevin Nash: For me it is the satisfaction that comes with a request for assistance from law enforcement. In the AML SAR filing space there are many more SARs that get passed over than actually get the attention of law enforcement. It is comforting to get those calls for assistance on a case and it is even more satisfying when the agency you are assisting keeps you in the loop on the outcome of the investigation. Knowing that something our group worked on assisted in the successful outcome of a case makes it all worthwhile.

Dorina Vornicescu: The most rewarding part of my job is being able to help provide financial institutions with ideas and recommendations to improve their AML programs after assessing their program. This in turn will hopefully aid the financial institutions to stay ahead of the criminals and be able to mitigate against financial crimes.

AT: What advice would you give future financial crime prevention writers?

KN: I simply recommend that they be engaged with the subject matter that they are going to write about and try to write it from a common sense perspective.

DV: My advice is to focus on a topic that they are passionate about and also, as much as possible, provide the readers with examples from your personal experience.

AT: What is your favorite article from the ACAMS Today?

KN: If I said Dorina's and mine would that be too obvious? I do not know that I have one favorite article. I enjoy reading the various viewpoints offered by all of the diverse AML professionals that participate in writing for ACAMS Today.

DV: One of my favorite articles is Train like a Champion by Yashica N. Whitehead. The message in the article was clear, concise and very useful.

AT: What topics would you like to see covered in the ACAMS Today in 2013?

KN: Anything related to the ever-changing regulatory landscape of AML programs. Given the number of enforcement actions and penalties leveraged recently, it is always good to hear of things that may be coming down the examination pipeline, in an effort to be as prepared as possible.

DV: I would like to see more articles on investigations that have led to interesting discoveries of suspicious activity patterns and trends.

James Candelmo, CAMS is the executive compliance director and BSA/AML officer for Ally Financial Services. Candelmo is responsible for all anti-money laundering investigations, operations, programs and global sanctions as well as other compliance activities.

Before joining Ally, Candelmo was the deputy criminal chief (Terrorism/National Security) for the United States Attorney's Office in Raleigh, North Carolina, where he was responsible for investigation and prosecution of all national security cases. Prior to that, Candelmo served as a senior trial attorney with the Department's elite Counter Espionage Section and Fraud Section. He is a veteran of both the Department's New England Bank Fraud Task Force and San Diego Bank Fraud Task Force.

AT: In your current role as executive compliance director, what are the three biggest challenges faced by compliance professionals when handling financial crimes?

James Candelmo: In the area of financial crimes the speed of change has to be one of the biggest challenges out there. Whether it is regulatory change, fraud methodologies or AML typologies things move very quickly in our industry. When you consider that our ability to meet many of these challenges is dependent on operating in a corporate structure with appropriate governance and change management—you have to have great people—strong executive support, rock solid policies and procedures, all this is needed to be able to address these challenges.

Coming in a close second is an organizations ability to intelligently implement technological solutions. We have come to a point where technology permits us to do so much with our programs. The problem is that the technology does not and cannot take the place of knowing your business and your customers. In this way, they are only enablers. Unless you can implement technology in a strategic and thoughtful manner, you end up creating more problems than you are solving and the problems that you create are extremely complex. In this way it is so important to have great analytical insight into all AML and fraud tool development and implementation.

Last but not least, we are at a crossroads in dealing with the seemingly eternal question of AML and fraud convergence. Today, it really is not a question of "if" but "how and when." With the development of technological solutions that can make this goal a reality and companies looking to leverage their compliance resources, Financial Crimes Intelligence Units are essential.

ACAMS has done an outstanding job in being on the leading edge of all three of these challenges. AML/fraud convergence and financial crimes comes immediately to mind. Industry leaders sharing insights and lessons learned in a variety of venues and formats is something unique to this industry. The bottom line is more institutions appreciating the rigor that compliance professionals bring to fraud programs especially in light of increasing regulatory interest in this area.

AT: What recommendations would you give on how-to make a financial crime prevention program successful at any financial institution?

JC: First of all, we all know there is no "silver bullet" and one size does not fit all. But there are some fundamental principles that are foundational for any program. Success in this field starts with vision and people. Articulating your vision to senior leaders, regulators, stakeholders and teammates is critical because change is inevitable. Changing regulatory expectations, changing compliance resources and changing fraud and AML threats are certain. You cannot develop your program to meet these challenges without support and that support starts with vision.

Now how do you affect that change? That is where you need the right people. Finding and retaining great people sounds so cliché, but when it comes to financial crimes prevention it all starts with great people. Great investigator and analysts know the value they bring to the organization and are always looking for new and better ways to do their jobs. Creating an environment where they can affect that change is critical and has to be part of your program's DNA.

