ACAMS Today had the opportunity to interview Deborah Morrisey, CAMS, the assistant special agent in charge for Homeland Security Investigations in Miami, Florida about her extensive career in financial investigations.

Morrisey leads four investigative groups covering every aspect of criminal investigations focused on transnational financial crimes and money laundering.

She is a nationally recognized subject-matter expert (SME) in financial investigations and money laundering and she is frequently enlisted to review and provide input and represent ICE in foreign and domestic meetings, prepare articles for publication and instruct personnel on money laundering worldwide.

In addition, Morrisey has helped establish and maintain effective public-private partnerships with financial industry leaders and law enforcement professionals worldwide to promote effective efforts against money laundering and other financial crimes.

ACAMS Today: Have financial crimes increased in the last five years? Are there new financial crime trends today that did not exist five years ago?

Deborah Morrisey: Financial crimes have increased and evolved over the last five years. It is difficult to empirically track the changes in financial crimes. One thing we have seen are organizations that were typically gang or street crime related have migrated into financial fraud, such as identity theft and telemarketing fraud. Financial crimes are more lucrative and perceived to be less risky. For example, you get more money these days by stealing someone's identity than by walking into a bank with a gun.

Another trend we are seeing is a big uptick in identity fraud, prepaid cards with access devices, credit cards and income tax refund fraud. Criminals are now filing income taxes for the identities they have stolen.

One thing I can say empirically is that over the past five years financial criminals and money launderers have substantially become more sophisticated and international.

AT: What type of financial crime does your agency investigate the most?

DM: I oversee the Miami-Dade area but also specifically the southern part of Florida. I would say trade-based money laundering is where we expend a good deal of our resources. We have a whole group dedicated to investigating trade-based money laundering. We also focus on international public corruption crimes and bulk-currency smuggling. Our breath of authority to investigate financial crime and money laundering is pretty broad. We also investigate financial fraud that crosses the international border and schemes that center around the hiding of assets of foreign corruption cases.

AT: Can you walk us through the process on how your investigative department starts building a case against someone who has committed a financial crime?

DM: This is actually a difficult question because every case has a different fact base and a different origin. How we make our decisions regarding an investigation depends on how the investigation was initiated and what facts we have to go off of. For example, an investigative process that started by us receiving a suspicious transaction report (STR) will be handled differently than if we received our information from a confidential source. What I can say is that the common denominator every financial case has is to follow the flow of money and to really get into the details — follow the transactions.

Another thing we do is that we use every tool in our toolbox, whether that is analyzing the BSA data, cultivating sources of information or witnesses, accessing the physical environment and taking the facts from A to Z. In the end, the process of the investigation depends on what type of crime it is and what facts you have available at the beginning. We tell our investigators that you also have to be as creative as the bad guys when you are investigating a case, but make sure your creativity fits into the legal parameters.

AT: How many cases have you investigated regarding human trafficking and human smuggling?

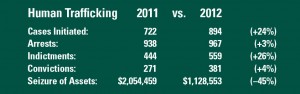

DM: On the next page are the stats for cases initiated, prosecuted, and cases that have come up with a positive outcome in arrests for the 2012 fiscal year:

AT: What can financial institutions do to help the fight against human trafficking and human smuggling?

DM: As far as financial institutions go we always go back to Know Your Customer. We encourage banks to know the red flag indicators for human trafficking such as wire transfers coming in from third parties or foreign remitters, aberration in activity and type of customer. As with most criminal activity being aware is extremely important.

AT: How often do drug traffickers utilize the formal financial sector?

DM: The riskiest thing for drug traffickers is to have the cash at hand because it is hard to secure and to store. As a result drug traffickers seek to use the formal financial sector. They utilize it in very creative ways to get their funds in the system and not to look like drug dealers. Once they are in the financial system it is easier for them to mask and move their proceeds. When they are in the black market or in large cash reserves is when it is the riskiest for drug traffickers. I think one of the things we can count on is that all criminals will seek to use the formal financial system.

AT: What money laundering schemes do South American drug traffickers typically employ outside the formal financial sector?

DM: Outside of the formal financial sector what we see the most of here in South Florida is the Black Market Peso Exchange (BMPE) because it has been tried and true since the early 90s. It is such a good marriage of trade-based money laundering and a parallel financial system for both legitimate business people and drug traffickers in places like Colombia. This is the most common parallel financial system employed outside the formal financial sector. The other one is bulk-cash smuggling. We see a steady flow of money trying to be smuggled primarily out of the Southwest border of the United States. BMPE and bulk-cash smuggling are the two schemes outside the formal financial sector that we can tie back to drug traffickers.

