Identifying beneficial owners with a satisfactory level of certainty has been a manual and often fastidious task for know your customer analysts and compliance officers. Issues vary from deciphering poorly scanned articles of association, to the design, collection and verification of beneficial ownership statement forms as well as pencil-drafted ownership diagrams. However, the recent EU directives that require member states to create and maintain public beneficial ownership registers are a game changer in the pursuit of greater corporate transparency.

In the field of anti-money laundering (AML) and counter-terrorist financing (CTF), corporate transparency is not a secondary objective. The majority if not all recent high-profile money laundering scandals involved the misuse of legal persons to layer and integrate ill-gotten proceeds. The Panama Papers, Russian Laundromat and Danske Bank scandals used, inter alia, shell companies or other opaque legal arrangements, nominee directors or bearer shares. These practices are well-known red flags for AML/CTF compliance practitioners. For financial criminals, these legal entities are necessary instruments to conceal the real ownership of assets and their illicit source.

Streamlining Corporate Transparency

Financial institutions (FIs) routinely deal with various types of legal entities, such as companies, partnerships, associations, trusts, foundations and not-for-profit organisations. As part of customer due diligence (CDD), FIs are required to identify the beneficial owners behind these entities. According to the Financial Action Task Force (FATF), a beneficial owner refers to ‘the natural person(s) who ultimately owns or controls a customer and/or the natural person on whose behalf a transaction is being conducted.’1

Identifying beneficial owners requires collecting accurate, complete and up-to-date information. Thus, the following two questions must be answered:

- Where can the necessary information be found?

- Whose responsibility is it to attest that the beneficial ownership information is current, accurate and complete?

The EU’s Fourth AML Directive (4AMLD)2 clarified that it should be the responsibility of each legal person to obtain, hold and share that beneficial ownership information. The beneficial ownership registers receive this information directly from the legal persons, based on a detailed definition of what beneficial ownership means. The good news for banks is that the concept of beneficial ownership is becoming better acknowledged by the legal persons. Moreover, the onus of reliable beneficial ownership information is shared between the legal persons and the public authorities entrusted to maintain the national registers. As primary users of the register that have collected beneficial ownership information for a long time, AML/CTF obliged firms will be important gatekeepers. They will be expected to flag inconsistencies in the official beneficial ownership register and raise the situations where discrepancies in beneficial ownership information uncover AML/CTF risks to the relevant authorities.

Beneficial ownership registers will free banks and other obliged entities from the burdensome processes of interpreting and verifying beneficial ownership information. If used within a sound CDD framework, registers could potentially enhance how obliged entities assess the AML risk of their legal person customers. Ultimately, it will be up to each obliged entity to utilise the bandwidth saved from not having to collect beneficial ownership information toward enhancing risk assessment and risk mitigation.

