Cryptocurrencies are seen as bringing innovation to the payments-services sector; furthering financial inclusion; and facilitating greater efficiency in cross-border transactions. However, as with other financial products and services, cryptocurrencies are also exposed to financial crime risks. The following article provides some background in relation to cryptocurrencies in general, and some insights into ongoing regulatory approaches and discussions in Europe.

Innovation and Cryptocurrencies

According to a Reuters article published in February 2018, more than 1,500 cryptocurrencies are active around the world. In addition, hundreds of initial coin offerings (ICOs) who are seeking token buyers aim to join that list over the coming months and years.1 By market capitalization, Bitcoin (at the time of writing) is the largest blockchain network, followed by Ethereum, Ripple, Bitcoin Cash and Cardano.

Beyond Bitcoin, the wider adoption of cryptocurrencies is still in its infancy but is likely to spread both into the traditional economy as well as throughout the sharing economy in the coming years. In order for mainstream adoption to take place, a regulatory framework, which protects all stakeholders, must also be developed. In the meantime, only minor regulatory steps have been taken, thus regulators regularly warn that investing in cryptocurrencies is high risk. In July 2014, the European Banking Authority (EBA) published an opinion on cryptocurrencies in which it outlines some 70 risks and makes recommendations on how to develop short and long-term regulatory measures to mitigate the risks.2

Governance and Regulation

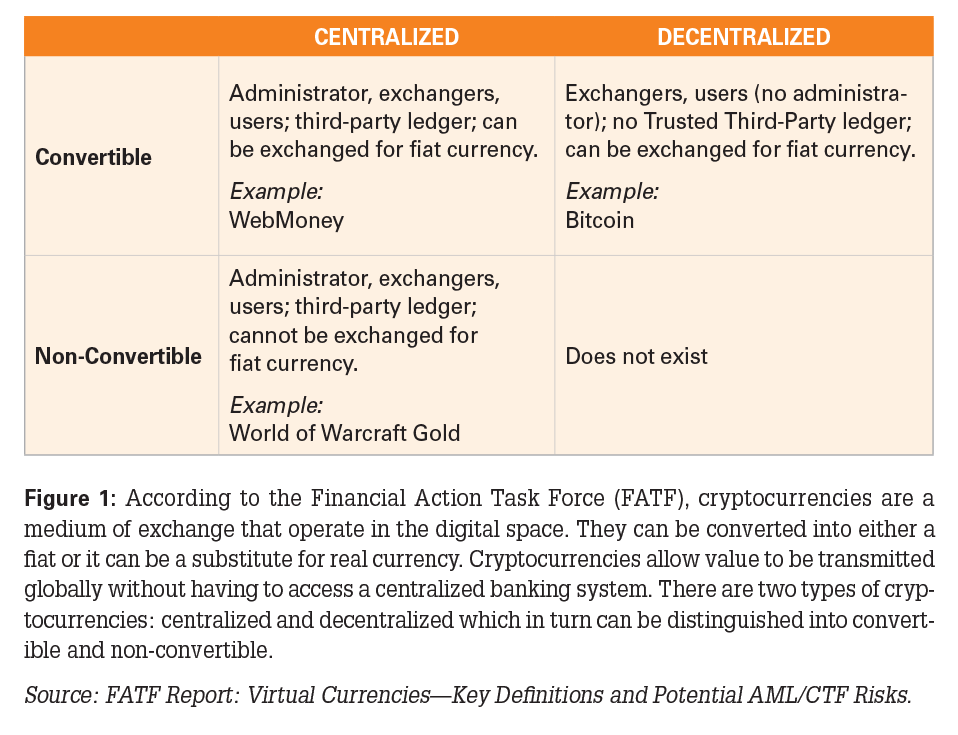

In May 2017, FATF held a Fintech and Regtech Forum that brought together 150 representatives from the fintech and regtech sectors, financial institutions, and FATF members and observers to address the regulatory and supervisory challenges posed by emerging technologies.3 This initiative resulted in the guiding principles also known as the San Jose Principles.4 In regards to cryptocurrencies, FATF encourages a risk-based approach. In its 2015 report, it provides an overview of the most widely introduced regulatory approaches, quoting the Bank for International Settlements’ approach as follows:

