Online video games have become a popular pastime for people of all ages. However, with the evolution of the gaming industry, exposure to financial crimes is rapidly increasing.1 The rise of virtual economies and the increasing value of in-game items and currencies have made it more appealing for criminals to use microtransactions and loot boxes in video games to launder money. The anonymity and global reach of the internet make it an attractive option for money launderers, as it allows them to transfer money across borders and through different financial systems with relative ease. In addition, the lack of regulation and oversight on virtual currencies and in-game items in video games can make it easy for money launderers to operate in these environments.

With changes to anti-money laundering (AML) laws and Bank Secrecy Act (BSA) requirements, criminals who want to launder their funds through the financial system using traditional laundering methods are faced with many challenges. This leads criminals to look for other ways to launder money. According to Sanction Scanner, “The video game industry is one of these ways. The video game industry carries money laundering risks due to in-game trades.”2 The video games use a virtual currency known as in-game currency, which is earned by winning the challenges and overcoming the hurdles within the video games.

In-game Currencies

The video games use a virtual currency known as in-game currency, which is earned by winning the challenges and overcoming the hurdles within the video games.

In-game currencies are a form of currency in a virtual world and are obtained in a variety of ways. Massively multiplayer online role-playing games (MMORPGs) all have in-game currencies and even their own in-game economies. Well-known MMORPGs include World of Warcraft, Runescape and Final Fantasy XIV.

There are two types of in-game currencies: Convertible in-game currency and nonconvertible in-game currency.

Convertible In-game Currency

A player can exchange real fiat currency—or currency made legal by a government decree or fiat—for convertible in-game currency. The convertible game currency has a fluctuating exchange rate and a particular exchange platform. This currency is used to sell, buy or exchange virtual properties with other players.3

Nonconvertible In-game Currency

With nonconvertible in-game currency, the players can exchange real fiat money for the game’s currency. This currency cannot be exchanged with other players. It can be used to buy accessories in video games, such as skills, weapons and other items to improve the skill sets of a particular character or to customize it. Today, many worldwide popular games use this type of currency and monetize it by selling nonconvertible in-game currencies.4

How Money Laundering in an Online Video Game Occurs

The use of in-game convertible and nonconvertible currencies in the online video game industry and the anonymity provided to players has created an environment that is susceptible to criminal activities. These criminal activities and money laundering schemes often begin with the criminals stealing credit card information from other users and from external sources outside of the video game. The stolen credit cards are then used to purchase in-game currencies and other items by conducting microtransactions or by purchasing loot boxes.

Other methods of criminal activities and money laundering schemes include:

- Purchasing virtual currency or in-game items with illicit funds and then selling them on third-party marketplaces for a profit.

- Using virtual currency or in-game items to purchase real-world goods or services, such as weapons, drugs or other illicit items.

- Creating multiple accounts in a game and using them to transfer virtual currency or in-game items between them.

- Gambling with virtual currency or in-game items in online games.

- Creating fake virtual items in a game and selling them to other players.5

Microtransactions

“Microtransactions are systems that allow players to purchase virtual currencies, digital assets and additional gaming content.”6 In essence, microtransactions describe player purchases of in-game items with real money. A microtransaction purchase is often small in price and is present in mobile apps and free-to-play model games. “Microtransactions are also present in games in which players are required to initially purchase a base game, usually in the form of loot boxes.... [The term “microtransaction”] is somewhat of a misnomer, as while some of the transactions may be small ($0.99-$4.99) … to unlock a particular character within a game can cost up to $80-$99, or more.”7

Criminals use microtransactions to buy expensive characters, props or skills in the game and then sell the characters or the in-game virtual currency on secondary market websites at discounted prices. The money is invested in the game and then converted into the game’s currency. With the help of microtransactions which allow buying items for low dollar amounts, the criminals are successful in not drawing attention, making laundering money through microtransactions difficult to track.

Another way that criminals launder money with microtransactions is through selling accounts on the video game platform. A criminal could create an account, buy items through microtransactions with illegal money in that account and then sell the account online for “real,” “clean” cash. These accounts can sell anywhere from $5 to $3,500. Usually, in cases like this, the laundered money comes in the form of stolen credit cards. By the time the crime has been reported, the account is already sold and the money that the criminal has received is “clean” money.”8

Loot Boxes

The National Society for the Prevention of Cruelty to Children (NSPCC) describes loot boxes as “mystery boxes containing a random selection of items that can be purchased with real money or credits built up within a game.”9 Loot boxes are usually accessed through in-game play. What is included in a loot box will depend on the game being played. For example, a player can buy a key to open a loot box with access to various types of in-game content that enhances the player experience. Items in loot boxes may consist of cosmetic items for game customization (i.e., new looks for a player’s avatar, also known as “skins”) or items affecting gameplay (i.e., new tools, weapons, levels, maps, in-game currency, the ability to chat with other players, etc.).10