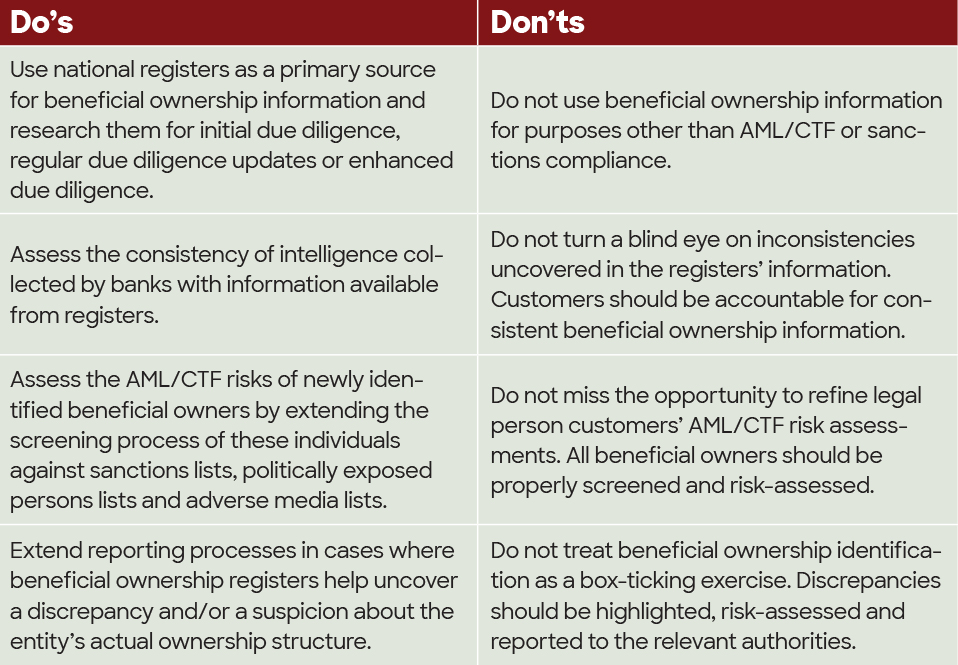

The following table summarises key considerations for obliged entities to utilise beneficial ownership registers within enhanced CDD processes.

While beneficial ownership registers may represent a significant opportunity for obliged entities to enhance the effectiveness and the efficiency of CDD processes, they also bring a range of challenges. These include ensuring beneficial owners identified in national registers are not experiencing disproportionate impacts on their privacy rights.

Intelligent Actions for Informed CDD

FIs and other obliged entities should have a clear action plan to integrate the information stored in the beneficial owners’ registers within their CDD data. Although new customers should be onboarded through current processes that include retrieving beneficial information from official registers, obliged entities should engage in more global verifications to confirm or possibly to update and/or complement their records. These verifications cannot realistically be performed in a single batch. National registers are not likely to be developed with technical capabilities for processing mass requests and the results would require significant bandwidth from obliged entities. A rational alternative would be to implement a staged approach that prioritises customers assessed at a higher risk level such as:

- Customers with a nexus with high-risk jurisdictions

- Customers that conduct activities in high-risk economic sectors

- Customers associated with higher-risk entities or individuals

- Customers with a history of suspicious transactions

The volume of identified beneficial owners is expected to increase due to an enhanced understanding of the concept of beneficial ownership by legal persons and through legal persons’ firmer liability to provide complete, accurate and current ownership information. The increased volume of individuals will require increased screening capabilities to load and process data, analyse the screening results and remediate the uncovered risks. For obliged entities that want a sound customer risk assessment, it might be a good time to determine how suitable their screening tools are.

Side Effects on Privacy

In addition to AML/CTF, protecting personal data is another significant regulatory momentum in the EU. Thus, introducing public beneficial ownership registers could have consequences for the individuals being recorded on those registers. With the introduction of the General Data Protection Regulation (GDPR), the EU placed data protection at a very high level of its political agenda. As a result, there have been heightened debates among EU policymakers about the merits of making these registers public, especially considering potential risks weighing on the individuals’ privacy. This regulatory challenge and the resulting balance that was reached is nicely defined in the Fifth AML Directive (5AMLD):

‘A fair balance should be sought between the general public interest in the prevention of money laundering and terrorist financing and the data subjects’ fundamental rights. The set of data to be made available to the public should be limited, clearly and exhaustively defined, and should be of a general nature, so as to minimize the potential prejudice to the beneficial owners.’3

The ‘potential prejudice’ includes ‘risk of fraud, kidnapping, blackmail, extortion, harassment, violence or intimidation.’ The 5AMLD allows member states to provide for public disclosure exemptions when that information would expose beneficial owners to the aforementioned risks. However, this is not a sufficient safeguard for the European Data Protection Supervisor (EDPS). Regarding the 5AMLD,4 the EDPS argues that the purpose of the 5AMLD (to prevent the misuse of the financial system for money laundering, terrorist financing or other financial crimes) does not entail public access to beneficial ownership registers because investigative journalists, non-governmental organisations and the general public are not obliged entities under the 5AMLD. Therefore, their access to beneficial ownership registers cannot be justified through the purposes sought by this directive.

