Due to the establishment of a conducive ecosystem that has supported the proliferation of financial technology (fintech) start-ups and an upwards trajectory that does not appear to be stopping any time soon, Australia has been attracting a good share of attention from this sector, similar to what has been happening on the global market. This article discusses the current situation of the fintech industry and predicts the future of the fintech industry in Australia.

Current Situation of Fintech in Australia

The COVID-19 pandemic dominated the Australian atmosphere in 2020 and 2021, but by 2022, the economy had recovered and there was a focus on fintech and the rapid digital expansion of the financial sector. Australia’s fintech sector has significantly matured, and the majority of fintechs (78%), now post-revenue up from 70% in 2021, but founders expect significant headwinds in 2023.1 The market's largest segment will be digital investment, with a total transaction value of $2.47bn in 2023. The average transaction value per user in the digital investment segment is projected to amount to $837.70 in 2023. The Digital Assets segment is expected to show a revenue growth of 36.8% in 2024.2

Many fintech companies saw the pandemic as a chance to rethink and improve their products and services in light of shifting consumer preferences as well as new possibilities presented by technological development. Businesses that took advantage of incorporating digital payment system facilities and delivering online services had a considerably better acceptance rate as a result of social distance and lockdown measures.

The rate of innovation in fintech, as well as its development and adoption picked up speed in 2022. The market's largest segment will be digital investment with a total transaction value of $2.47 billion by the end of 2023. This surge is being fueled by the increasing variety of services provided by Australia's fintech industry, and it is being aided by the development and refinement of Australia's policy and regulatory framework. Traditional financial services, including lending, personal finance, and asset management, were previously untapped territory for fintech's offers. Nonetheless, the market has moved to compete with many Australian financial institutions' principal product offerings3 such as payments, wallets, wealth and investment, data and analytics, as well as decentralized finance.

The Global Fintech Adoption Index found that 58% of Australians make use of financial technologies, and this keeps rising.4 The “wealth and investment management, the lending, and the data analytics and big data” subfields are the three primary categories of fintech that operate in Australia's financial sector. There are currently around 800 fintech companies operating in Australia, and approximately 25% are profitable. Seven of these were included on the Fintech 100 list for 2019 around the world.5

By the end of 2020, fintechs in Australia had reached a value of AU$4 billion ($2.78 billion). In addition, 63% of respondents in the FinTech Australia Census believe that Australian fintech companies can compete successfully at an international level.6

Australia's position in the worldwide rankings for fintech companies moved up two spots. According to a global research and analytics business known as Findexable, the nation currently holds the sixth position in the world and second in the Asia Pacific region.7 These most recent rankings demonstrate that Australia has a thriving culture of fintech. Businesses, governments and individuals in Australia are all early adopters of new technologies. Australia boasts one of the most advanced fintech businesses in the world. According to estimations provided by Fintech Australia, the industry has risen from being worth AU$250 million ($168.8 million) in 2015 to AU$4 billion ($2.78 billion) in 2021.8

