In the financial services industry, money laundering, terrorist financing and sanctions regulations require financial institutions (FIs) to implement governance frameworks for managing risks, accountability and public trust. Effective compliance programs are tailored to FIs’ unique risk profiles and other factors, including regulatory requirements, products and services, client base, geographies and delivery channels. In managing risks, FIs risk rate verticals, at times excluding entire industries, e.g., gambling, marijuana and charities. Within the payment ecosystem1 for example, dating services (aka matching services) are generally classified as high or very-high risk, or prohibited altogether. Yet the services are legal, profitable and in increasing demand.2

Dating services are not formally listed as high-risk by rule or standard-setters,3 however the fact that FIs prohibit or deem them high-risk is not arbitrary. Rather, the classification is based on the industry’s merchant category code.4 They also exhibit risk characteristics prevalent in high-risk industries, including cross-border interaction, susceptibility to financial crimes and limited regulatory oversight.

The online dating ecosystem is increasingly exploited by bad actors to perpetrate financial crimes5 targeting vulnerable singles.6 Moreover, dating platforms collect and maintain sensitive data, allow high-risk interactions and even facilitate value exchanges via gifting.7 These risks intensify in a weak control environment.

Indeed, these services are not just social outlets; they have become breeding grounds for emotional, financial and reputational damage. Yet the industry operates in a gray compliance zone, leaving some FIs to grapple with potential reputational, financial and compliance risks when onboarding them.

This article explores frameworks and best practices underpinning financial crimes compliance programs that dating services can look to in the absence of formal oversight to increase access to financial services. It also explores avenues for FIs to reassess their risk posture and suggestions for government participation.

The risk landscape

There is currently no overarching regulatory body overseeing online or offline dating services. Instead, the industry is governed by a patchwork of general consumer protection, business and data privacy laws, some of which vary by state. Dating platforms have been subject to periodic enforcement actions yet shielded by Section 230 of the Communications Decency Act.8 However, as the industry expands amid scattered requirements it is facing new risks, including being an entry point for financial crimes. Below is a discussion of the risk landscape.

A. Due diligence dilemma and client obscurity

Trust is the bedrock of business. Although FIs follow the “trust but verify” ethos, dating services have only recently begun to incorporate customer due diligence (CDD). Some dating services currently take only basic measures to verify user identities or authenticate profiles, with many of them making verification optional. Lack of assurance around the end customer is a risk many FIs refuse to take.

B. Heightened fraud exposure

Internet-based dating services have become a hotbed for various fraud schemes, with many platforms lacking controls to protect users.

1. Romance scams

Using fictitious dating profiles, scammers prey on vulnerable individuals, including the elderly, gaining their trust and ultimately convincing them to send funds or conduct financial transactions under false pretenses.9 The U.S. experienced an uptick in romance scams during the COVID-19 pandemic as Americans were isolated and increasingly relied on online interaction. This created more remote opportunities for scammers. In fact, romance scams were used to facilitate unemployment fraud.10 In 2020 alone, internet romance scams led to approximately $703 million in losses. By 2022, reported losses were $1.3 billion.11, 12 According to the Financial Crimes

Enforcement Network’s (FinCEN) 2024 Financial Trend Analysis, “the most reported way scammers contacted victims was through online dating platforms.”13

2. Pig butchering

In recent years, government agencies14 have warned against pig butchering, a highly lucrative relationship investment fraud scheme with a blockchain flair. This confidence scam15 is often perpetrated by criminal syndicates abroad16 and involves bad actors leveraging fake identities, domain spoofing17 and trust-building tactics to convince victims to send funds, either directly to them18 or to a cryptocurrency wallet, for purported cryptocurrency investments.19 Online dating platforms are one of the primary conduits for pig butchering.20

3. Money mules21

Romantic manipulation is also used to facilitate money laundering activity. After forming trust bonds with unwitting dating site users, bad actors trick their victims into moving illegitimate funds for them through the creation of new bank accounts, wire transfers, gift card purchases and/or converting fiat into cryptocurrency to avoid detection by law enforcement (LE).22

4. Consumer complaints and high charge-back rates

Matching services experience high charge-back rates. Many of them rely on subscriptions and auto-renewals, frequently resulting in consumer complaints and disputes over the charges. Yet not all consumer complaints are legitimate; this is referred to as “friendly fraud.”23 Inadequate fraud controls, along with vague or nonexistent refund conditions, ultimately make matching services a gateway to other fraud schemes, including charge-backs.24, 25

C. Anonymity, cross-border activity and gifting

Online platforms enable users to mask their true identities for obvious safety reasons. That users can establish accounts/profiles with minimal information, however, allows for synthetic identities, fictitious profiles and even bot accounts. Some dating services operate across jurisdictions, particularly in niche markets, e.g., international matchmaking or expat dating, which, in the absence of adequate CDD and fraud controls, allow for misuse of services and potential sanctions exposure.