US Lags the EU on Beneficial Ownership Efforts

In the US, the 2018 Financial Crimes Enforcement Network (FinCEN) CDD Final Rule introduced the requirements for banks to identify their customers’ beneficial owners, 13 years after the EU’s Third AML Directive (3AMLD). Although the US has been slower than the EU in establishing requirements for banks and other obliged entities to identify their customers’ beneficial ownership, it is beginning to catch up. At the time of this writing, the Corporate Transparency Act of 2019, which would implement a federal register of beneficial owners under FinCEN’s aegis, has been passed by the House of Representatives and is in committee in the Senate. Its provisions suggest that the current regulatory gap may not last for long.

However, the US seems to have struck a slightly different balance with data protection. The proposed federal register would not be available to the public, but would be available based on formal requests for access from law enforcement, national security, intelligence agencies and Bank Secrecy Act/anti-money laundering subjected firms. Although it is uncertain if this proposed bill will find its way through the Senate before the US election, the proposal was met with good bipartisan support and demonstrates that beneficial ownership registers are sound political measures for the purpose of greater corporate transparency.

On 6 February 2020, the US Treasury released the ‘National Strategy for Combating Terrorist and Other Illicit Financing.’ This document states the lack of beneficial ownership information as the number one vulnerability in the current US AML/CTF regulatory framework, further fuelling the need for more transparency around beneficial ownership. The 2016 FATF mutual evaluation of the US also flagged the lack of timely access to beneficial ownership information as one of the main deficiencies of the US AML/CTF framework.

A Step Forward

Ultimately, beneficial ownership registers will improve the amount, quality and timeliness of obliged entities’ suspicious activity reporting

Beneficial ownership registers are a welcome element to advance greater corporate transparency. These registers will allow banks and other obliged entities in the EU to hold complete, accurate and current information about their customers’ beneficial owners. Time saved collecting the required information should be wisely spent on improving customer risk assessments. Ultimately, beneficial ownership registers will improve the amount, quality and timeliness of obliged entities’ suspicious activity reporting.

Although beneficial ownership registers complicate the misuse of legal persons and arrangements by financial criminals, their availability to the public may also pose risks to some of the individuals identified. How long before cases of kidnapping, extortion or fraud reveal that the victims were identified through searches on beneficial ownership registers? Safeguards are necessary to counterbalance the right to transparency and the right to privacy. To address balance and proportionality, some national regulators have already designed registers that limit the amount of personal data that is made available to the general public and exemptions to disclosure are only possible in case of disproportionate risks.

However, beneficial ownership registers should not be assumed to be the decisive regulatory step. The issue of corporate transparency remains complex and multifaceted so other mechanisms will also need to be addressed (eg nominee directors/owners, bearer shares, opaque legal arrangements). Bearing in mind the global nature of the economy, any transparency-enhancing measures must be adopted at a global level as well. It will be interesting to observe whether other jurisdictions follow the EU’s lead and set up public beneficial ownership registers—however, as long as loopholes exist, financial criminals will take advantage of them.

- “International Standards On Combating Money Laundering And The Financing Of Terrorism & Proliferation,” Financial Action Task Force, June 2019, https://www.fatf-gafi.org/media/fatf/documents/recommendations/pdfs/FATF%20Recommendations%202012.pdf

- “Directive (EU) 2015/849 of the European Parliament and of the Council of 20 May 2015 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing, amending Regulation (EU) No 648/2012 of the European Parliament and of the Council, and repealing Directive 2005/60/EC of the European Parliament and of the Council and Commission Directive 2006/70/EC (Text with EEA relevance),” EUR-Lex, 20 May 2015, https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex%3A32015L0849

- “Directive (UE) 2018/843 Of the European Parliament and of the Council of 30 May 2018 amending Directive (EU) 2015/849 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing, and amending Directives 2009/138/EC and 2013/36/EU (Text with EEA relevance),” EUR-Lex, 30 May 2018, https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:32018L0843

- “EDPS Opinion on a Commission Proposal amending Directive (EU) 2015/849 and Directive 2009/101/EC EDPS,” European Data Protection Supervisor, 2 February 2017, https://edps.europa.eu/sites/edp/files/publication/17-02-02_opinion_aml_en.pdf