AT: What advice would give financial crime professionals on how-to succeed in this field?

JC: Don't manage—lead instead. It is so tempting to try to manage when it comes to all things pertaining to financial crimes. The problem is the field is constantly changing and your business is probably changing even faster. If you are waiting for things to stabilize to the point you can manage them, you will spend your entire career waiting. Instead lead. From the line investigator to the programs analyst, educate yourself about this field. Learn what others are doing, take what works for you, create what you need and share it back with the industry. You will find that the local ACAMS chapter provides a great venue for this. Make your membership work for you and your institution.

AT: Do you have a New Year's compliance resolution you would like to share with the members?

JC: Same as it is every year. Don't ever be afraid to ask questions. It is the only way to truly learn and lead from the front whenever possible. It means you are genuinely invested in the success of your people and your program.

Vasilios Chrisos, CAMS, oversees the management of Macquarie's AML and sanctions programs in North and South America. He is responsible for conducting risk assessments, developing AML policies and procedures, ensuring employees receive periodic AML training, acting as an adviser to stakeholders regarding AML/CTF and sanctions matters, managing investigations, as appropriate, ensuring Suspicious Activity Reports are prepared and filed timely, performing compliance testing, participating in the new business/product approval process, and chairing various AML Working Groups across the region.

Prior to joining Macquarie, Vasilios helped lead Ernst & Young's AML advisory practice by managing projects/initiatives at large complex institutions. He assisted and advised financial services institutions in developing comprehensive AML risk assessment frameworks, identifying inherent money laundering vulnerabilities, establishing customer risk ranking protocols, designing AML compliance programs, implementing policies, procedures, and controls, creating AML governance structures, establishing Enhanced Due Diligence (EDD) protocols, and developing transaction monitoring capabilities.

Chrisos has worked with financial institutions that were either undergoing or facing regulatory enforcement actions and advised them on the construction of action plans and communication strategies with regulators, including regular updates on the progress of remediation efforts. In addition, to his role on the New York chapter board, he's also involved with several ACAMS taskforces.

AT: As an international manager for AML and sanctions programs, what do you find is most challenging about developing and implementing AML and sanctions policies and conducting risk assessments?

Vasilios Chrisos: The biggest challenge from an AML policy standpoint is managing differences in regulatory requirements across several jurisdictions. In my experience, the most effective way to sort through some of these challenges is to develop global minimum standards that are applicable across the entire enterprise and then allow each country to develop local policies and procedures, which, at a minimum meet the global standards, but also factor in local requirements if they're more stringent. From a sanctions perspective, policy creation is not too difficult, but developing specific procedures for dealing with indirect exposure to sanctioned countries can be challenging and time consuming. Regarding risk assessments, the most important thing is to develop a sound and defensible methodology. Once that is documented and in place, the execution of the assessments is not too challenging.

AT: Which ACAMS benefit do you find the most useful?

VC: I find all that ACAMS has to offer very useful. I find a lot of value in the moneylaundering.com service. It provides a sort of "one-stop shopping" for AML, sanctions, and financial crime-related news and is a great reference tool for looking up rules, regulations and prior enforcement actions. I also enjoy the webinars and listening to the live chats. Nevertheless, the biggest benefit for me has always been the networking opportunities that ACAMS affords. Whether at the local, chapter level or at national conferences, the opportunity to meet new people and build a network of contacts has been invaluable for my career.

AT: What is the key to longevity in the compliance field?

VC: First of all, it is important to have a passion for AML/sanctions or the broader financial crime subject matter. This is one of the traits that I look for when hiring a compliance professional. People tend to stay in the compliance field longer when they are excited about the work they are doing. The key to being successful over the long haul is the ability to balance commercial goals with the need to appropriately manage risk within our respective institutions. What I mean by this is that we, as compliance professionals, must be responsive to our business partners and help them find ways to succeed while protecting our institutions from being used as conduits for unwanted or illicit activities. Someone who can achieve this balance, but also hold firm when necessary, can carve-out a long and successful career in compliance.

AT: As an ACAMS advisory board member, what would you like to help ACAMS accomplish in 2013?

VC: I am very excited and honored to be one of the new advisory board members. I would like to continue to help ACAMS build out its Advanced Certification program. I have been heavily involved in the creation of the AML Audit curriculum and I am keen to assist with the development of different advanced programs. I would also like to assist with the development and launch of new and exciting products that ACAMS will be offering in 2013—such as the risk assessment tool. Finally, I would like to continue to help the new ACAMS chapters by providing advice and guidance based on my experiences chairing the New York Chapter.