Gold takes the crown for being the most useful metal on Earth.1 Not only

is it eye-catching, making it a particularly popular choice for jewelry, but

it is functionally versatile. Gold has made its way into many industries,

from electronics, dentistry and medicine to aerospace, glass insulation and

of course, money. All this to say, gold is an extremely valuable commodity—and

like with anything valuable, it can be used for good or for bad.

“Gold conjures up a mist about a

man, more destructive of all his old senses and lulling to his feelings than the fumes of charcoal.”— Charles Dickens, Nicholas Nickleby

The latest example of the bad is the Miami-based trio who led a $3.6 billion gold smuggling operation through their positions at an established gold refinery, NTR Metals. Juan P. Granda aka Flecha and his two co-workers, Samer Barrage and Renato Rodriguez, pled guilty to charges related to the money laundering conspiracy, admitting that they purchased gold from illegal mines in South America and forged documents to import it to the U.S.

The secret to success for the self-proclaimed “Pablo Escobar of Gold” and his cohorts was their access to an accredited and established business in which to hide the activity. The result: The demise of the three overly eager salesmen and putting NTR Metals and its parent company, Elemetal, on center stage for law enforcement and regulators to probe, and for the anti-money laundering (AML) community to dissect. While the activity has only been attributed to the trio so far, the investigation continues and questions are looming: How was this missed by NTR Metals and Elemetal? Were they complicit in the activity? Were there warning signs? What can the precious metals industry and banks learn from this?

This case reminds us of a few key things:

- The tried and true methods for money laundering will prevail. Beyond the glitter of gold, the dark reality is that the precious metals industry serves as a convenient and opportune foundation for trade-based money laundering (TBML). All of the ingredients are there: high volumes, high-dollar amounts, import and export vehicles, and the ability to hide activity in a large corporate infrastructure with a low risk of being detected.

- Be the knowledge and share the knowledge. Awareness is integral to changing the mindset and culture of a company’s employees when it comes to compliance and AML, especially in regulated nonbanking institutions. Training and staying up-to-date on issues that both enrich and plague these businesses must be a priority. Only then can companies take the appropriate steps to put the right program in place to prevent and detect potential exploitation.

- Unlock the power of data at your fingertips. The strength of an AML program lies in having access to data and having the right tools in place to interpret it. Without these, organizations are operating blind. With them, the impactful insights can be used to inform critical decisions.

While most of the data on which AML professionals rely is internal data, there is a whole world of public data that is underutilized. Together with internal data, public data gives deeper context to a customer’s activity. Let us explore what public data tells us about the gold industry and our Miami-based operation.

The Lay of the Land

With the price of gold steadily increasing, the business of gold is extremely lucrative.2 For compliance professionals in the financial services industry, this makes precious metals dealers vulnerable to exploitation by criminals. Therefore, whether you are providing financial services to a precious metals dealer or are a dealer yourself, you must familiarize yourself with how the business works to understand the lay of the land.

Data from the U.S. Geological Survey, as well as the United Nations Commodity Trade Statistics Data for Pearls, Precious Stones, Metals and Coins, provides insight into both the location of gold mines and international imports and exports activity. Using that data, trends on the gold industry can be tracked on a regular basis.

As seen in Figure 1, the modern-day gold rush to the U.S. primarily originates from Europe and Asia, though recent reports have noted an increase of illegal gold from South America. Tracking the regular import trends of gold and other precious metals, can help inform risk assessments and due diligence reviews. Next, it is important to know how gold can be used to launder money. Many organizations have dedicated resources on this topic. For example, a 2015 Financial Action Task Force report focused on risks in dealing with gold.3 The Global Initiative Against Transnational Organized Crime and Estelle Levin Ltd. partnered on the Gold and Illicit Financial Flows Project, a program built on four months of research into illegal mines in Sierra Leone.4 However, the most compelling sources are the actual criminal complaints and indictments, which provide specific, sourced details.

Figure 2: Gold Smuggling Map

Let us turn our attention back to the Miami story.

Cash from criminal enterprises is collected in the U.S. The cash is given to a person who has a legitimate, but complex infrastructure system in which to operate (e.g., NTR Metals). Then it is taken into areas (e.g., Peru or the Caribbean) where illegal gold mines—which are oftentimes funded by criminal organizations—are more than willing to sell for cash, and the gold is illegally imported back to the U.S. using forged documents and/or shell companies. When there is a change in regulations, our bad actors adapt quickly by finding ways to circumvent the establishment. Specific to this case, sources claimed that cars were being driven across the Peruvian border to and from Ecuador, Argentina, Chile and Colombia. Figure 2 depicts the general movement of gold and money as described in articles written about our Miami ring, as well as where traces of the activity can be seen in public data.