- Imposing restrictions on regulated entities for dealing with cryptocurrencies

- Adopting legislative/regulatory measures, such as the need for exchange platforms dealing with cryptocurrency to be subject to regulation as money remitters, or the proposed regulation of cryptocurrency intermediaries in some jurisdictions for anti-money laundering/counter-terrorist financing (AML/CTF) purposes

- Publishing statements cautioning users about risks associated with cryptocurrency and/or clarifying the position of authorities with respect to cryptocurrency; and

- Monitoring and studying developments5

According to Global Policy Watch, the EU is assessing how blockchain and distributed ledgers technologies (DLT) can be used to improve transparency and manage the ever-increasing threats posed by cybersecurity risks amongst others. Given that the EU is supporting a number of projects in this area with the aim of harnessing the potential of this emerging technology, European institutions believe that it is too early to put in place a regulatory framework for blockchain technology.

A recent European Parliament Report on cryptocurrencies underlined that, “cryptocurrencies and DLT have the potential to contribute positively to citizens’ welfare and economic development, including in the financial sector.”6 At the same time, however, the report also highlighted the risks noting that a regulatory framework will become important once DLT applications become systemically relevant. Of key importance is that the regulatory approach at the EU level is proportionate, so as not to stifle innovation or add superfluous costs at this early stage—while taking seriously the regulatory challenges that the widespread use of cryptocurrencies and DLT might pose. The report stressed the importance of any regulatory initiatives being equally as innovative as the technologies they aim to regulate, in order to be relevant and effective.7

The Fifth European AML Directive and Cryptocurrencies

On July 5, 2016, the European Commission adopted a proposal to enhance the EU’s anti-money laundering (AML) and counter-terrorist financing (CTF) framework. To prevent cryptocurrencies being used for the purpose of financial crime, the Commission aims to include virtual currency exchange platforms (VCEPs) and custodian wallet providers (CWPs) under the scope of the Fourth AML Directive (4AMLD),8 whereas, virtual-to-virtual currency exchanges fall outside the scope of the amended 4AMLD.9 VCEPs and CWPs will thus have to implement AML/CTF policies and procedures including adequate customer due diligence controls in order to be able to identify exchange’s customers. The European Commission’s Vice President, Valdis Dombrovskis, was quoted as stating that the new rules mean “less anonymity and more traceability, through better customer identification, and strong due diligence.”10

This was confirmed in April 2018 when the European Parliament adopted the Fifth AML Directive (5AMLD).11 The 5AMLD extends AML and CTF rules to cryptocurrencies and will now apply to entities which provide services that are in charge of holding, storing and transferring cryptocurrencies. Therefore, cryptocurrency exchange platforms and CWPs are now required to implement know your customer procedures. Once the 5AMLD has been formally endorsed by the European Parliament and the Council, member states will then have up to 18 months to transpose the directive.

On February 26, 2018, the European Commission hosted a roundtable to debate the topic of cryptocurrencies.12 The discussion touched on blockchain technology whilst noting that it holds strong promise for financial markets and that Europe must embrace this innovation in order to remain competitive. Concerns were voiced regarding the volatility and speculation around cryptocurrencies and ICOs’ lack of transparency due to unknown factors regarding identity and underlying business plans as well as the risks which crypto-assets present with regard to money laundering and the financing of illicit activities. However, no concrete decisions were made as to whether and to what extent regulatory action at the EU level is required besides cryptocurrency exchanges and wallet providers being subject to the 5AMLD.

At an ACAMS Germany Chapter event hosted in Berlin on April 25, 2018, experts active in the cryptocurrency space joined a discussion on the risks and opportunities linked to cryptocurrencies as well as best practice approaches in regards to regulation. With experts joining from Poland and Germany, there was a general consensus to echo the current watch-and-see approach pursued by the regulators given that this is a burgeoning industry. Experts also raised the importance of establishing a unified taxonomy in order to develop a harmonized approach globally by more broadly enabling and facilitating the establishment of the cryptocurrency market. In terms of self-regulatory initiatives, varied organizations are active. In Germany, the Bundesblock13 is a forum established some six months ago that also works on regulatory risk projects. On a more international scale, Global Digital Finance brings together cryptocurrency businesses, banks, regulators and industry experts in an attempt to develop a global approach. Some countries already appear to be putting in place a very attractive cryptocurrency regulatory framework and are thus preparing to attain a competitive advantage for when cryptocurrencies become better established. In this regard, it is worth quoting the Swiss Ministry of Finance, which recently stated that they want the ICO market to prosper without compromising standards or the integrity of the Swiss financial market.

