On June 22, 2017, the ACAMS Netherlands Chapter, in partnership with Mollie, a European online payment provider and a technology-driven company that is continuously looking at quicker and more secure ways to make payments, hosted a seminar titled “Modern Ways of KYC.”

Key Takeaways of the Event

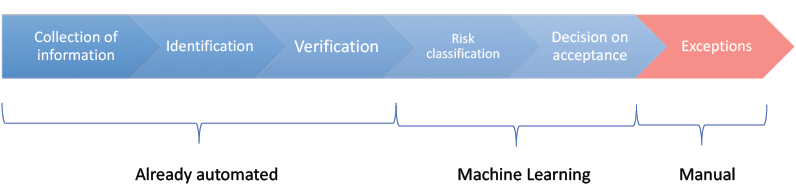

Remco Boer, director at Mollie, started the seminar with a presentation about Mollie’s experiment with machine learning and customer due diligence (CDD). To keep up with the company development and remain a sustainable business, it is necessary to automate CDD in order to reject unwanted merchants at an early stage and to keep the process efficient. Mollie started an experiment to automate the entire CDD process for 95 percent of applications.

Boer defined machine learning as a construction of algorithms that gives computers the ability to learn without being explicitly programmed (i.e., the ability to learn by itself). Based on what it has learned, it can predict, classify or make decisions. There are various models of a ‘blackbox’ and Mollie chose to work with one called Random Forest.

The model takes the data considered to be important. It is a human decision—which can be biased—on what is important data and how to grade it. It takes all inputted features and produces a decision tree. It is important to understand that the model works with the data you input, therefore the outcome is greatly dependant on the source data (e.g., ultimate beneficial owner information, country, age). It is also essential to understand the effects of your decisions and the consequences, since it is important to have a proper audit trial. During its test case, Mollie learned that it is too early to use these models for CDD purposes because outcomes can be biased.

As a tip for the industry, Mollie advises to stay abreast of technology developments, whereby other forms of supervision are marching in: reading and understanding algorithms and statistical outcomes instead of policy documents. A combination of domain knowledge developers with technical knowledge compliance officers is paramount.

The next part of the seminar was presented by Dennis Martens, managing consultant at Synechron, a digital, business consulting and technology services firm.

Martens discussed what blockchain is and how it works. Blockchain is a technology that facilitates the exchange of value between the participants of a network.

The greatest example of blockchain is Bitcoin. Transactions are recorded in a shared distributed ledger by direct parties, which excludes intermediaries (any third-party services). Parties use smart contracts where they can block/de-block each other and there are agreed rules. The system works in such a way to create a chain of blocks that are transparent to all parties involved.

After the basic introduction on blockchain’s functionality, the presentation covered how know your customer (KYC) and anti-money laundering (AML) can benefit from blockchain. The conclusion was that blockchain can bring a number of benefits to KYC and AML (from cost reduction to reduced risk); however, blockchain can also possibly facilitate money laundering when the setup stimulates anonymity. There is still a long way to go before blockchain is used for KYC purposes.

Joachim von Hänisch, product manager at SWIFT, finished the seminar with a presentation on the SWIFT KYC Registry for correspondent banks. After a short explanation on de-risking and the unintended consequences that could ultimately lead to less transparency, the link was made with the SWIFT KYC Registry functionality as a community-inspired financial crime compliance solution. Some basic highlights of the registry that were covered in the next part of the presentation concerned:

- Standardized KYC baseline efficiency: All KYC data provided by counterparties arrives in the same format and structure;

- Up-to-date information: Time-stamped data and diligent update requirements;

- Any changes to client data are communicated in real-time to all counterparties; and

- Data verification by SWIFT: All data are verified and validated by SWIFT compliance professionals.

This seminar had a more technical perspective and received overall positive feedback. The audience found it very interesting to see these new developments in the market that could facilitate future compliance. The ACAMS Netherlands Chapter is grateful to the speakers, the sponsor Mollie and participants for a highly informative seminar.

Board of the ACAMS Netherlands Chapter