Researching the Companies

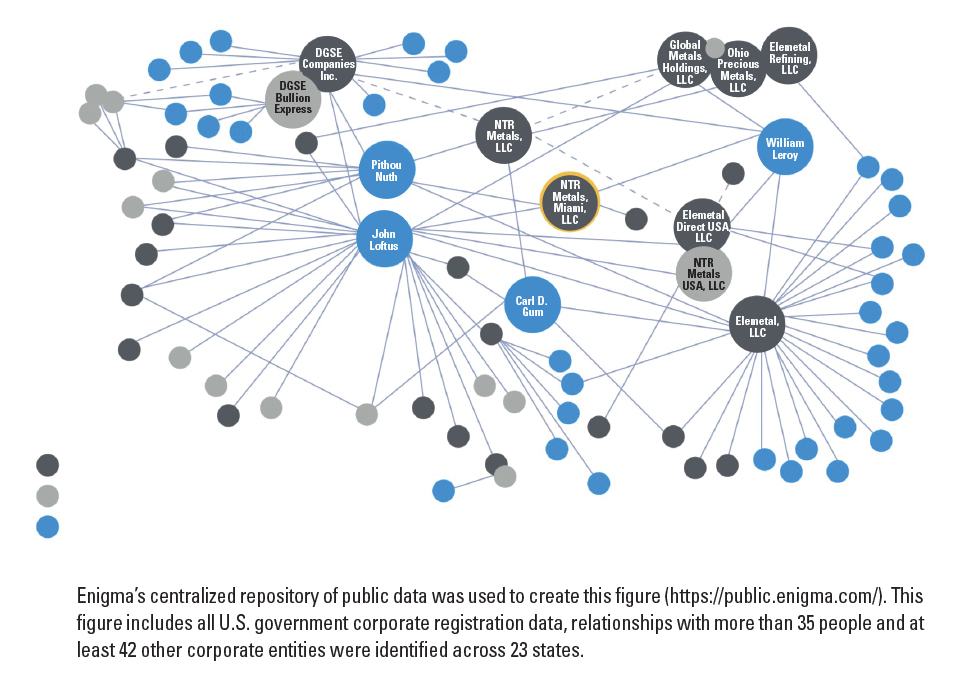

Central to TBML cases is understanding the overly complex and large organizational structures, often involving the same corporate officers and governing persons. Figure 3 shows that NTR Metals was part of an intricate network of more than 40 companies, all associated with different aspects of the precious metals industry. Based on publicly available information through the corporate registration data from 23 states and 10-K reports, the interconnected relationships between the companies and people (officers, governing persons and registered agents) becomes clear, as depicted in Figure 3.

Figure 3: Related Businesses and Persons

Each person and company is another lead for regulators and law enforcement to uncover illicit activity. This is further confirmed by the affidavit wherein the agent testifies that shell companies were created to facilitate doctoring the paper trail. One such shell company listed the same address as a high-end boutique in Coral Gables, Florida.

Another place to dig is shipping and trade information. The U.S. Automated Manifest System includes available data from the bill of lading, cargo descriptions and import records. For worldwide trade statistics, datasets, such as the United Nations Commodity Trade Statistics for Pearls, Precious Stones, Metals, and Coins, can prove to be helpful in understanding trends and patterns. In instances where deeper due diligence should be performed, the U.S. Customs and Border Protections offers trade activity data through their system, Importer Trade Activity requests.5 In this instance, shipping manifests show shipments to NTR Metals offices in Miami from the Caribbean supporting information in the affidavit that the operation was expanding to other nearby countries.6

Another trace of evidence was seen in H-1B visa data, showing that NTR applied for three separate visas (one of which was granted) for a “Caribbean marketing manager” in 2011. The work location listed was the same address in Doral, Florida as the three convicted NTR Metals employees.

Of note is the power of numerous datasets when centralized into one place. In this case, the majority of the public sources were identified through single searches by name or company in Enigma’s public data repository.