Furthermore, some online dating platforms allow users to send virtual gifts to live streamers. Streamers can convert gifts into real money, typically via payment mechanisms supported by the platform.26 The monetization model enables users to potentially “make big bucks.”27 But, it does raise concerns about pseudo-anonymous value transfers, especially absent redemption thresholds or controls to verify user identity, prevent otherwise prohibited cross-border transactions or limit the use of multiple accounts.

Regulatory and LE efforts

FinCEN issued advisories to warn against dating shams linked to money laundering, romance scams and pig butchering throughout recent years.28 Similarly, the FBI has issued public warnings and regularly distributes educational content via its website and podcast.29

The Federal Trade Commission (FTC) also plays an important role in the dating industry, publishing data on romance scam trends and consumer losses and investigating deceptive practices by numerous mainstream players dating back as early as 2013.30,31 The FTC would also be responsible for enforcing requirements under the proposed Romance Scam Prevention Act, if passed; the Act is intended to address online dating fraud, requiring platforms to inform users who interacted with other users who were ultimately banned32

In addition, in February 2025, the Commodity Futures Trading Commission launched the “Dating or Defrauding?” initiative, a nationwide effort between federal and state regulators and nonprofit organizations to raise awareness about romance investment scams.33

These are meaningful―although ad hoc―advancements. The industry could benefit from structured oversight to legitimize the space and invite collaboration with external partners.

Bridging the gap―Avenues for FIs

With dating services on the rise, FIs in the mainstream payment space are presented with more opportunities to engage with the industry.

1. Seek assurances

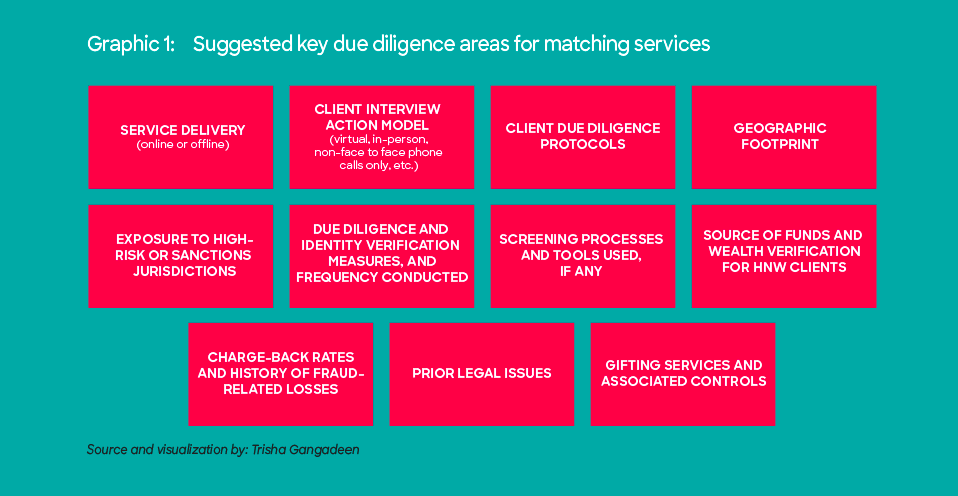

Most FIs take a tiered approach to onboarding. When considering high-risk verticals, they often require clients complete specialized due diligence (SPDD) questionnaires, which are intended to gather specific information about the client’s operations, risk profile and compliance controls.34 Mainstream payment players interested in expanding their client base to matching services can implement SPDD-like questionnaires covering key areas listed in Graphic 1 below.35

Such insights foster trust and transparency and serve as certification that clients have implemented reasonable controls.

2. Conditional onboarding

FIs could consider implementing conditional onboarding for matching services based upon overall risk ratings, disclosures from SPDD forms, and a review of key aspects of the control environment, e.g., depth of client-vetting procedures, contract disclosures and content moderation (if online). Conditional onboarding grants access, albeit restricted, according to the FI’s risk tolerance.36

Tips for dating services

Dating services can take notes from FIs and establish uniform minimum standards that include:

1. CDD

Sound client-vetting protocols could include adverse media checks using search strings, open-source research techniques and/or third-party verification tools. Dating services are not exempt from sanctions compliance obligations (though not subject to strict compliance programs like FIs) and should explore their exposure, considering if and how they might be engaging in business with sanctioned individuals or in sanctioned jurisdictions.

