For the past several years, conversations on anti-money laundering (AML) and counter-terrorist financing (CTF) have been at the forefront for public and private (P/P) sector leaders alike. From published articles to conference presentations to national governments’ priorities and international intergovernmental organizations’ priorities, these conversations remain focused on how to make regulations and standards more effective. One topic that is frequently discussed—as its value is widely appreciated by both the P/P sectors—is partnerships and how each sector can more effectively share valuable information to combat heinous crimes. However, these conversations often fail to identify practical steps that might improve the value and information shared within P/P partnerships. The goal of this article is to provide a practical two-phased approach for building and operationalizing effective P/P partnerships.

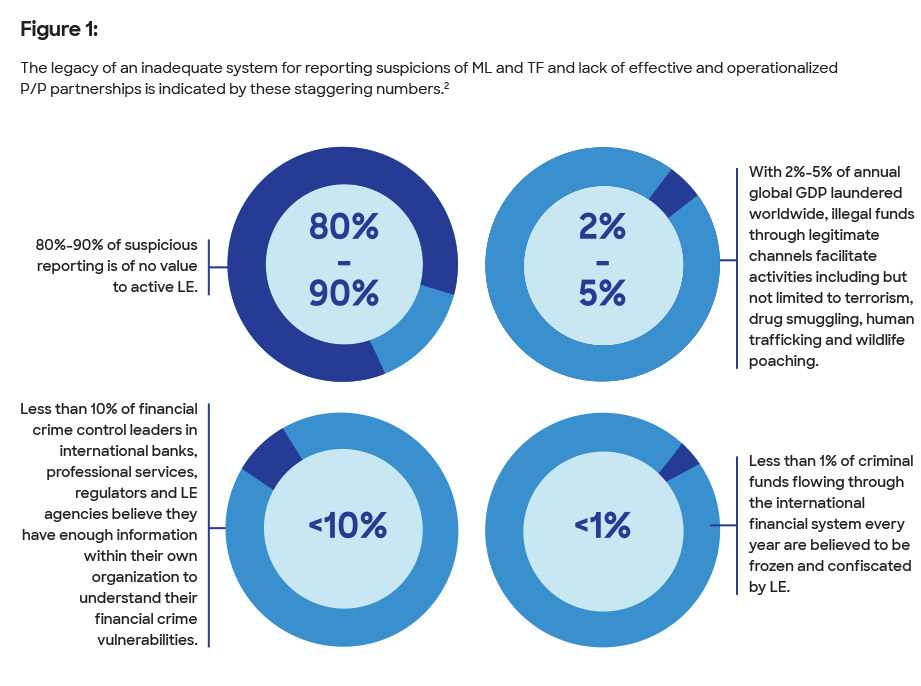

The core intent of AML regulations and establishing global standards against money laundering (ML) and terrorist financing (TF) has been clear from the outset: Provide useful information on suspicious financial transactions to law enforcement (LE). For decades, financial institutions (FIs) have understood this to mean they are required to put systematic controls in place to protect their FI from illicit use; this includes having an effective program to identify and report suspicious activity. However, these mechanisms have proven to be far from effective. A 2017 report published by the Royal United Services Institute (RUSI) indicates, “80-90% of suspicious reporting is of no immediate value to active law enforcement investigations, according to interviews conducted with past and present financial intelligence unit (FIU) heads […], with one jurisdiction indicating that 97% of suspicious transactions were of no immediate value to law enforcement investigations.”1 While there has been much progress on information sharing between FIs and LE over the past few decades, these numbers indicate that much more still needs to be done (see Figure 1 below).

ML and TF can be effectively combated within the financial system through an evolving P/P partnership value chain. This requires a phased approach of operationalizing tactical information shared through P/P partnerships and building strategic relationships that will provide highly useful information to both sectors. Creating a successful partnership value chain is not without challenges and obstacles. However, most of the identified obstacles can be navigated by a shared devotion and understanding of each sectors’ perspectives, resulting in a symbiotic relationship. In the world of finance, criminal activity can be quite sophisticated. To combat financial crime effectively, operationalized P/P partnerships are of utmost importance.

