Allegations of the real estate market being used for money laundering (ML) and tax evasion have made headlines in the German media. This has resulted in heated political debates across the political spectrum, particularly, debates on the role of intermediaries. Notaries have been accused by various political parties of neglecting their responsibility in the fight against ML in the real estate sector. In 2017, Berlin’s Senator for Justice Dirk Behrendt1 asserted that of the 60,000 reports of suspected ML filed nationwide with the financial intelligence unit (FIU),2 only five were filed by public notaries.3 The discrepancy between the low number of reports filed by notaries and the confiscation of 77 apartments, houses and allotments in Berlin in July 2018 for suspected ML was used to highlight notaries’ lack of attention to ML indicators.4 In mid-2019, Behrendt announced that he was planning on establishing a ‘money laundering task force’ to prevent the investment of illegal proceeds in real estate. He stated that the primary assignment for this task force would be to review the work of public notaries.5

In 2017, following the implementation of the Fourth AML Directive (4AMLD), real estate agents were drawn into the scope of Germany’s revised anti-money laundering (AML) legislation Geldwäschegesetz (GwG).6 As soon as an interested buyer pays a deposit or receives a sales contract, the real estate agent is obliged to undertake know your customer procedures, including identifying and verifying the ultimate beneficial owner (UBO) of the acquired property. Following the implementation of the Fifth AML Directive (5AMLD), which came into force in Germany in January 2020, public notaries who play a key role in authorising real estate transactions in Germany (besides real estate agents) are obliged to implement AML measures. The following article will focus on the due diligence requirements for public notaries and how revisions in tax law related to real estate transactions should make these transactions less attractive for tax optimisation.

The Role of German Public Notaries

German civil law notaries play a key role in real estate law, mortgage law, contract law, corporate law as well as family and succession law.7 Within the German system of ‘preventive justice’, the civil law notaries’ function is complementary to the role of a judge. The involvement of a notary is required for transactions with long-term effects and a particular economic or personal significance for the parties involved. Among others, these cases include the sale of land, the establishment of a mortgage, the incorporation of a limited liability company or a public limited company, and certain corporate share deals or asset deals. Civil law notaries act as independent, impartial and objective advisers to all parties to a transaction. They examine the intentions of the parties, draft the contracts and instruments necessary to carry out the intended transaction and ensure that the contractual provisions are in full compliance with the law.

AML Obligations and Notary Guidance

Under Germany’s newly introduced AML legislation, notaries are obliged to perform due diligence when it involves the acquisition of real estate, the incorporation of entities, and when providing custodian or special power of attorney services.

The Bundesnotarkammer is a body established and governed by federal law representing the German civil law notaries that has issued guidance for notaries, including templates and information on how to file suspicious transaction reports (STRs) through the FIU’s online platform, goAML.8

The main requirements for notaries include:

- Undertaking a risk assessment and documenting the results (ie low, medium, high)

- UBO identification

- Documentation of ownership and control structures of legal entities

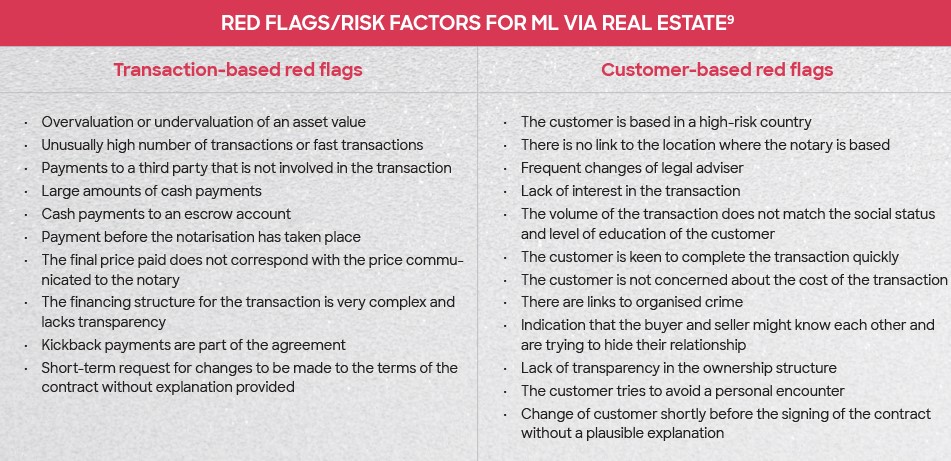

If the notary identifies a party to be high-risk, enhanced due diligence (EDD) is required, the source of wealth should be determined and increased monitoring should be executed. EDD is also required if the party or the legal entity of the transaction involve politically exposed persons linked to a high-risk country or if the transaction and the structure are in any way unusually complex.