Looking In

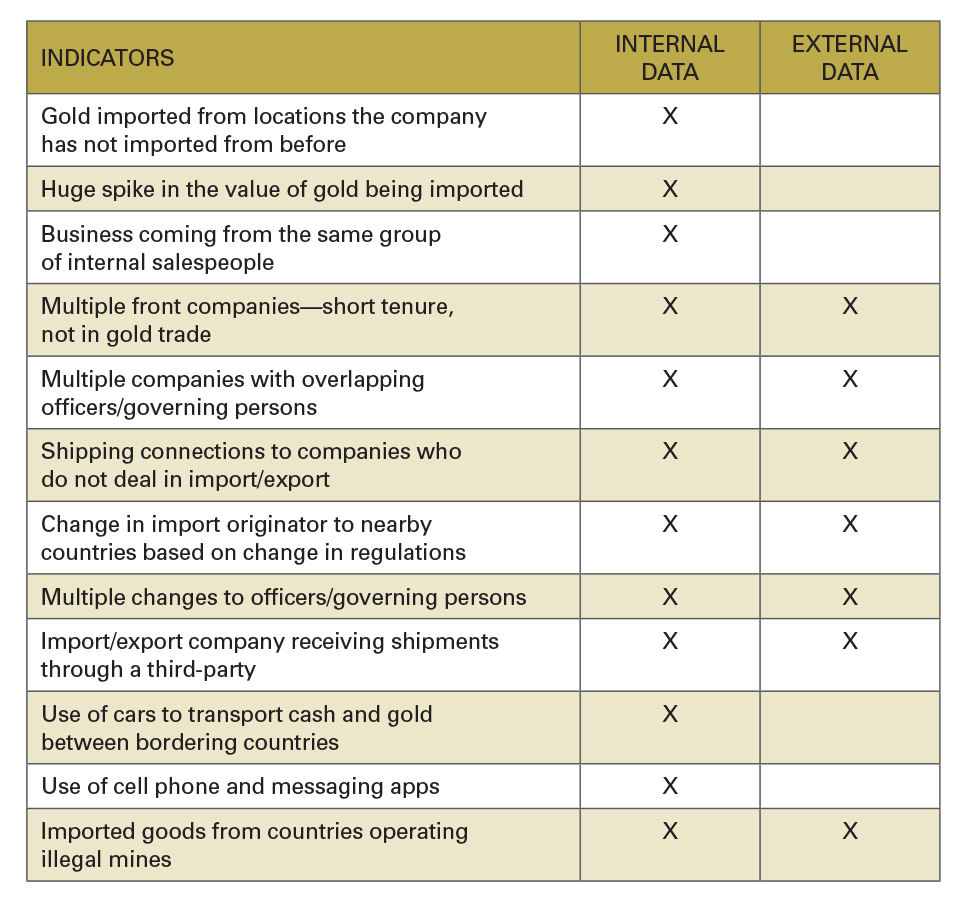

The ultimate goal is to set effective internal controls to generate accurate risk signals. Like public data, when internal data is properly structured with the right tools, the ability to apply learned indicators is greatly impactful. Table 1 shows the indicators of the Miami gold smuggling operation from the filed affidavit and research conducted.

Table 1: Gold Smuggling Indicators

The Buck Does Not Stop Here

The story sounds like it was written for a Hollywood screenplay, but the actions, people and impact are very real and the truth of the matter is that no one wins in the end. While the question of whether there are additional complicit actors remains unanswered, there is no question that there were hundreds of people who were not. This includes the victims of forced labor and sexual exploitation associated with illegal mines, the people impacted by the rainforest deterioration and mercury poisoning in the surrounding land and water, and those who lost their jobs when the refinery conglomerate was delisted by the London Bullion Market Association and had to shut down operations in some of their locations.7,8

A Different Ending

Regardless of whether law enforcement finds criminal liability on the part of NTR Metals or Elemetal, no financial institution wants to be caught off guard. Do not cut corners if you are a nonbank because criminals will find the weaknesses in the system. Do invest in a proper AML program and tailor it to your business. Do not stop at just enough. This does not mean more work, it means work smarter. Do your research on the industry norms and current relevant issues, and stay on top of it. Do get access to all of your internal data as all of it is relevant to AML. Do invest in the right tools to see your data. Do draw the complete picture—this requires both internal data as well as external and public data. And lastly, do demand better.

- Hobart M. King, Ph.D, “The Most Useful Metal,” Geology.com, https://geology.com/minerals/gold/uses-of-gold.shtml

- According to the London Bullion Market Association, the value of gold in February 2001 was $367.14 and the value of gold in January 2018 was $1,343.10.

- “Money Laundering/Terrorist Financing Risks and Vulnerabilities Associated with Gold,” Financial Action Task Force, July 2015,

http://www.fatf-gafi.org/media/fatf/documents/reports/ML-TF-risks-vulnerabilities-associated-with-gold.pdf - Marcena Hunter and Asher Smith, “Follow the Money: Financial Flows linked to Artisanal and Small-Scale Gold Mining

in Sierra Leone,” Global Initiative against Transnational Organized Crime and Estelle Levin Ltd, March 2017,

http://globalinitiative.net/wp-content/uploads/2017/03/sierra-leone_06.03.17.compressed.pdf - “Importer Trade Activity (ITRAC) Requests,” U.S. Customs and Border Protection, January 12, 2018, https://www.cbp.gov/trade/itrac-requests

- Connections identified in public data was identified through the use of a public repository available at www.public.enigma.com.

- The London Bullion Market Association protects the integrity of the precious metals industry by setting standards for the largest businesses involved in trading, broking, shipping and storage, mining and refining, inspection and assaying, and researching precious metals.

- For additional exploration of the data to track accountability on the supply chain beyond NTR Metals, visit www.enigma.com/blogs.