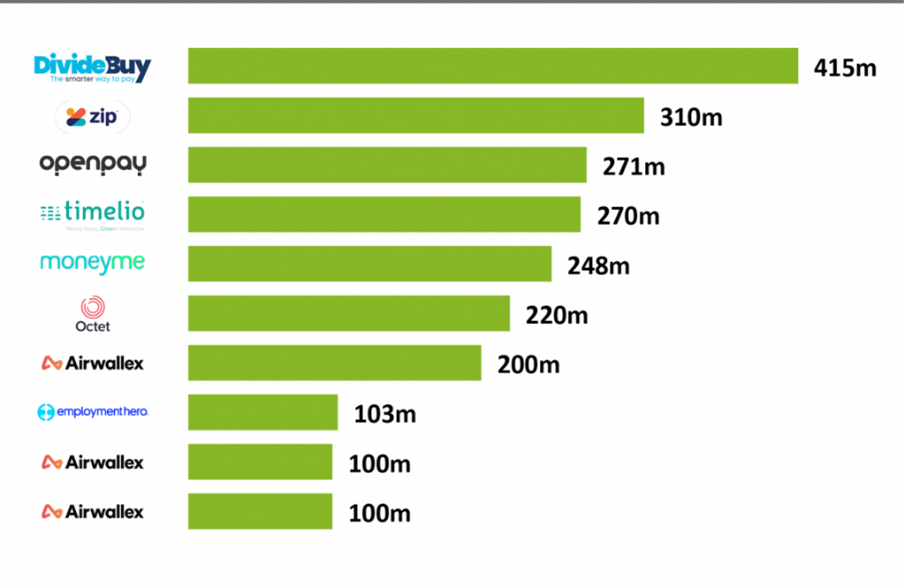

In today's world, Australian fintech is helping to drive transformation in the field of financial services. Payments, business financing, and installment finance, also known as "buy now pay later services," are examples of specialized areas of expertise. Graphic 1 demonstrates the top ten fintech deals in Australia as of 2022. Global investment is driving development in exports of fintech products as well as global expansion. The recent acquisition of Afterpay by U.S.-based Square Inc. for $29 billion is indicative of the strength of Australian fintech, including in overseas markets.9

Graphic 1: Top Ten Fintech Deals in Australia

The regulatory climate in Australia is reliable. The authorities in charge of market regulation are forward-thinking and have devised regulations that foster innovation while preserving the status quo. The strong economic, geographical proximity and cultural ties that Australia shares with Asia make it an ideal location to conduct operations and investigate possibilities for expanding into international markets. Graphic 2 shows additional reasons for the expansion of Australian fintechs.

Graphic 2: Reasons for Fintech Growth in Australia

The Future of Fintech in Australia

Fintechs in Australia are putting existing financial institutions under pressure to put digital innovation at the top of their list of strategic goals, which is causing the conventional finance industry to go through a period of significant transition. Technological advancements are making it possible for nimbler and more specialized fintech organizations to compete on operational efficiency and cost reduction.11

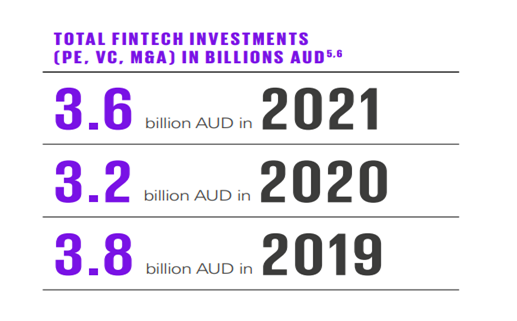

The major cities of Australia are becoming increasingly attractive destinations for talent and investment as a result of the positive effects of a number of prominent megatrends.12 Australian fintech is experiencing a rapid uptick in the establishment of new companies, the volume and value of investments, the demand and interest in tech-integrated solutions, and so on. This is supported by the emergence of digitally innate generations, the growth of fast-growing areas of the economy and an emerging legal framework. As shown in Graphic 3, the significant aggregate investment of AU$3.6 billion ($2.4 billion) in 2021 was close to the AU$3.8 billion ($2.5 billion) pre-COVID-19 levels. This gives us reason to be optimistic about the future of Australia's fintech industry beyond 2022.13 Emerging trends in consumer-to-business and business-to-business interactions, new ecosystems are forming and business models are evolving in response to developments in areas like open banking and embedded finance.

Graphic 3: Investments in Fintech

Since 2012, the number of physical withdrawals has decreased by 65%, and over 90% of all contacts with one of Australia's main banks are now conducted digitally.15 This raises questions about the viability of traditional bank offices and ATMs. The competitive advantages of digital native banks include lower operational costs, greater proficiency in analyzing financial data, and superior digital user experiences. This is because COVID-19 greatly hastened the transition to digital service delivery.

Fintech communities all over the world are starting to take notice of decentralized finance because of its potentially disruptive nature. While much of the development that has taken place to date is speculative and is regarded as high risk. The cryptocurrency community in Australia is rapidly developing, even though the U.S. market is significantly larger than it is in Australia.16

The challenge for regulators and governments is striking a balance between consumer protection and innovation when adjusting and aligning existing financial regulation to new goods and services. Regulators in Australia, including Australian Securities & Investments Commission (ASIC), Australian Prudential Regulation Authority (APRA) and Australian Transaction Reports and Analysis Centre (AUSTRAC), have taken a more stringent approach to enforcement and have become more proactive regarding licensing, conduct and disclosure.

According to KPMG, fintechs in Australia have proven to be highly robust and dynamic, with new developments and increasing investment emerging across a wide range of sub-sectors.18 It is anticipated that as start-ups develop, incumbents adjust, and business models change, innovative Australian fintechs will continue to attract the interest of investors across the world and the brightest in the field of technology.