2. Risk rating and ongoing behavior monitoring

Dynamic risk scoring throughout the customer relationship is another compliance best practice that FIs rely on. Monitoring behavior over time enables dating platforms to risk rate customers and cluster accounts exhibiting similar suspicious behaviors or that appear interconnected. This could lead to detecting coordinated efforts―like romance scams and mule activity―perpetrated by criminal groups.

3. Risk and control inventories

FIs typically maintain inventories of risks, mitigating controls, red flags, fraud typologies and trends, suspicious activity patterns and governance documents. Dating services may want to consider maintaining similar inventories of scam/fraud types and behavioral red flags, and accordingly mapping controls to current risks to identify opportunities for enhancements. For example, clear contract terms and refund policies, along with explicit client acknowledgement, could serve as mitigating controls for charge-back abuse.

4. Content moderation and behavioral analytics

Online dating platforms are not legally required to moderate user content, though it is a regulatory expectation, particularly in jurisdictions with stricter online safety laws. Preemptive content moderation provides users with a safety net, potentially minimizing scams, harassment and hateful/explicit content. It also demonstrates to payment partners that the industry is raising standards and addressing illicit behavior. Platforms can level up by employing behavioral analytics, similar to transaction monitoring implemented by FIs, and leveraging artificial intelligence (AI) to search for key words, patterns of suspicious behavior or explicit or AI-generated images. They could also leverage sentiment analysis to detect financial grooming, manipulative language and indicators of potential scams,37 pig butchering38 and fake profiles.

5. Location monitoring and screening

Most online dating platforms collect geolocation data to match users in close proximity. However, VPNs are widely used to mask locations, circumventing geo-restrictions and obscuring jurisdictional risks. VPN use also complicates user authentication and enables account takeovers and creating multiple accounts. Dating platforms can implement processes to screen user IP addresses against IP reputation databases39 and leverage their location monitoring capabilities to: (1) perform velocity checks to detect improbable location shifts and (2) analyze login data to determine if multiple accounts are accessed from the same VPN IP addresses or devices, potentially detecting bot or fraud ring activity.

What is next?

The dating industry is approaching an inflection point, where compliance-grade governance may no longer be discretionary. By borrowing risk management and compliance frameworks that FIs employ to fulfill financial crimes compliance requirements, matching services can demonstrate risk awareness and improve their standing with necessary mainstream payment partners. The industry can also benefit from partnerships with compliance consultants to create lightweight frameworks in the absence of formal regulations.

Surprisingly, the “Dating or Defrauding?” campaign has yet to engage industry players.40 But community engagement to spread awareness and discuss compliance expectations, even in their most basic forms, has been precedent for other previously underregulated industries. This type of collaboration should be invited; participation will indicate the industry is willing to align on expectations with its partners, consumers and authorities.

Trisha Gangadeen, CAMS, independent AFC expert and financial crimes writer, Las Vegas, NV, USA, trishagangadeen@gmail.com, ![]()

- This ecosystem includes payment networks, processors, facilitators, gateways, money services businesses and merchant banks.

- In fact, the online dating service market is expected to reach $8.29 billion this year, with the majority of the revenue being generated in the U.S. Offline dating services were not included in this figure.Please see: “Online Dating―Worldwide,” Statista, https://www.statista.com/outlook/emo/dating-services/online-dating/worldwide

- Neither the Financial Action Task Force nor FinCEN officially list the dating industry as high-risk.

- Merchant category codes are determined by the International Organization for Standardization and are used by payment networks and providers to determine the fees that should be charged to businesses based on their risk levels. Dating services fall under MCC 7273, which is a Tier 1 category associated with heightened risk of illegal activity, reputational harm and consumer disputes. Please see: Rolands Selakovs, “The ultimate guide to merchant category codes (MCCs) and why they matter,” The Payment Association, March 10, 2025, https://thepaymentsassociation.org/article/the-ultimate-guide-to-merchant-category-codes-mccs-and-why-they-matter/ and “ISO: Global standards for trusted goods and services,” International Organization for Standardization, https://www.iso.org/home.html

- Financial crimes include, but are not limited to fraud, money laundering, terrorist financing, sanctions evasion, tax evasion, bribery and corruption, market abuse and insider trading, and embezzlement. Please see: “Financial Crime: Main Types, Consequences, + Real-Life Examples,” Unit 21, https://www.unit21.ai/fraud-aml-dictionary/financial-crime

