The metaverse has been making headlines for the past few months since Facebook announced its rebranding to Meta. However, there is much more to the metaverse than Facebook’s version. The metaverse has actually been around for a few years now, and there is more than one single metaverse. The metaverse itself is a concept in its very early stages of development. Current popular metaverse projects include Decentraland, Somnium Space and Sandbox. Each of these metaverse projects have a different overall purpose but function relatively similarly. For example, real estate can be bought on each, but Decentraland tends to be the most popular. Some of these projects have different size land plots (parcels) that the players can buy. Virtual real estate is an increasing market in 2022, with expected projections to reach around 1 billion dollars. Early buyers of virtual real estate can profit by renting their land in the future, as parcels of land are limited on each metaverse project. With limited space and an increase in demand, the prices are increasing rapidly, and investors are interested in seeing what will happen to the future of the virtual real estate industry.

In the future, metaverse projects are expected to offer experiences in the tourism industry, including time travel back to ancient times to experience the world as it was in the past

Players in the metaverse can join and buy virtual assets from luxury brands for their avatar in a non-fungible token (NFT) form. A common argument for expensive fashion in the metaverse is that as more time is spent in the virtual world, what an avatar looks like to other virtual players will be more important than what we do in the real world. In the future, metaverse projects are expected to offer experiences in the tourism industry, including time travel back to ancient times to experience the world as it was in the past. For example, a player could use their virtual reality (VR) headset to immerse themselves in this virtual experience and walk with dinosaurs or meet their family at the ancient pyramids of Egypt. Virtual gatherings will become easy as family members from across the globe can enter each other’s virtual space to feel like they are together in the same room. As technology modernises and grows, the virtual world may become more of a norm in society, and it is important that players and regulators understand the risks posed by a virtual world.

Metaverse Real Estate and Luxury Fashion

Virtual real estate is generating headlines in mainstream media. Real estate in the metaverse is expensive and is rapidly increasing in price. In 2021, the metaverse real estate, on just four major platforms, reached 501 million dollars and there are projections that it will double in 2022 to over 1 billion dollars.1 At the time of writing, the average price of a parcel of land a person could buy was around 13,000 dollars.2 A player can buy real estate easily by connecting a crypto wallet and purchasing a parcel via an NFT marketplace, like OpenSea. Once a player buys the land, they can either hire a virtual builder or, if skilled on their own, build on their land. Some players want to host concerts, parties or small cosy spaces to meet with their friends, and some even want to open their own virtual stores to sell NFTs or avatar fashion. Luxury fashion companies, including Gucci, Burberry, Balenciaga and Dolce & Gabbana, have developed an online NFT presence in NFT marketplaces and metaverses.3 Luxury fashion is popular for users of the metaverse because luxury brands release limited quantities and the buyers receive a certificate of ownership, proving they own something rare and coveted. For example, Dolce & Gabbana released a nine-piece digital luxury collection on the UNXD marketplace for 5.7 million dollars.4 In addition to fashion, popular musicians have already played virtual concerts in the metaverse worlds, including Marshmello, Travis Scott and Justin Bieber.5 Players on the chosen metaverse platform can attend the event, pay with their linked crypto wallet, if it is a paid event, and attend the concert virtually. Some players even opt to use a VR headset to increase their viewing experience. To emphasise the popularity of these virtual concerts, Snoop Dogg bought his own real estate in Sandbox to develop for future virtual concerts. Currently, players can purchase land for concert development, or players may rent their space to a musician to play a concert. As the different metaverse projects become more mainstream, it is likely that more major brands will buy space in the metaverse to increase their profit margins and popular musicians will develop land for events.

Luxury fashion is popular for users of the metaverse because luxury brands release limited quantities and the buyers receive a certificate of ownership, proving they own something rare and coveted