An innovation-friendly regulatory framework by Australian regulatory bodies like APRA and ASIC will attract institutional capital from across the world, fueling the growth.19 The regulation, such as risk management frameworks and operational criteria, will be of further benefit to the credibility and risk profile of this expanding asset class. Australian crypto-focused fintechs need active industry interaction with regulatory agencies if they are to remain globally competitive.

Conclusion

Fintechs are rapidly becoming more prominent in today's economies. As the industry develops, with the assistance of technologies such as artificial intelligence, blockchain and machine learning, huge alterations in financial systems will continue to be seen, as well as service models and customer behaviors. However, for the fintech industry to make its revolution in the way we handle our finances, the companies in this area need to take a close look at the ways they handle their own finances and accounting. In growth objectives, fintech companies will need to embrace a unified, cloud-based platform for financial management. This will allow them to maintain the same degree of efficiency and innovation. This will provide comprehensive control, global business management capabilities, and a single source of truth that will enable them to design goods while also empowering decision-making that is insight-driven regarding partnerships and growth.

Rekha Vedagiri, chief People Officer, FlyWallet

- Mary Lam, Malia Forner, Fintech Australia, “Why Australian fintechs are sufficiently robust to weather the coming storm,” EY, November 2, 2022, https://www.ey.com/en_au/economics/fintech-australia-census-report-2022

- “FinTech – Australia,” Statista, https://www.statista.com/outlook/dmo/fintech/australia

- “Global Legal Insights: Fintech in Australia 2022,” Gilbert+Tobin, August 30, 2022, https://www.gtlaw.com.au/knowledge/global-legal-insights-fintech-australia-2022

- “Global FinTech Adoption Index,” EY, 2019, https://www.ey.com/en_gl/ey-global-fintech-adoption-index

- Legal Team Australia, “How is fintech changing Australia’s financial sector?” BizLatinHub, April 28, 2023, https://www.bizlatinhub.com/how-fintech-changing-australia-financial-sector/

- “Australian FinTech funding more than doubled in 2021 to hit $3.8bn,” Fintech Global, January 26, 2022, https://fintech.global/2022/01/26/australian-fintech-funding-more-than-doubled-in-2021-to-hit-3-8bn/

- Edmund Tang, “Global Fintech Rankings 2021: Australia now ranks 6th in the world RSS Feeds,” Australian Trade and Investment Commission, August 16, 2021, https://www.austrade.gov.au/news/economic-analysis/global-fintech-rankings-2021-australia-now-ranks-6th-in-the-world

- “What is Fintech?” Fintech Australia, https://www.fintechaustralia.org.au/what-is-fintech?rq=what%20is%20fintech

- Edmund Tang, “Global Fintech Rankings 2021: Australia now ranks 6th in the world RSS Feeds,” Australian Trade and Investment Commission, August 16, 2021, https://www.austrade.gov.au/news/economic-analysis/global-fintech-rankings-2021-australia-now-ranks-6th-in-the-world

- “What is Fintech?” Fintech Australia, https://www.fintechaustralia.org.au/learn/

- Peter Goldfinch, “A global guide to FinTech and future payment trends,” Routledge, 2019

- Isabel Ford, “The future of fintech in Australia,” Annexa, June 21, 2022, https://blog.annexa.com.au/the-future-of-fintech-in-australia

- “What is Fintech?” Fintech Australia, https://www.fintechaustralia.org.au/learn/

- Ibid.

- James Caddy, Luc Delaney and Chay Fisher, “RDP 2020-06: Consumer Payment Behaviour in Australia: Evidence from the 2019 Consumer Payments Survey,” Reserve Bank of Australia Research Discussion Papers, September 2020.

- Nikesh Lalchandani, Payments and Banking in Australia: From Coins to Cryptocurrency. How It Started, How It Works, and How It May Be Disrupted, Innovations Accelerated, August 2020.

- Amy Harriman, “Playing in the Sandbox: Lessons US Regulators Can Learn from the Successes of Fintech Sandboxes in the United Kingdom and Australia,” Wisconsin International Law Journal, 37, p. 615, https://wilj.law.wisc.edu/wp-content/uploads/sites/1270/2020/10/37.3_615-648_Harriman.pdf

- “Australian Fintech Survey Report 2022,” KPMG, June 29, 2022, https://home.kpmg/au/en/home/insights/2022/06/australian-fintech-survey-report-2022.html

- “Global Legal Insights: Fintech in Australia 2022,” Gilbert+Tobin, August 30, 2022, https://www.gtlaw.com.au/knowledge/global-legal-insights-fintech-australia-2022