The Association of Certified Anti-Money Laundering Specialists (ACAMS) Greater Salt Lake City Chapter held a one-day financial crimes conference on June 21, 2019. The event was the first of its kind for the chapter and was a big success. Those in attendance were treated to a variety of topics including discussions on virtual currency, fraud and cybercrime, exam do’s and don’ts with Federal Deposit Insurance Corporation (FDIC) examiners, dark web and the anatomy of a money services business (MSB).

The day began with a presentation on virtual currency by Eric Vogeler of Bitsy, Inc., which was a total hit. As the chief compliance officer for Bitsy, Vogeler discussed the current state of cryptocurrencies and industry efforts to ensure the viability of virtual currency moving forward. In addition to sharing his insights from the perspective of an exchange, he also brought up what exchanges can do to address anti-money laundering (AML) issues.

Attendees were then treated to an interesting discussion on fraud and cybercrime from Special Agent (SA) Paul Bingham of the FBI. His presentation covered topics such as phishing, hacktivism, organized crime, state-sponsored cybercrime and business e-mail compromises. SA Bingham talked about how cybercrime is a worldwide problem. He advised participants on how to look for these typologies in their institutions and how to protect their customers from falling victim to scams and fraud. He also suggested that attendees consider joining into the FBI’s public-private partnership, InfraGard, which is set up to protect the infrastructure of the U.S.

Following the presentation on fraud and cybercrime, there was a group discussion with FDIC examiners Dan Hastings and John Murphy. The examiners provided useful information on how institutions can prepare for examinations and talked about how keeping an open channel of communication with your examiners will lead to successful partnerships. There were many questions from the audience ranging from how institutions should be handling the new CDD Final Rule, to the Financial Crime Enforcement Network’s (FinCEN) joint statement on developing innovative approaches, to reporting and detecting money laundering.

The next presentation was by Tyler Knotts, vice president of compliance at TAB Bank. Knotts gave a presentation on the anatomy of an MSB. Before his current job, Knotts worked as a senior Bank Secrecy Act (BSA) compliance manager for a money transmitter. He shared his in-depth knowledge on the functions of MSB agents and what is being done in the MSB space to combat money laundering and fraud. He spoke about the use of money orders and fund remittances in complex schemes to move illicit funds.

The following presenter was Aaron Sherman, senior director of cyber threat intelligence at Braintrace. Sherman gained his expertise in cybersecurity during his time with the FBI and the Army National Guard. He led a great discussion about the dark web and how it can be used proactively to search for fraud involving their institution. He gave a live demo of pointers on what to look for and how to use the dark web. With that bit of information, Sherman cautioned that if a financial institution utilized the dark web for research, it should be accessed from a device not on their network and to use the buddy system.

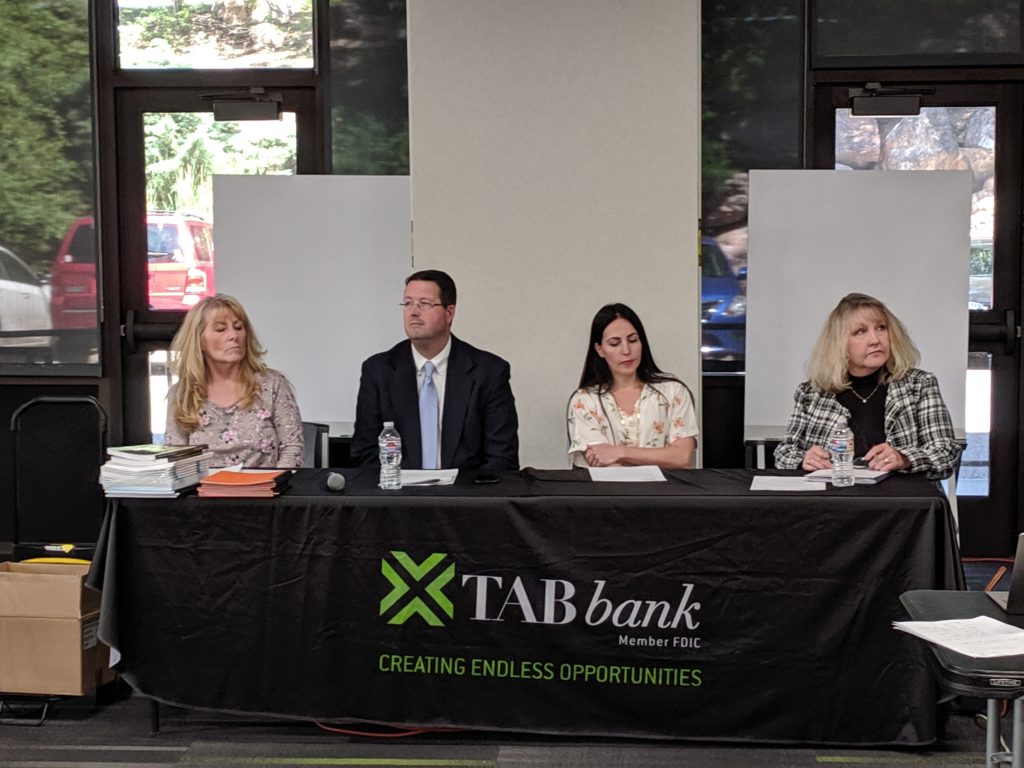

To close out the day, there was a panel discussion with a diverse group of experts in the AML/anti-financial crimes community. Included in the panel were Terry Baker-Smith, chief Bank Secrecy Act/anti-money laundering (BSA/AML) officer at Zions Bancorporation; Darin Jarrett, deputy BSA/AML officer at American Express; Debbie Booth, information specialist at Utah Department of Human Services; and Tiffany Chesnos, vice president at The Data Initiative. The panel spoke on a broad range of financial crime topics such as marijuana banking, best practices with auditors and examiners, elder financial exploitation, innovation in AML technology and many more.

It was a full day of AML knowledge sharing and networking within the close-knit Greater Salt Lake AML community. All in attendance learned crucial information that will help them better detect and report suspicious activity. They also earned five Certified Anti-Money Laundering Specialist (CAMS) credits toward certification. The chapter would like to thank the event sponsors, TAB Bank and Web Bank, presenters and attendees for making the event a success.

Submitted by: ACAMS Greater Salt Lake City Chapter, chapters@acams.org