P/P Partnership Value Chain

A value chain is a set of activities that a specific industry performs in order to deliver a product of value. What better way to describe the ongoing efforts of FIs large and small that invest in, build and manage AML and CTF compliance programs globally. These programs aim to identify the ever-changing strategies of illicit actors who attempt to gain access to the global financial system. Once these criminals do gain access, their potential for harm is magnified. According to the United Nations Office on Drugs and Crime, 2% to 5% of annual GDP is laundered worldwide,3 potentially equating to trillions of dollars in illicit fund flows. To interrupt these financial flows, FI compliance programs require suspicious activity reports (SARs), suspicious transaction reports (STRs) or suspicious matter reports (SMRs) be submitted to the national FIU. These reports are an important part of the P/P value chain. When properly investigated and written by FIs, SARs can prove to be useful information to LE. Equally as important is the public sector’s role in the P/P value chain. When the public sector shares valuable information on important trends and typologies, blueprints of illicit behavior, geographical vulnerabilities and money laundering/terrorist financing (ML/TF) red flags, FIs can use that information to align their monitoring and investigation capabilities to identify and report suspicious activity.

Sharing valuable information between the P/P sector is key to promoting financial transparency and protecting the integrity of the financial system.4 As James Barnacle, chief of the FBI Money Laundering Unit, stated, “The relationship we have with private industry is just as important as the partnerships we have with other government agencies and regulators. Our mission would not succeed without our partnership with the private sector.”5

Strategically linking these two activities—SARs and information sharing through partnerships—shows the value of the available information and supports the goal of a collaborative and effective framework to combat ML/TF.

Understanding the Obstacles, Challenges and Conflicting Priorities

Furthering the success and evolution of these partnerships can be challenging due to continuous obstacles and conflicting priorities. One of the main obstacles is ensuring information shared, especially from the public sector, remains confidential. Compromised information can adversely affect intelligence gathering or tip off subjects of active investigations. Other challenges and conflicting priorities include:

- Limited available resources to investigate on both P/P sector sides

- Countries’ legislative environments inhibiting public-to-private and private-to-private information sharing

- Potential disconnect and gaps between regulatory and LE priorities

- Regulatory compliance is the end to be achieved rather than a means for making the financial system safer

These obstacles, individually or collectively, should not deter either sector from nurturing these relationships; they should be seen as opportunities to break down the silos of legacy cultures, fill gaps between priorities, and bridge the shared devotion of each sector to leverage resources, expertise, data and tools to combat ML/TF.

For years, the industry has found meaningful ways to overcome these challenges and has had many success stories, hence why it is important to continue fostering these relationships.

Operationalizing P/P Partnerships Through a Two-Phased Approach

P/P partnerships can be effective if there are appropriate mechanisms in place for sharing tactical and strategic information and subsequently operationalizing that information. This calls for an understanding of perspective, adaptability, trust and accountability from each sector (see Figure 2 below).

With input from several senior LE leaders within the public sector, the following two-phased approach was developed to provide the conduit for each sector to share the valuable information that is key to protecting the integrity of the financial system and combat ML/TF.