AT: Is there anything financial institutions can do to help with your investigations even when criminals are not using the formal financial sector?

DM: Yes, even when criminals are not using the formal financial sector criminals will still end up engaging the formal financial system somewhere along the process. For example, a drug dealer has cash in the United States and the businessman in Colombia is going to use his pesos to buy the cash that is sitting in the U.S. That is all informal, but when the cash gets exchanged to a wire transfer to pay for his shipment of goods from a U.S. company that is coming down to Colombia, that is when the formal financial system gets engaged. Also, the goal of bulk-cash smuggling is to get the money back into the formal financial system at some weak point inside or outside the U.S., such as changing it into a prepaid card or by structuring. I think that the only parallel financial system that does not touch the formal financial system is the true Hawalas.

AT: What should a compliance officer do in the event he or she is threatened by a drug trafficker?

DM: Obviously, if it is an immediate threat you need to call law enforcement or the emergency service right away. If it is more like a veiled threat, you are going to have to work within your legal parameters. You will need to engage law enforcement and they can tell you what to do or not to do.

AT: How have trade-based money laundering schemes evolved in the past five years?

DM: The biggest change in trade-based money laundering in the past five years is the emergence of Venezuela and its parallel market. Proof of a debt is required to get money out of Venezuela, which creates incentive to utilize false invoices or overvalued invoices to assist in the transfer of funds out of the country. Also, when precious metals uptick it makes it easier to hide a lot of money. It is easier to carry a small amount of precious metals to transfer value from one place to another.

Something that was brought up during the ACAMS conference in March in regards to trade-based money laundering was that there is a small amount of containers that get physically searched at the border. Once the containers leave the border (whether it is leaving the U.S. or coming into the U.S.) that is when the debate can start about what was actually in the container. All we have to go by is paperwork. When that is all you have, there is a vulnerability that criminal organizations will alter the value of what was actually in the container.

The more containers you inspect the slower things go for commerce, so we need to be efficient and effective in intelligent targeting. One way to do this is by using everything at your disposal. We have a Trade Transparency Unit in Washington, D.C. where we partner with our international counterparts, including Argentina, Australia, Brazil, Colombia, Guatemala, Ecuador, Paraguay, Mexico and Panama, to share our trade data. One of the things we do that we share with our partners is we graph the data we have in a computer program called darts. This program helps us identify anomalies that in turn help us in the fight against trade-based money laundering.

AT: What suggestions could you share on how the private and public sectors can increase information sharing?

DM: One of the things we do is we put out a quarterly report called the Cornerstone report (www.ice.gov/cornerstone). This is how we share with the private sector our case typologies and red flag indicators. We also try to attend as many meetings as we can on the local level. We try to get to the professional meetings so that we keep the public and private sector dialogue going, both on a national level and in our field offices.

AT: What has your agency done to build global partnerships in the fight against financial crimes?

DM: Partnerships and international partnerships are a huge priority for us, especially since all our investigations are cross-border investigations. We build our partnerships on several different levels.

- First of all we have a presence internationally in key points across the globe (74 offices in 48 countries), we build relationships with local law enforcement, develop sources and make every effort to work cross border in real time efficiently and effectively.

- Secondly, we have a big program to do mutual training with our international law enforcement partners. That international training means sending instructors to foreign countries and having foreign instructors come to the U.S. where we share ideas, investigative techniques and case studies.

- On a higher level, we have what we call Operation Firewall where we actually do real-time operations. For example, if a guy is leaving Miami and heading to another country and he declares $20,000 outbound, we would call our counterparts in the other country and give them a heads up on what the guy declared because who knows what he will declare inbound. We also share customs data through Operation Firewall.

- We are also an active partner with FATF, the World Bank (Stolen Asset Recovery Initiative), Interpol and we sit on many multi-national boards and we are domestically part of the BSA Advisory Group (BSAAG), Financial Fraud Enforcement Task Force and the Financial Services Information Sharing and Analysis Center.

- In addition, we have the Cornerstone Initiative, which is what brought me to ACAMS. The initiative tasks our groups to make public and private partnerships, open those dialogues and share what we learn from our investigations with the private sector and international partners. If we are not sharing what we are learning it does not do anyone any good. We also send our employees to participate as speakers in conferences all over the world and we do international conferences for other agencies as well. Building these partnerships helps us to work effectively informally even before the formal process starts.

Interviewed by: Karla Monterrosa-Yancey, CAMS, editor-in-chief, ACAMS, Miami, FL, USA, editor@acams.org