Laundering Illicit Proceeds in the Metaverse

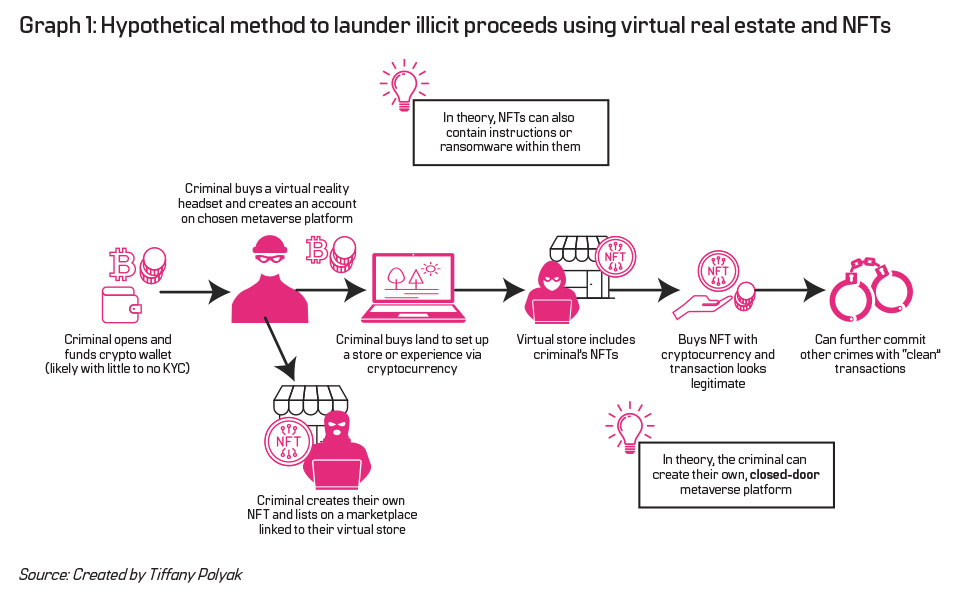

It is also possible that criminals will open stores on the metaverse to launder their illicit proceeds through NFT selling and trading, to make transactions look clean. Graph 1 shows a hypothetical method that a criminal could use to launder their illicit proceeds using virtual real estate and NFTs. The criminal can open a crypto wallet, which, if advertised as decentralised, is likely to have minimal or no know your customer (KYC) procedures. The criminal can then fund their wallet with cryptocurrency and buy a parcel on a chosen metaverse platform. Once the parcel is bought, they can build a store to hold their NFTs if they would like to sell to a large audience or potentially make their land invite-only and sell NFTs as a cover for illicit products in real life. NFTs can be created using an online marketplace, like OpenSea, but they have fees associated with creating and selling “gas fees.” To bypass the gas fees, the criminals may use a free platform like Polygon to increase profit margins. Once the NFTs are made, they list them on the marketplace and connect them to their virtual store on their parcel of land and they are ready to sell. As NFT sales would look like a legitimate transaction, the criminal can then exchange the virtual currencies for fiat currency or continue to use the funds for other activities, even other criminal activity.

Risks Associated with Metaverse Transactions

The types of cryptocurrencies differ depending on the metaverse being used. Some platforms are open to wallets with strict compliance regulations, whilst others have no compliance regulations. It is important to understand the potential risk from quickly emerging technology to stay ahead of criminal organisations and take a proactive approach to analyse financial intelligence. With no KYC protocols for numerous decentralised crypto wallets, it can be difficult for law enforcement (LE) to determine the wallet’s beneficial owner, even if the transactions are all on a public ledger. In addition, the transactions may look legitimate or may be sent through mixers to disguise the original illicit funding. Moreover, closed-door, invite-only, virtual spaces may be used for nefarious purposes. If a decentralised terrorist organisation bought a parcel of land and established it as a closed-door space, it would provide quick and easy communication for cells across the globe to plan a large-scale attack. Presently, a VR headset is not necessary for every metaverse platform. Therefore, a “guest” account can access the metaverse as long as there is internet access to enter these closed-door worlds with a link. Also, metaverse platforms do not require any information to log in, making it difficult for LE to determine nefarious activity. Also, gamers have noted that there is already an established “underground” on different metaverse platforms, possibly using the lax content controls for explicit content or child sexual abuse materials/online child sexual exploitation. Therefore, it is important that compliance officers take a proactive approach to new technologies, especially with technologies that are inherently private and have the ability to make large sums of virtual currency. Professionals must stay vigilant to combat this when analysing accounts noted to have virtual assets and real estate.

• If your customer owns a store on the metaverse, determine the purpose of the store.

• If your customer primarily earns income from NFT selling and trading, determine the underlying purpose of the NFTs.

• If your customer buys parcels of land on underregulated metaverse platforms for reasons other than building an experience or investing, investigate further.

• If your customer is suspected to be tied to another crime or is a felon, investigate further.

• If your customer uses a crypto wallet with little to no compliance, investigate further.

• If your customer commonly changes the type of cryptocurrency they are using, or uses private coins and unregulated tokens, investigate further.

Conclusion

As technology advances and the virtual world becomes more mainstream, it is important that compliance officers and LE develop proactive strategies to combat crime and terrorism. To do this, professionals must understand regulations around virtual assets and virtual platforms. It is also helpful to red team hypothetical situations on moving money throughout new platforms to understand how suspicious activity may occur. If compliance officers and LE can stay ahead of criminals, it is possible that criminal activity and terrorist attacks can be curbed from the start. The different metaverse platforms do not seem to be losing interest and are increasing in profit. Therefore, it is important to start monitoring for suspicious activity as soon as possible.

Tiffany Polyak, researcher, ACAMS, tpolyak@acams.org

- See statistics on Metaverse real estate: “The Ultimate Guide to Metaverse Virtual Real Estate,” Influencer Marketing Hub, 2 March 2022, https://influencermarketinghub.com/metaverse-virtual-real-estate/#toc-6

- Ron Shevlin, “Digital Land Grab: Metaverse Real Estate Prices Rose 700% In 2021,” Forbes, 4 February 2022, https://www.forbes.com/sites/ronshevlin/2022/02/04/digital-land-grab-metaverse-real-estate-prices-rose-700-in-2021/?sh=437dbde77cdc

- Bernard Marr, “How Luxury Brands Are Making Money In The Metaverse,” Forbes, 19 January 2022,https://www.forbes.com/sites/bernardmarr/2022/01/19/how-luxury-brands-are-making-money-in-the-metaverse/?sh=433fb6ea5714

- Ibid.

- Bethany Hickey, “How VR concerts work in the metaverse,” Finder, 13 April 2022, https://www.finder.com/vr-metaverse-concerts