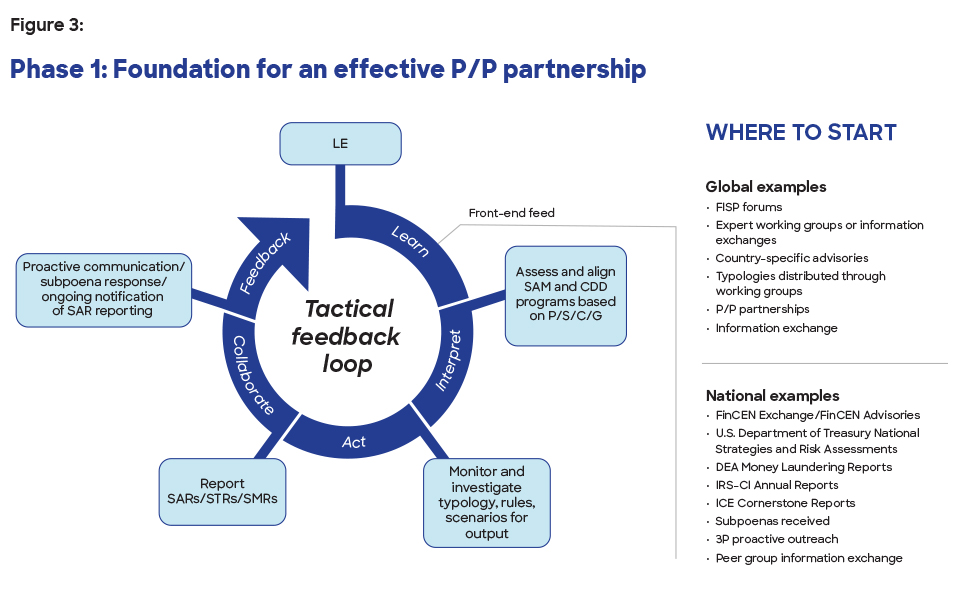

Phase 1: Establishing a Foundation of an Effective P/P Partnership Through Feedback

The first phase (see Figure 3 below) is to build a foundation of partnership that focuses on operationalizing front-end feed, developing typologies and providing a better understanding of risk both to the FIs and LE through feedback. The first step in this phase is being able to use the information from LE effectively. For those at FIs that are only beginning to work with LE, that entails leveraging existing resources that identify current priorities, typologies, emerging threats and scenarios, etc. This tactical information can come from existing financial information-sharing partnership (FISP) programs, specific typologies distributed though expert working groups or sources of information received through P/P partnership information exchanges. This is considered the front-end feed. For example, the U.S. has a number of valuable front-end feed sources including the following:

- The National Strategy for Combating Terrorist and other Illicit Financing, and other risk assessments issued by the U.S. Department of Treasury

- Financial Crimes Enforcement Network (FinCEN) Exchange

- FinCEN Advisories

- IRS Criminal Investigations Annual Report

- Drug Enforcement Administration Money Laundering Report

The front-end feed could also come from emerging threats and typologies discussed in P/P working groups or information exchanges between local and regional FI peer groups.

The next step is to evaluate the risk within the FI from the information gathered. Based on the products, services, customer base and geographies (P/S/C/G) served, where are there increased vulnerabilities to ML/TF? Furthermore, existing suspicious activity monitoring (SAM) programs and customer due diligence (CDD) programs should be evaluated. Would the customer risk, typologies, threats and conduit of activity addressed in the front-end feed be identified? If not, there is an opportunity to re-align and strengthen SAM and CDD processes. This could include:

- Implementing or further tailoring rules and scenarios within the SAM program

- Building new typologies

- Focusing CDD and high-risk account monitoring based on a certain customer base, products used or geographical footprint

This process may be more difficult for smaller FIs with manual monitoring or those that rely on SAM programs that cannot customize and align their systems to the ML/TF threats based on the FI’s P/S/C/G. In this situation, it is important to continue to work with (and demand) the third-party service provider to encourage innovation and customization opportunities as no FI’s risk profile or customer base is the same.

The next step is to investigate the output and determine if filing a SAR is warranted. If the SAM program is aligned with typologies that have come directly from LE, SARs filed on alerts generated from the front-end feed are more likely to be of interest to LE. It is highly recommended to reach out to LE proactively on cases that seem more urgent and/or have highly valuable information.