The UBO is defined as a person who holds more than a 25% stake in the company or equivalent voting rights. When dealing with legal entities, German legislation generally allows for a fictitious UBO (eg a legal representative, a CEO or a partner of the company) to be named if the true UBO cannot be determined. However, the reason why the UBO could not be identified needs to be documented, including a list of all steps that were taken to identify the UBO. For real estate transactions, the UBO information must be disclosed to the notary public—otherwise the notary should refuse to notarise the transaction or provide the requested services.

The Bundesnotarkammer guidance details how to use the UBO registry known as the transparency register and the submission requirements for corporate entities to the registry. The guidance clearly states that searching the register alone is insufficient for identifying the UBO. Furthermore, it explains that although entities are obliged to disclose ownership information, the companies are not obliged to resubmit the same information to the transparency register if this information is already available in other registries (eg company’s registry, registry of cooperatives, registry of associations or partnerships). If shares are held in a trust by a third party, this would not be included in the list of shareholders filed with the company’s registry. In this case, the company would be obliged to submit the UBOs’ information to the transparency register. The same applies to limited partnership structures.

If a foreign company wants to acquire a property in Germany, then it must provide documentation that it has registered either with the transparency register in Germany or in another EU member state. If this registration information is not disclosed upon a subsequent request, the notary is obliged to refrain from notarising the transaction. These requirements are only necessary if the company is acquiring property, not when it is selling property. The notary should file an STR with the FIU when ML is suspected. If the notary identifies that a mandatory entry has not been filed, that there is a discrepancy in the information entered, or that the information was received or retrieved independently, then the notary is obliged to report this to the transparency register.

Loopholes and Mitigants

In addition to the draft law, Germany’s Federal Ministry of Finance published the country’s first ever National Risk Assessment or Nationale Risikoanalyse to combat ML and terrorist financing in October 2019. The project began in December 2017 and involved 35 federal and regional authorities. The report assessed the ML risk in the real estate sector as high. In particular, it highlighted concern toward share deals.

Despite 5AMLD efforts to combat laundering funds through real estate transactions, loopholes in share deals remain a concern. Share deals are real estate investments where the investors buy shares in a property that holds one or more properties, rather than acquiring the real estate asset directly. In legal terms, the transaction is a purchase of shares and not a real estate acquisition. Therefore, it does not require the notaries’ certification.10 A share purchase agreement only needs to be notarised if the shares in a private limited company (GmbH) are transferred or encumbered, or if an obligation to do so is created when acquiring a GmbH and Co. KG—a limited partnership where the general partner is a GmbH. Both the acquisition of the shares in the GmbH and the acquisition of the limited partner shares must be notarised normally because they constitute a single legal transaction.11

To a certain degree, these loopholes will be mitigated by the efforts of the German government to combat tax evasion by making share deals less attractive. Germany has put in place measures to combat tax fraud and avoidance in line with the Organisation for Economic Co-operation and Development (OECD) base erosion and profit shifting (BEPS) framework. This OECD framework aims to do the following to address BEPS:

‘The BEPS Package provides 15 Actions that equip governments with the domestic and international instruments needed to tackle tax avoidance. Countries now have the tools to ensure that profits are taxed where economic activities generating the profits are performed and where value is created. These tools also give businesses greater certainty by reducing disputes over the application of international tax rules and standardising compliance requirements.

‘OECD and G20 countries along with developing countries that are participating in the implementation of the BEPS Package and the ongoing development of anti-BEPS international standards are establishing a modern international tax framework to ensure profits are taxed where economic activity and value creation occur.’12

In addition, the German Real Estate Transfer Tax Act (RETT) or Grunderwerbsteuergesetz (GrEStG) makes share deals less attractive for tax avoidance as of January 2020. On 30 December 2019, Germany published a law introducing the obligation to report cross-border tax planning arrangements in the official gazette, which provides for the implementation of the EU Directive on the ‘automatic exchange of information in the field of taxation in relation to reportable cross-border arrangements.’13 The law also includes measures that require the exchange of information reported with other EU member states. The Ministry of Finance underlines that the reporting requirement primarily applies to intermediaries that design, market, organise or manage the implementation of a reportable arrangement.14

The plan to introduce a centralised and publicly searchable land registry in Germany has been postponed until March 2024 (instead of November 2019) due to the difficulty of digitising some 40 million pages of information contained in the multiple regional land registers. Although this has been seen as a setback,15 the effort to establish a registry for searching for real estate assets is positive. Overall, this will support efforts to reduce the attractiveness of the German real estate sector for ML or other predicate offences such as tax evasion.