- “Dating or Defrauding? Protect Yourself Against Romance Scams With Help From the Government,” USAgov, https://connect.usa.gov/dating-or-defrauding; “FinCEN Reminds Financial Institutions to Remain Vigilant Regarding Potential Relationship Investment Scams,” Financial Crimes Enforcement Network, February 26, 2025, https://www.fincen.gov/news/news-releases/fincen-reminds-financial-institutions-remain-vigilant-regarding-potential

- “Zoosk Live,” Zoosk, https://help.zoosk.com/hc/en-us/articles/4402057167250-Zoosk-Live

- Section 230 of the Communications Decency Act provides liability protections for online platforms concerning user-generated content. It is intended for platforms to moderate user content, without penalization, so long as it is done in good faith (the Good Samaritan protection). However, it does not require platforms to do so, since they do not own user-generated content, i.e., they are not the “publishers or legal speakers.” Please see: “Communications Decency Act, 47 U.S.C. §230,” Columbia University, https://www.columbia.edu/~mr2651/ecommerce3/2nd/statutes/CommunicationsDecencyAct.pdf

- “Nigerian National Pleads Guilty to Role in Romance Scam and Money Laundering Scheme,” United States Attorney’s Office, June 26, 2025, https://www.justice.gov/usao-ma/pr/nigerian-national-pleads-guilty-role-romance-scam-and-money-laundering-scheme

- Scott Stump, “Women looking for love say men tricked them into being ‘money mules’,” Today, June 21, 2021, https://www.today.com/money/women-looking-love-say-they-were-tricked-being-money-mules-t222936

- Emma Fletcher, “Romance scammers’ favorite lies exposed,” Federal Trade Commission, February 9, 2023, https://www.ftc.gov/news-events/data-visualizations/data-spotlight/2023/02/romance-scammers-favorite-lies-exposed

- Wendy Battles, “February Cybersecurity Awareness Tip: Spot romance scams & safeguard your heart,” Yale Information Security, https://cybersecurity.yale.edu/monthly-tip/february-cybersecurity-awareness-tip-spot-romance-scams-safeguard-your-heart#:~:text=The%20Facts,up%20our%20cyber%20know%2Dhow

- This analysis specifically focused on financial exploitation of the elderly; the covered period was June 2022 to June 2023. Please see: “Elder Financial Exploitation: Threat Pattern & Trend Information,” Financial Crimes Enforcement Network, April 2024, https://www.fincen.gov/sites/default/files/shared/FTA_Elder_Financial_Exploitation_508Final.pdf

- “Pig butchering―How to spot and report the scam,” Department of Financial Protection & Innovation, CA.gov, https://dfpi.ca.gov/news/insights/pig-butchering-how-to-spot-and-report-the-scam/; “FinCEN Reminds Financial Institutions to Remain Vigilant Regarding Potential Relationship Investment Scams,” Financial Crimes Enforcement Network, February 26, 2025, https://www.fincen.gov/news/news-releases/fincen-reminds-financial-institutions-remain-vigilant-regarding-potential

- “Operation Level Up,” Federal Bureau of Investigation, https://www.fbi.gov/how-we-can-help-you/victim-services/national-crimes-and-victim-resources/operation-level-up

- Brian Laverdure, “‘Pig butchering’ crypto scams a growing concern,” Independent Community Bankers of America, April 11, 2024, https://www.icba.org/newsroom/blogs/main-street-matters/2024/04/11/pig-butchering-crypto-scams-a-growing-concern; “Operation Level Up,” Federal Bureau of Investigation, https://www.fbi.gov/how-we-can-help-you/victim-services/national-crimes-and-victim-resources/operation-level-up

- According to FinCEN, “The term ‘spoofed’ refers to domain spoofing and involves a cyberattack in which fraudsters or hackers seek to persuade individuals that a web address or email belongs to a legitimate and generally trusted company, when in fact it links the user to a false site controlled by a cybercriminal.”

- Funds are sent through spoofed domain addresses that the scammers have provided. Please see: “FinCEN Alert on Prevalent Virtual Currency Investment Scam Commonly Known as ‘Pig Butchering’,” Financial Crimes Enforcement Network, September 8, 2023, https://www.fincen.gov/sites/default/files/shared/FinCEN_Alert_Pig_Butchering_FINAL_508c.pdf

- “Avoid Scams: Investment Fraud and Pig Butchering,” United States Secret Service, https://www.secretservice.gov/investigations/investmentfraud-pigbutchering

- “Cryptocurrency Investment Fraud,” Federal Bureau of Investigation, https://www.fbi.gov/how-we-can-help-you/victim-services/national-crimes-and-victim-resources/cryptocurrency-investment-fraud