Virtual Crime Investigations

Intelligence and law enforcement agencies continue to see cryptocurrencies being used for the purpose of financial crime

Intelligence and law enforcement agencies continue to see cryptocurrencies being used for the purpose of financial crime. There is proof of established criminal and terrorist groups using cryptocurrencies on a large scale, though it seems they still rely on the more traditional and stable channels for money laundering such as cash or credit cards. However, the prospect that traditional criminal and terrorist networks could adopt cryptocurrencies more widely does pose a real concern. Albeit small in number, there have been cases which have demonstrated to law enforcement that money laundering and terrorist financing can take place within virtual realities where high levels of anonymity and low levels of detection are given, and thus removing many of the risks associated with real-world money laundering and terrorist-financing activities.14 In early 2018, Europol announced that some 4 billion pounds ($5.4 billion) worth of cryptocurrencies have been laundered throughout Europe. Money laundering is one of several techniques that criminals use to obfuscate the movement of their assets so as to evade detection by authorities. Some have been known to utilize the Bitcoin blockchain for this purpose—attracted by its decentralized structure and notions of anonymity and pseudonymity.

A Royal United Services Institute report on cryptocurrencies published in March 2017 points out that governments understand that engaging with the cryptocurrency sector is key to help develop knowledge and insights into the legitimate uses of cryptocurrencies and the related technology. The cryptocurrency industry can also more effectively tackle financial crime if it understands the challenges and perspectives facing investigators and law enforcement agencies.15 In September 2016, Europol, Interpol and the Basel Institute on Governance established a working group on money laundering and cryptocurrencies and to investigate and recover proceeds of virtual currency crimes.16 The partnership has been developed as a network for information and knowledge exchange amongst European law enforcement agencies and other industry experts.

New challenges emerge for investigators and prosecutors when tracing, seizing and confiscating the proceeds of crime in cryptocurrencies.17 On March 19, 2018, the Office of Foreign Assets Control announced that it might include specific cryptocurrency addresses associated with blocked persons as identifiers on the Specially Designated Nationals List, in order to strengthen its efforts to combat the illicit use of cryptocurrency transactions.18 A number of companies (i.e., Coinfirm, Elliptic, Chainalysis, BitRank) specialized in the development of tools built specifically to investigate financial crime through cryptocurrencies have emerged in recent years. These firms are being used by companies and law enforcement to investigate financial crime activity and for AML purposes such as trying to establish the source of wealth of an individual whose wealth stems from cryptocurrency transactions.

Conclusion

Like the fintech sector overall, cryptocurrencies are laying the foundation for innovation in the payment space. Cryptocurrencies have legitimate uses and are thus attracting significant venture capital investment. The main attraction offered by cryptocurrencies is that they are seen as potentially being able to improve the efficiency of payments and thus reduce the costs for payments and fund transfers.19 Like with traditional banking products and services, cryptocurrencies are exposed to the risk of financial crime.

Gary Gensler, one of the key regulators during Obama’s tenure who is now at M.I.T., suggests that regulators are likely to scrutinize many of the current cryptocurrency projects. Although he claims that Bitcoin can remain exempt from securities regulations, he is of the opinion that Ether and Ripple, the second and third-most widely used cryptocurrencies, have most likely been issued and traded in violation of American securities regulations and will thus have to become compliant with U.S. securities legislation.20 It is likely that European regulators will take a similar approach in terms of regulating cryptocurrencies and the activity linked to them.

With the arrival of cryptocurrencies along with other innovative approaches stemming from fintech, there is a consensus that putting in place strong public–private partnerships to improve AML/CTF is key in order to develop typologies and build a repository of red-flag indicators, and ultimately to pave the way for a sustainable cryptocurrency regime. A number of regtech companies are spearheading the development of cutting-edge investigative tools, which can support not only anti-financial crime investigations but also financial crime prevention in the cryptocurrency space.

To learn more about how to understand virtual currencies and blockchain technology and how to mitigate the risks, please visit: http://www.acams.org/virtual-currency-and-blockchain-training/.