But do not stop at the proactive SAR notification. It is important to continue communication with LE to create an effective two-way relationship. This can be established through conversations between the LE agent and the FI on the activity reported and why it may be of interest to LE. Even if the specific SAR is not of immediate interest to LE, understanding the value and what is useful to LE is critical. In addition, both parties should examine this mechanism of information sharing and structure it so that the right kinds of information are shared.

There is no doubting the benefit of partnership, but partnership can take many forms, all of which should be recognized and nurtured. While the ultimate objective is to secure better outcomes against financial crime, this will not be achieved without building inclusive trust and confidence across the P/P sector divide.6 An ongoing P/P partnership requires all-around cooperation and should build off trust and confidence toward the second phase of a more strategic partnership.

Phase 2: Expanded Framework for an Effective and Trusted Strategic Partnership

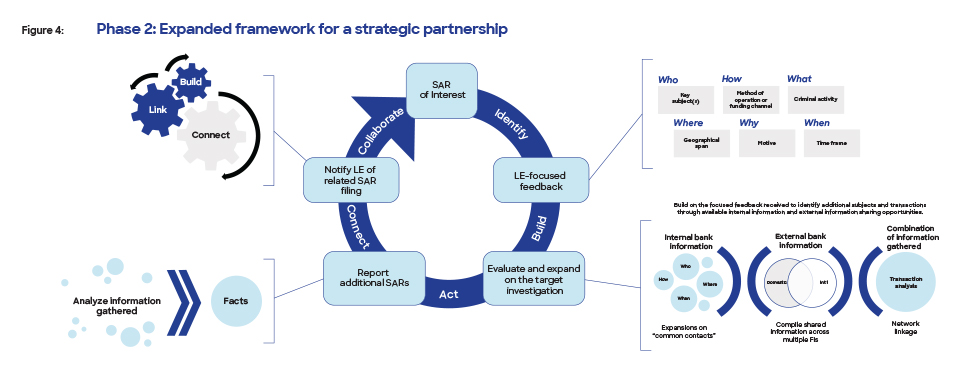

The second phase (see Figure 4 below) strives for an evolved strategically trusted relationship. At this point, the P/P sector stakeholders would understand each side’s perspective, interact and engage with one another, and exchange information, analysis and intelligence. Through this trusted relationship, information that fills the intelligence gaps, assists in building networks and helps promote a more comprehensive analysis of available data would flow unimpeded. The relationship would provide highly useful information to LE and based on feedback from LE, the FI would be able to translate focused information into more tailored monitoring systems, targeted investigations and valuable SAR reporting. It is time the AML industry builds and expands into more strategic partnerships that allow for a central view of how criminals are exploiting the financial infrastructure and how each side of the partnership is accountable for providing highly useful information.

Figure 4 serves as an example of an effective strategic partnership. Note that a one-size-fits-all approach is not feasible in every circumstance. Depending on the LE agency, the FI, the maturation of the partnership and potential information-sharing challenges, this could evolve into several different frameworks.

Specific to this framework, the process begins at the “SAR of Interest.” The SAR of Interest will be defined as a SAR that was filed by the FI, has elicited active interest by LE and through the strategic partnership, LE-focused feedback has been provided to the FI. Focused feedback is defined as LE providing the trusted FI with a data point of interest or unit of information to pay particular attention to that is related to the SAR of Interest.

Beginning from the SAR of Interest and leveraging the focused feedback received, the FI would begin to expand the investigation to include further assessment on internal information available, such as other common contacts, beneficiaries of related funds, other transactions with similar flows, transactions in the same geographic footprint, etc. The FI may also leverage external information-sharing opportunities with other FIs both domestically and internationally. Information sharing among FIs allows for the revelation of new accounts, activities and/or associated entities or individuals. It facilitates a more comprehensive understanding of the subjects’ activities, especially if the funds flow across several FIs, entities and geographies. In the U.S., this could occur through 314(b) information-sharing practices. Further understanding of the direction, location and method used to transmit the funds both from the origin and destination is useful information to LE and when possible, information sharing among FIs should be leveraged.