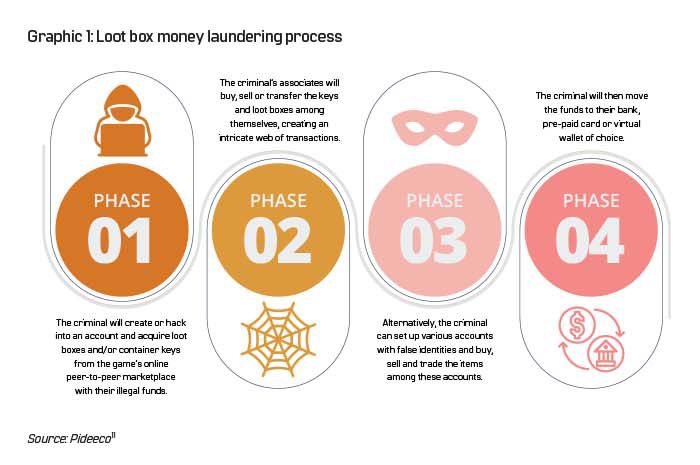

Players can pay real money for a key to unlock loot boxes. However, players can also buy keys and sell them to others online for a profit. Although the amount paid for keys is small, this anonymous system of commerce that allows the trading of keys has allowed criminals to launder dirty money. Graphic 1 illustrates money laundering using loot boxes.

Preventing Money Laundering

Money laundering has become a growing concern in the online video gaming industry, as criminals are using virtual currencies and in-game items to launder illegal funds.12 To combat this issue, many game developers have implemented fraud detection and prevention systems to detect and prevent suspicious transactions. These systems use machine learning algorithms to analyze transactions and identify patterns that may indicate money laundering.

To further combat money laundering in the online video gaming industry, some game developers have also introduced know your customer (KYC) and AML procedures to identify and verify the identity of players and monitor their in-game transactions. These procedures are designed to prevent illegal activities such as money laundering and to comply with the legal regulations and laws of the countries in which they operate. An example of this occurred with Linden Lab, the developer of the online game Second Life. Linden Lab announced in July 2019 that all Second Life users would “need to register with its fully owned subsidiary Tilia Inc., a money [services] business (MSB). As [an] MSB, Tilia is required to comply with AML/CTF [counter-terrorist financing] obligations under the Bank Secrecy Act and its implementing regulations, including in relation to customer verification and suspicious transaction reporting.”13 This provides Tilia with the ability to combat any potential money laundering or other potentially suspicious activities that may be conducted through Second Life.

Money Laundering Incidents

In March 2023, a proposal was submitted to a San Francisco federal court, which reported that Roblox, an online video gaming platform, faces a possible money laundering issue. As per a new court filing, over 300 users are allegedly laundering money by buying fake in-game items with in-game currency.14 It has been reported that these users appear to be using the Roblox platform to send money to one another by purchasing fake items. In addition, there is some evidence to suggest that the majority of users are children who scam each other out of items that have an in-game value, which can then be sold for monetary value.

In November 2021, Twitch, a video game streaming platform, confirmed that nearly $10 million was funneled through and laundered on the Twitch streaming platform. Initially, Twitch took action against approximately 150 users during the final months of 2021. However, it was reported that in January 2022, 40 individuals were arrested in relation to the Twitch scandal.15 This was discovered in the later months of 2021 when Twitch found that a group of streamers was receiving hundreds of dollars in donations daily. The donations were made in Bits, the Twitch currency used to tip or donate to streamers. The Bits always seemed to find their way back to the donating party. As it turns out, the Bits were reportedly purchased using stolen credit cards, and this was part of a scheme to launder money through the Twitch platform. The goal was for the perpetrators to use the stolen credit cards to purchase large sums of Bits, work out an agreement with streamers, “donate” the Bits to them and have the streamer later send most of the Bits back where they could be cashed out.

The online video game industry has seen a surge of fraudulent and money laundering activity in recent years

The Counter-Strike: Global Offensive video game series previously had “CS:GO” container keys available to purchase in-game. “These purchased items could be sold and exchanged on the Steam Community Market virtual trading platform.”16 In 2019, however, developers of the Counter-Strike game series decided that “CS:GO” container keys could no longer be bought and traded. According to Counter-Strike, they made this decision because worldwide fraud networks began using “CS:GO” keys to liquidate their earnings. At that time, they also noted that almost all significant purchases traded on the market were believed to be fraudulent.17

Reported in January 2019, a joint investigation by The Independent and the cybersecurity firm Sixgill uncovered that Fortnite’s in-game currency was being used to launder money from stolen credit cards.18 According to a report by The Independent and Sixgill, the money laundering schemes operated by hackers who would “access someone else’s credit card information, and then use it to create a Fortnite account and buy V-bucks (the game’s currency). Once the account fills up with V-bucks, it is then sold through a legitimate vendor like eBay, or on the dark web, for lower rates than gamers will get in the game or through an authorized online store.”19

Conclusion

The online video game industry has seen a surge of fraudulent and money laundering activity in recent years. Due to its lack of targeted laws and regulations locally and internationally and few KYC rules, the video game industry fosters an environment for criminal financial activity.