- “Cybercriminals target booming cryptocurrencies”, Reuters, February, 1, 2018, https://www.reuters.com/article/us-cryptocurrency-cybercrime/cybercriminals-target-booming-cryptocurrencies-report-idUSKBN1FL5Q7

- “EBA Opinion on ‘virtual currencies,’” European Banking Authority, July 4, 2014, https://www.eba.europa.eu/documents/10180/657547/EBA-Op-2014-08+Opinion+on+Virtual+Currencies.pdf

- “FATF FinTech and RegTech Forum 2017,” Financial Action Task Force, May 26, 2017, http://www.fatf-gafi.org/publications/fatfgeneral/documents/fatf-fintech-regtech-forum-may-2017.html

- Ibid.

- “Guidance for a Risk-Based Approach,” Financial Action Task Force, June 2015, http://www.fatf-gafi.org/media/fatf/documents/reports/Guidance-RBA-Virtual-Currencies.pdf

- Jakob von Weizsäcker, “Report on Virtual Currencies,” European Parliament, May 3, 2016, http://www.europarl.europa.eu/sides/getDoc.do?pubRef=-//EP//TEXT+REPORT+A8-2016-0168+0+DOC+XML+V0//EN

- Jurgita Miseviciute, “Blockchain and Virtual Currency Regulation in the EU,” Global Policy Watch, January 31, 2018, https://www.globalpolicywatch.com/2018/01/blockchain-and-virtual-currency-regulation-in-the-eu/

- “Commission strengthens transparency rules to tackle terrorism financing, tax avoidance and money laundering,” European Commission, July 5, 2016, http://europa.eu/rapid/press-release_IP-16-2380_en.htm

- Jurgita Miseviciute, “Blockchain and Virtual Currency Regulation in the EU,” Global Policy Watch, January 31, 2018, https://www.globalpolicywatch.com/2018/01/blockchain-and-virtual-currency-regulation-in-the-eu/

- “Remarks by Vice-President Dombrovskis at the Roundtable on Cryptocurrencies,” European Commission, February 28, 2018, http://europa.eu/rapid/press-release_SPEECH-18-1242_en.htm

- “Statement By First Vice-President Timmermans, Vice-President Dombrovskis and Commissioner Jourovà on the adoption by the European Parliament of the 5th Anti-Money Laundering Directive,” European Commission, April 19, 2018, http://europa.eu/rapid/press-release_STATEMENT-18-3429_en.htm

- “Remarks by Vice-President Dombrovskis at the Roundtable on Cryptocurrencies,” European Commission, February 28, 2018, http://europa.eu/rapid/press-release_SPEECH-18-1242_en.htm

- https://www.bundesblock.de/

- David Carlisle, “Virtual Currencies and Financial Crime: Challenges and Opportunities” Royal United Services Institute, March 2017, https://rusi.org/sites/default/files/rusi_op_virtual_currencies_and_financial_crime.pdf

- David Carlisle, “Virtual Currencies and Financial Crime: A Challenge and an Opportunity,” Royal United Services Institute, December 6, 2016, https://rusi.org/publication/newsbrief/virtual-currencies-and-financial-crime-challenge-and-opportunity

- “Basel Institute, Europol and Interpol establish working group money laundering with digital currencies,” Basel Institute on Governance, September 9, 2016, https://www.baselgovernance.org/news/icar/basel-institute-europol-and-interpol-establish-working-group-money-laundering-digital

- “The Aim of the Europol-Interpol Working Group” Bitcoins Channel, September 12, 2016, https://bitcoinschannel.com/europol-starts-group-to-study-cryptocurrency-launderers

- “OFAC FAQs: Sanctions Compliance,” U.S. Department of the Treasury, April 13, 2018, https://www.treasury.gov/resource-center/faqs/Sanctions/Pages/faq_compliance.aspx

- “Guidance for a Risk-Based Approach,” Financial Action Task Force, June 2015, http://www.fatf-gafi.org/media/fatf/documents/reports/Guidance-RBA-Virtual-Currencies.pdf

- “A Former Top Wall Street Regulator Turns to the Blockchain,” The New York Times, April 22, 2018, https://www.nytimes.com/2018/04/22/technology/gensler-mit-blockchain.html