Once the FI has gathered all of the information, internally and externally, assessed the information, and has determined that additional SAR reporting is necessary, it is important that the revised SAR is a record of facts. At this point, facts are important to LE as they can be proven using data and information that can be provided by the FI. It is best practice to limit the content of investigative reports to facts.7 This will subsequently allow LE to continue building networks, linking important connections and filling potential intelligence gaps based on information received in the subsequent SAR filing.

Upon filing, FIs should proactively notify LE and begin collaborating to capitalize on the additional information. Remember that building a strong, ongoing collaborative ecosystem is iterative. Criminal networks are constantly evolving and so are the manners in which they move their illicit funds. Both phases of the partnership are an agile process that continues to evolve, not just as the front-end feed and SARs of Interest change but as the ML/TF threats, risks, typologies and priorities change as well.

The industry is evolving and finding success in these types of partnerships. In a statement before the U.S. Senate Committee on Banking, Housing, and Urban Affairs, Steven D’Antuono, section chief of the FBI Criminal Investigative Division, said the following,

“Since the FBI relies heavily on Bank Secrecy Act data, we work closely with financial institutions to ensure open lines of communication. We routinely sit down with banks, both large and small, to discuss what SARs were helpful to our operations and what type of data is useful for future filings. By providing this feedback, the quality of SARs continually improves which means the FBI has better data to support our investigations. The FBI has also begun conducting outreach to banks to share declassified information, to include certain selectors, in an effort to marry their SARs with existing case information. This allows the banks to submit a proactive filing based on articulable intelligence, not just typologies.”8

Conclusion

Defending the global financial system against money launderers and terrorist financiers requires continued nurturing of the P/P partnership value chain. All stakeholders in the value chain will recognize that while the flow of information can always be improved, the objective of all parties is ultimately the same—to detect, interrupt and reduce the number of illicit actors who attempt to gain access to the global financial system. Strengthening P/P partnerships through this two-phased approach is an effective mechanism to achieve this objective. When all parties to the information-sharing process understand each other’s perspective and are adaptable, accountable and trusting of each side’s perspective, the most effective results will be achieved.

Lauren Kohr, CAMS-FCI, senior vice president, chief risk officer, Old Dominion National Bank, Tysons Corner, VA, USA, LKohr@ODNBonline.com

- Nick J. Maxwell and David Artingstall, “The Role of Financial Information-Sharing Partnerships in the Disruption of Crime,” Royal United Services Institute, October 2017, https://www.future-fis.com/uploads/3/7/9/4/3794525/ffis_report_-_oct_2017.pdf

- Ibid.

- “Money Laundering and Globalization,” United Nations Office on Drug and Crime, https://www.unodc.org/unodc/en/money-laundering/globalization.html

- “Private Sector Information Sharing,” Financial Action Task Force, November 2017,http://www.fatf-gafi.org/media/fatf/documents/recommendations/Private-Sector-Information-Sharing.pdf

- “Combatting the Growing Money Laundering Threat, Specialized FBI Unit Focuses on Disrupting Professional Money Launders,” FBI, October 24, 2016, https://www.fbi.gov/news/stories/combating-the-growing-money-laundering-threat

- Tom Keatinge, “Public-Private Partnerships and Financial Crime: Advancing an Inclusive Model,” Royal United Services Institute, December 1, 2017, https://rusi.org/commentary/public%E2%80%93private-partnerships-and-financial-crime-advancing-inclusive-model

- Report Writing for Financial Investigators, (ManchesterCF, 2020), 32.

- “Combating Money Laundering and Other Forms of Illicit Finance: Regulator and Law Enforcement Perspectives on Reform.” United States Committee on Banking, Housing and Urban Affairs, November 29, 2018, https://www.banking.senate.gov/hearings/10/24/2018/combating-money-laundering-and-other-forms-of-illicit-finance-regulator-and-law-enforcement-perspectives-on-reform