A robust money laundering/terrorist financing (ML/TF) risk assessment is the cornerstone of a sound compliance program. With more reliance on automated transaction monitoring systems, it is more important than ever to ensure that your transaction monitoring program is properly configured and aligned to the ML/TF risk profile of your institution.

On June 30, 2016, the New York Department of Financial Services (NYDFS) issued final rule part 504 requiring senior officers or board of directors to certify the effectiveness of anti-money laundering (AML) and Office of Foreign Assets Control (OFAC) transaction monitoring and filtering programs.1 The final rule goes on to state that an institution’s transaction monitoring program should be reasonably designed based on the risk assessment of the institution and appropriately matches BSA/AML/OFAC risks to the institution’s businesses, products, services and customers/counterparties.

While conducting ML/TF risk assessments is not a new practice, it is the first time that ML/TF risk assessments are a written requirement for NYDFS-regulated institutions. This article will provide best practices for bridging identified ML/TF risks to your transaction monitoring program.

Identifying ML/TF Risks Within Your Institution

The board of directors and management set the risk appetite and are responsible for creating a culture of compliance to ensure staff adherence to the financial institution’s compliance program. A robust risk assessment will help your financial institution to promptly and accurately identify risks and apply appropriate controls to mitigate risk or identify unacceptable risks to avoid. A sound risk assessment will identify potential events that might impact compliance objectives and should employ a combination of qualitative and quantitative risk assessment methodologies. The risk assessment should be utilized for the purpose of driving policy, procedures, controls and independent testing.

The risk assessment process has four main steps:

- Identify the ML/TF inherent risks

- Analyze the mitigating controls

- Evaluate residual risk

- Determine the direction of risk

The composition of a complete customer and transaction database is the first step in understanding where the ML/TF risks are within your institution

Inherent risk is the risk that is present without regard to mitigating controls. Per the Federal Financial Institutions Examination Council’s (FFIEC) BSA/AML Examination Manual,2 a risk assessment should include an assessment of the financial institution’s products, services, customers, entities, transactions and geographic locations. A sound risk assessment should include gathering relevant customer and transaction data and interviews of business line leaders. The composition of a complete customer and transaction database is the first step in understanding where the ML/TF risks are within your institution. It is best practice to include at least two years of customer and transaction data within your database as this helps identify potential trends utilized for determining the direction of risk.

The interview process is essential to obtaining a tailored and effective risk assessment and can assist with providing a qualitative assessment of the customer and transaction data. The interview process can identify ML/TF risks that were not previously identified and can help foster a line of communication between each business line and the compliance department. In addition, the interview process can help promote a culture of compliance by breaking down the silos of a traditional financial institution by encouraging information sharing and looking at ML/TF risks across the financial institution.

For each ML/TF risk identified throughout the risk assessment process, it is important to cross reference the institution’s policies and procedures to ensure that there are policy statements and controls in place to mitigate the ML/TF risk. This helps financial institutions determine whether there is a potential gap in the policy and procedures and the ongoing monitoring of the particular ML/TF risk.

How to Establish a Risk Assessment Methodology for Assessing ML/TF Risk

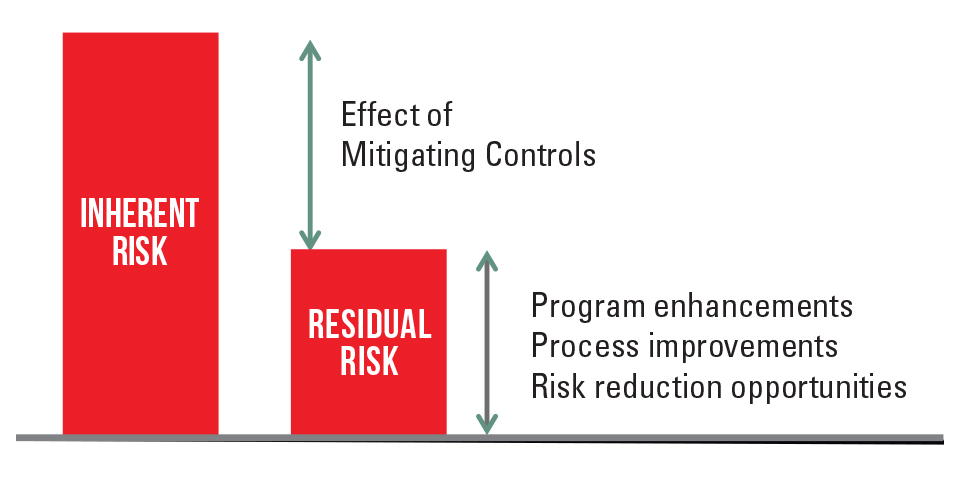

One of the biggest shortcomings with ML/TF risk assessments is the lack of a well-defined risk assessment methodology. The risk assessment process should follow a well-defined methodology, which should be fully described in your risk assessment report and supporting documents. The risk assessment methodology should provide: 1) measurement of inherent risks accounting for the principals of impact and likelihood; 2) an assessment of the effectiveness of the mitigating controls; 3) an evaluation of the residual risks that exist after consideration of the mitigating controls; 4) a determination of the direction of risk for each risk; and 5) a process for determining the overall inherent and residual risk rating of the institution.