- Berlin’s Senator for Justice is the regional equivalent of the Minister of Justice at a national level.

- “Financial Intelligence Unit,” Zoll online, https://www.zoll.de/DE/Fachthemen/FIU/fiu_node.html. The FIU is a body at the German Customs Investigation Bureau (Zollkriminalamt) responsible for receiving, collecting and evaluating reports of suspicious transactions that may be related to money laundering and terrorist financing.

- “Justizsenator will Task Force ‘Geldwäsche’ einrichten,’” Berliner Morgenpost, 21 May 2019, https://www.morgenpost.de/berlin/article219304873/Justizsenator-will-Task-Force-Geldwaesche-einrichten.html; “Notare sollen im Kampf gegen Clan-Kriminelle helfen,” Der Tagesspiegel, 21 May 2019, https://www.tagesspiegel.de/politik/berlin-plant-geldwaesche-task-force-notare-sollen-im-kampf-gegen-clan-kriminelle-helfen/24365266.html

- “Polizei beschlagnahmt 77 Immobilien von arabischer Großfamilie in Berlin,” Berliner Zeitung, 19 July 2018, https://www.berliner-zeitung.de/mensch-metropole/polizei-beschlagnahmt-77-immobilien-von-arabischer-grossfamilie-in-berlin-li.7062

- “Justizsenator will Task Force ‘Geldwäsche’ einrichten,’” Berliner Morgenpost, 21 May 2019, https://www.morgenpost.de/berlin/article219304873/Justizsenator-will-Task-Force-Geldwaesche-einrichten.html; Hannes Heine und Fatima Keilani, “Notare sollen im Kampf gegen Clan-Kriminelle helfen,” Der Tagesspiegel, 21 May 2019, https://www.tagesspiegel.de/politik/berlin-plant-geldwaesche-task-force-notare-sollen-im-kampf-gegen-clan-kriminelle-helfen/24365266.html

- “Geldwäschegesetz (Gesetz über das Aufspüren von Gewinnen aus schweren Straftaten),” dejure.org, https://dejure.org/gesetze/GwG

- “What do you need a Notary for?” Bundesnotarkammer, https://www.bnotk.de/en/what_for.php

- “Willkommen im Meldeportal der Financial Intelligence Unit (FIU),” goAML, https://goaml.fiu.bund.de/Home

- “Geldwäschegesetz–Wesentliche Pflichten im notariellen Bereich,” Bundesnotarkammer, https://www.notk-sh.de/wp-content/uploads/2020/01/Merkblatt_GWG.pdf

- “First National Risk Assessment: Anti-Money Laundering/Countering the Financing of Terrorism 2018/2019,” Federal Ministry of Finance, https://www.bundesfinanzministerium.de/Content/EN/Standardartikel/Press_Room/Publications/Brochures/2020-02-13-first-national-risk-assessment_2018-2019.pdf?__blob=publicationFile&v=6

- “Bekämpfung von Geldwäsche und Terrorismusfinanzierung: Erste Nationale Risikoanalyse veröffentlicht,” Bundestanstalt für Finanzdienstleistungsaufsicht, 21 October 2019, https://www.bafin.de/SharedDocs/Veroeffentlichungen/DE/Meldung/2019/meldung_191021_Veroeffentlichung_NRA.html; “First National Risk Assessment: Anti-Money Laundering/ Countering the Financing of Terrorism,” Federal Ministry of Finance, https://www.bundesfinanzministerium.de/Content/EN/Standardartikel/Press_Room/Publications/Brochures/2020-02-13-first-national-risk-assessment_2018-2019.pdf?__blob=publicationFile&v=6

- “What is BEPS?” Organisation for Economic Co-operation and Development, http://www.oecd.org/tax/beps/about/

- “Council Directive (EU) 2018/822 of 25 May 2018 amending Directive 2011/16/EU as regards mandatory automatic exchange of information in the field of taxation in relation to reportable cross-border arrangements,” Official Journal of the European Union, June 5, 2018, https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32018L0822&from=EN

- “New reporting obligation will create greater fairness in taxation,” Federal Ministry of Finance, 9 October 2019, https://www.bundesfinanzministerium.de/Content/EN/Pressemitteilungen/2019/2019-10-09-fair-taxation.html

- Frank Matthias Drost, “Einführung des „Datenbankgrundbuchs“ verzögert sich um mehrere Jahre,” Handelsblatt, 5 February 2020, https://www.handelsblatt.com/politik/deutschland/immobilienregister-einfuehrung-des-datenbankgrundbuchs-verzoegert-sich-um-mehrere-jahre/25503960.html?ticket=ST-1839311-I7IToQUE1q5TNkAr4F7w-ap6