- “Money Mules,” Federal Bureau of Investigation, https://www.fbi.gov/how-we-can-help-you/scams-and-safety/common-frauds-and-scams/money-mules; Jim Axelrod, Sheena Samu, Andy Best, et al., “Romance scammers turn victims into ‘money mules,’ creating a legal minefield for investigators,” CBS News, April 23, 2024, https://www.cbsnews.com/news/romance-scams-victims-money-mules/

- Jim Axelrod, Sheena Samu, Andy Best, et al., “Romance scammers turn victims into ‘money mules,’ creating a legal minefield for investigators,” CBS News, April 23, 2024, https://www.cbsnews.com/news/romance-scams-victims-money-mules/

- “Chargeback fraud 101: What businesses need to know,” Stripe, February 14, 2025, https://stripe.com/resources/more/chargeback-fraud-101

- “Online Dating Industry Merchant Accounts,” First Card Payments, https://www.firstcardpayments.com/high-risk-merchant-accounts/online-dating-industry-merchant-account/

- Jereme Sanborn, “Online dating services: What it means to be a high-risk merchant,” Humboldt, https://www.hbms.com/blog/online-dating-services-what-it-means-to-be-a-high-risk-merchant#:~:text=Why%20are%20dating%20services%20considered,services%20category%20from%20the%20start

- “Zoosk Live,” Zoosk, https://help.zoosk.com/hc/en-us/articles/4402057167250-Zoosk-Live

- Ibid.

- “FinCEN Reminds Financial Institutions to Remain Vigilant Regarding Potential Relationship Investment Scams,” Financial Crimes Enforcement Network, February 26, 2025, https://www.fincen.gov/news/news-releases/fincen-reminds-financial-institutions-remain-vigilant-regarding-potential

- “Cryptocurrency Investment Fraud,” Federal Bureau of Investigation, https://www.fbi.gov/how-we-can-help-you/victim-services/national-crimes-and-victim-resources/cryptocurrency-investment-fraud; “Romance Scams,” Federal Bureau of Investigation, https://www.fbi.gov/how-we-can-help-you/scams-and-safety/common-frauds-and-scams/romance-scams

- “Online Dating Service Agrees to Stop Deceptive Use of Fake Profiles,” Federal Trade Commission, October 29, 2014, https://www.ftc.gov/news-events/news/press-releases/2014/10/online-dating-service-agrees-stop-deceptive-use-fake-profiles; “Federal Trade Commission v. Match Group, Inc.,” Court Listener by Free Law, https://www.courtlistener.com/opinion/9395880/federal-trade-commission-v-match-group-inc/

- Jim Axelrod, Sheena Samu, Andy Best, et al., “Romance scammers turn victims into ‘money mules,’ creating a legal minefield for investigators,” CBS News, April 23, 2024, https://www.cbsnews.com/news/romance-scams-victims-money-mules/

- “S.841―Romance Scam Prevention Act,” Congress.gov, https://www.congress.gov/bill/119th-congress/senate-bill/841#:~:text=This%20bill%20requires%20online%20dating,banned%20user%20of%20the%20service

- “‘Dating or Defrauding?’ a Joint Effort to Alert Online Daters, Social Media Users of Relationship Investment Scams,” Commodity Futures Trading Commission, February 10, 2025, https://www.cftc.gov/PressRoom/PressReleases/9052-25

- Other key areas may include jurisdictions, ownership structure and organizational charts, legal opinions, licensure and registrations, nature of the relationship, expected transaction volume and types, sources of revenue and even references.

- Note, this is not an exhaustive list of key areas and are merely suggestions.

- A tiered approach to onboarding typically involves tailoring onboarding requirements based upon the risks presented by the client. Regarding conditional onboarding, some restrictions can include caps on volumes, frequent period reviews or delayed settlements, to name a few.

- “Customer Advisory: Six Warning Signs of Online Financial Romance Frauds,” Commodity Futures Trading Commission, https://www.cftc.gov/LearnAndProtect/AdvisoriesAndArticles/RomanceScam.html

- “What to Know About Romance Scams,” Federal Trade Commission, https://consumer.ftc.gov/articles/what-know-about-romance-scams

- “Detect Fraud and Cyber Threats With Unmatched Accuracy,” IPQS, https://www.ipqualityscore.com/; “Who is Spamhaus Project?,” Spamhaus Project, https://www.spamhaus.org/who-is-spamhaus/

- “‘Dating or Defrauding?’ a Joint Effort to Alert Online Daters, Social Media Users of Relationship Investment Scams,” Commodity Futures Trading Commission, February 10, 2025, https://www.cftc.gov/PressRoom/PressReleases/9052-25