In addition, the risk assessment should incorporate new and emerging risks within the industry such as the FinCEN guidance FIN-2016-A005 on cyber-enabled crime and on how documenting cyber risk impacts a financial institution’s ML/TF risk profile. It is important to remember that the risk assessment should be tailored for each institution and allow for the application of specialized knowledge/professional judgment by the compliance officer. The professional judgment factor can allow for an accurate reflection of the financial institution’s risk profile based on intricate knowledge held by the compliance officer and/or stakeholders.

While risk assessments are typically conducted on an annual basis, it is often forgotten that it should be updated when a “major event” occurs as well. A major event is generally interpreted as: 1) a merger or acquisition; 2) exponential growth in a new market area; 3) introduction of a new product or service; and 4) significant changes in the regulatory environment that impacts the financial institution. It is recommended that each financial institution define in its institution’s policy what may necessitate an event-driven risk assessment. Furthermore, it is important to note that a supplemental risk assessment and/or mini risk assessment can be completed in lieu of a full risk assessment when a major event occurs. Failure to have a well-defined methodology tailored to the financial institution that also incorporates recent trends and/or regulatory guidance can expose the financial institution to undue scrutiny from the independent auditors and/or regulators.

Aligning Your ML/TF Risk to Your Transaction Monitoring Program

Over the past 18 months, one of the most commonly cited areas of examiner AML criticism is the concept of sound model risk management and inadequate enterprise-wide risk assessments. Regulatory agencies have shifted resources and attention to assessing how institutions set up their automated transaction monitoring and high-risk customer management programs.

Financial institutions rely heavily on automated systems to identify potential suspicious activity but have been inundated with high levels of false positives, which have taken time and resources away from the ML/TF risks that require the most attention. Scenarios principally based on judgmental and quantitative considerations should be tailored to the institution’s specific ML/TF risk profile.

Conceptual soundness is the foundation for setting up an automated transaction monitoring model commensurate with your institution’s ML/TF risk profile. Conceptual soundness involves assessing the quality of the model design and construction, as well as a review of documentation and empirical evidence supporting the methods used and variables selected for the model.3 In setting up your transaction monitoring system, you should ensure that judgment exercised in model design and construction is well informed, carefully considered and consistent with published research and with sound industry practice.

When setting up your scenarios or rules to be utilized in the automated transaction monitoring system, you should map the areas with higher ML/TF inherent risks to scenarios or rules to ensure there is coverage of such risks. When setting the thresholds for your scenarios or rules, it is important to consider conducting some level of statistical analysis of the percentage of coverage (i.e., customer or transactions that would be captured by the scenario) to determine whether the scenario will identify those customers and/or transactions that present the highest risk. When setting your production scenario or rule thresholds, it is important to consider the results of below-the-line scenarios as there may be potential suspicious activity below your threshold that may warrant the threshold of the scenario to be reduced to include suspicious activity that may have gone undetected.

In addition, you should consider historical suspicious activity experience within your financial institution. Also, it is important to remember that all scenarios and settings should be reviewed in a “test” environment before moving them into production to ensure that scenarios are operating as designed.

Once you have implemented your transaction monitoring scenarios or rules, it is important to maintain key performance indicators (KPIs), such as an alert to information request percentage, an alert to investigation percentage and an alert to suspicious activity report percentage, as this will assist the institution in determining the effectiveness of each scenario or rule on an ongoing basis.

Some common pitfalls that may occur when reviewing automated monitoring systems are:

- Inaccurate or incomplete model documentation

- New ML risks to the institution are not considered part of the transaction monitoring model

- Misaligned alerts to ML/TF risk profile (i.e., focus of scenarios or rules are for areas identified as low risk to the institution)

- High-risk jurisdiction alerts do not consider all countries involved with a transaction and redundant alerts or scenarios (i.e., looking at the same activity multiple times)

Financial institutions should look for opportunities to monitor transaction activity by customer peer grouping. This will allow for a more tailored transaction monitoring approach and it will allow an institution to benchmark customers against their peers and identify outliers that may present heightened ML/TF risk to the institution.

In the near future, at a minimum, institutions will need to consider creating a Model Governance Committee responsible for oversight of the institution’s model, risk management program. Your financial institution should conduct an AML model inventory documenting all the systems utilized to monitor ML/TF risks within the institution. The Model Governance Committee should determine and document the frequency of any calibration and validation efforts.

A sound enterprise-wide risk assessment is the key to bridging the gap to effectively identify and monitor ML/TF risks within your financial institution

In summary, a sound enterprise-wide risk assessment is the key to bridging the gap to effectively identify and monitor ML/TF risks within your financial institution. By setting up your compliance program in a manner commensurate with the institution’s ML/TF risk profile, you will be able to focus your attention and resources on those areas that present the highest risk to your financial institution.

In need of an AML Risk Assessment tool? ACAMS Risk Assessment® is the first AML risk assessment software of its kind to provide an automated means of measuring, understanding and explaining an institution's money laundering risks. To request a free demonstration, visit http://www.acamsriskassessment.com/. You may also reach us directly via email at riskassessment@acams.org.

- The final rule applies to banks that are chartered or licensed by New York, as well as nonbanks, such as money services businesses.

- FFIEC BSA/AML Examination Manual dated November 17, 2014, page 18.

- “Supervisory Guidance on Model Risk Management (OCC 2011-12),” Office of the Comptroller of the Currency, April 4, 2011, https://www.occ.treas.gov/news-issuances/bulletins/2011/bulletin-2011-12a.pdf

I wish to nominate this article for The Article of the Year

Peter Wild

Thank you, Peter!

Regards,

Karla