As financial crime and money laundering strategies become more sophisticated, so should AML practices. With the gaming industry in constant growth and projected to hit a staggering $298 billion by 2027, money laundering related to criminal activities is expected to rise.20

Overall, to combat money laundering in the online video gaming industry, game developers and law enforcement agencies should work together, combining technology and regulations, to identify, track and prevent financial crimes from occurring.

Although there are few “regulations to prevent money laundering in the online video game industry, the Financial Action Task Force added a note to money laundering Recommendation 15 in 2019. According to this note, perspectives on the regulation and supervision of virtual asset service providers have been introduced. It is believed that money laundering in the gaming sector will get curbed by introducing new regulations.”21 Unfortunately, until this happens, criminals may continue to take advantage of the absence of regulations within the online video gaming industry.

Mavis Bennett, CAMS, AVP transaction monitoring manager, Community Federal Savings Bank, NY, USA

- Hala Bou Alwan, “Money Laundering Crime: How Vulnerable Is the Gaming Industry?” Eventus International, September 2020, https://www.eventus-international.com/post/money-laundering-crime-how-vulnerable-is-the-gaming-industry

- “Online Video Games and Money Laundering,” Sanction Scanner, https://sanctionscanner.com/blog/online-video-games-and-money-laundering-183#

- Pathik Shah, “How do Criminals Launder Money using Video Games?” AML UAE, https://amluae.com/how-do-criminals-launder-money-using-video-games/

- Ibid.

- “Online Video Games and Money Laundering,” Sanction Scanner, https://sanctionscanner.com/blog/online-video-games-and-money-laundering-183#

- Alexandra Norton, “Gaming the System: Money Laundering through Microtransactions and In-Game Currencies,” JLIA Blog At Penn State Law, February 28, 2020, https://sites.psu.edu/jlia/gaming-the-system-money-laundering-through-microtransactions-and-in-game-currencies/

- “Money Launderers Exploit Online Gaming Loopholes,” Web Shield, February 24, 2020, https://www.webshieldltd.com/post/money-launderers-exploit-online-gaming-loopholes

- Alexandra Norton, “Gaming the System: Money Laundering through Microtransactions and In-Game Currencies,” JLIA Blog At Penn State Law, February 28, 2020, https://sites.psu.edu/jlia/gaming-the-system-money-laundering-through-microtransactions-and-in-game-currencies/

- “What is loot box?” NSPCC, June 27, 2022, https://www.nspcc.org.uk/keeping-children-safe/online-safety/online-safety-blog/loot-boxes/

- Ibid.

- Stefano Siggia, “How do criminals launder their money using video games?” Pideeco, March 9, 2020, https://pideeco.be/articles/aml-money-laundering-and-video-games/

- “Online Video Games and Money Laundering,” Sanction Scanner, https://sanctionscanner.com/blog/online-video-games-and-money-laundering-183#

- Anton Moiseienko and Kayla Izenman, “Gaming the System: Money Laundering Through Online Games,” RUSI, October 11, 2019, https://rusi.org/explore-our-research/publications/rusi-newsbrief/gaming-system-money-laundering-through-online-games

- Cyrus Farivar, “Hundreds Of Roblox Users May Be ‘Engaged In Money Laundering’, Court Filing Claims,” Forbes, March 30, 2023, https://www.forbes.com/sites/cyrusfarivar/2023/03/30/hundreds-of-roblox-users-may-be-engaged-in-money-laundering-court-filing-says/?sh=30c64038381c

- Jonathan Lochiatto, “The Twitch Money Laundering Scandal Explained,” SVG, January 5, 2022, https://www.svg.com/725611/the-twitch-money-laundering-scandal-explained/

- Vedant Sangit, “Laundering through video games is new trend in financial crimes,” Regtechtimes, April 17, 2020, https://regtechtimes.com/video-games-money-laundering/

- “Online Video Games and Money Laundering,” Sanction Scanner, https://sanctionscanner.com/blog/online-video-games-and-money-laundering-183#

- “Fortnite’s In-Game Currency Used In Money Laundering Schemes,” PYMNTS, January 21, 2019, https://www.pymnts.com/news/security-and-risk/2019/fortnite-in-game-currency-money-laundering/

- Ibid.

- Stefano Siggia, “How do criminals launder their money using video games?” Pideeco, March 9, 2020, https://pideeco.be/articles/aml-money-laundering-and-video-games/

- Vedant Sangit, “Laundering through video games is new trend in financial crimes,” Regtechtimes, April 17, 2020, https://regtechtimes.com/video-games-money-laundering/