On February 13, 2018, the ACAMS Netherlands Chapter, in partnership with Innopay, hosted a seminar on the Payment Services Directive 2 (PSD2). Luc van Oorschot (Innopay), Tijmen Daniels (DNB, Dutch Central Bank) and Michal Kalina (Rabobank) were the three speakers. Oorschot led the chapter through an explanation of the PSD2, Daniels explained the regulators’ position at the moment and Kalina closed out with the practical view of the PSD2.

Introduction to PSD2 by Luc van Oorschot

Oorschot’s presentation gave those who were new and those who were already familiar with the PSD2 a great and clear overview of its meaning and how it is a natural evolution and a complement to the previous Payment Services Directive (PSD1).

He also gave the chapter some insights into what the PSD2 will mean for the payment industry and for the customer. In addition, he pointed out the following reasoning behind this law:

- Achieving harmonization within the European payment infrastructure

- Enhancing competition

- Protection of consumers

- And the encouragement of digital evolution

The most important change brought by PSD2 relates to the third-party “access to accounts” (XS2A) and related strong customer authentication (SCA) requirements. In addition, PSD2 brings the following new services:

- AIS (AISP): Account information services

- PIS (PISP): Payment initiation services

- CAF: Conformation availability of funds

This will be guided by the Regulatory Technical Standards and strong requirements for the (new) third-party payment services providers. However, it opens up the market, resulting in new parties being able to enter a more level playing field.

PSD2 also prescribes the use of electronic, identification, authentication and trust services (eIDAS) certificates for the purpose of identification, but these certificates cannot yet be issued. These requirements were meant to bring the PSD2 in line with different existing European laws (General Data Protection Regulation [GDPR], Fourth AML Directive [4AMLD]).

PSD2—A Supervisory Perspective by Tijmen Daniels

In his presentation, Daniels guided the chapter along the difficult paths that the regulator walks on in order to get new legislation in place on time. Currently, the PSD2 is only implemented in eight of the EU member states (e.g., Germany, France) while the implementation in the Netherlands has been delayed. This of course has some implications because thus far no PSD2 license can be issued, the XS2A is not regulated and credit institutions are not obliged to the PSD2.

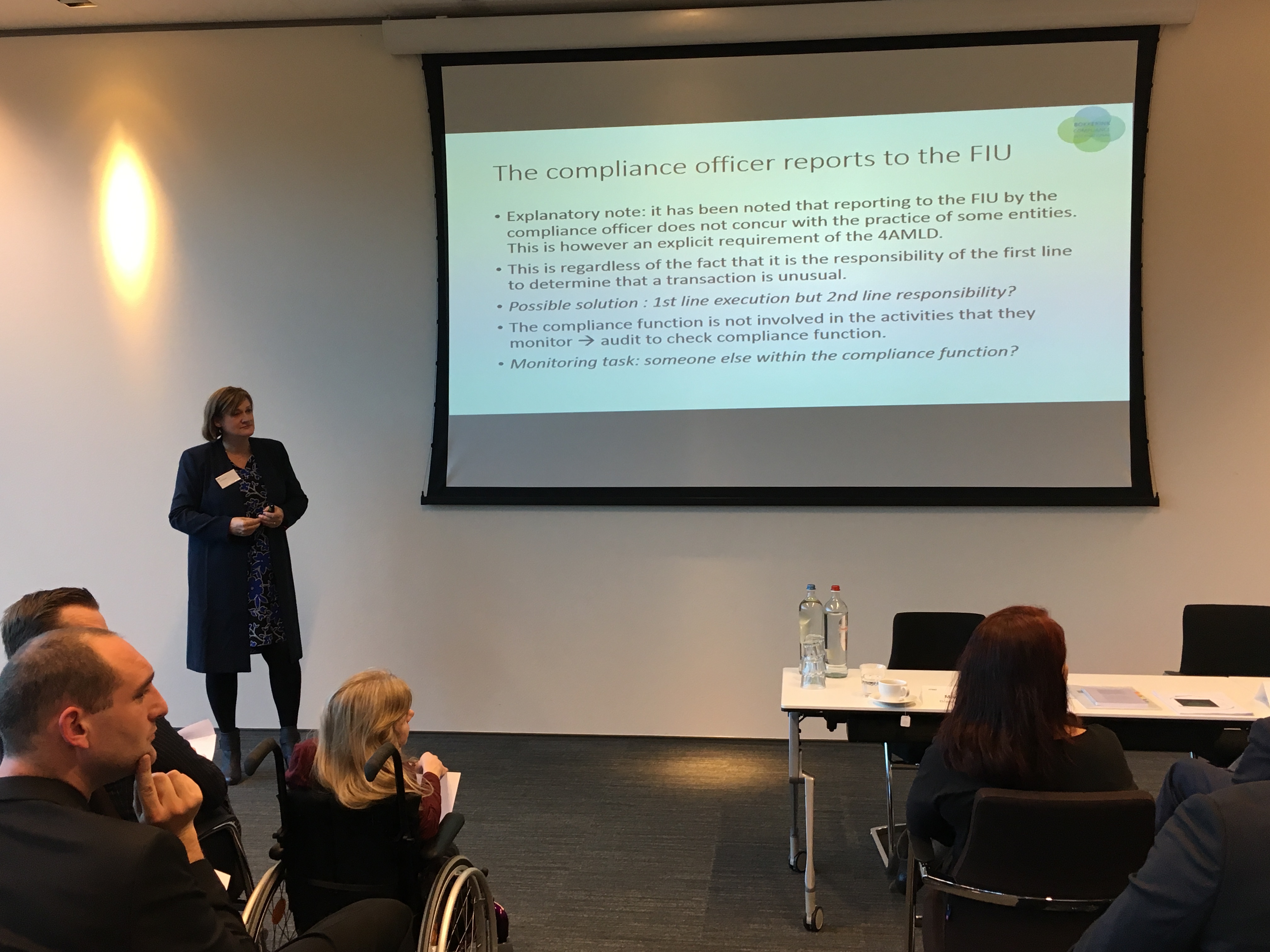

As the 4AMLD applies to all payment institutions there is a strong (maybe even stronger) need for customer due diligence by the PISP than by the AISP. The already needed transaction monitoring by PISP is still more than valid, while for the AISP it is basic not required.

PSD2 and XS2A by Michal Kalina

Kalina explained the practical implications for the consumers with the introduction of the XS2A. He began with the natural birth and evolution of PSD1 and PSD2, stating that it was not new, but a combination that regulated what was already out there.

PSD2 enables licensed parties, with explicit consent of the customer, to do the following:

- Directly initiate transactions on the payment account held at account-holding banks

- Retrieve payment transactions data from payment accounts with banks

- Receive confirmation on the availability of sufficient funds on the payment account held at the account-holding bank

Kalina presented how Rabobank is playing into this new option with the Omni-Bank RaboApp which, in the near future, will allow adding bank accounts from other banks. He also showed how Rabobank will add an “In Control” dashboard to allow clients to provide consent using user-friendly settings, the app PEAKS and the app Tellow, indicating how Rabobank introduces PSD2-based services.

Clearly, because the Netherlands is not ready, there is still a lot that is unclear.

Final Remarks

The ACAMS Netherlands Chapter is grateful to the speakers, the sponsor Innopay and the participants for another highly informative seminar.

Board of the ACAMS Netherlands Chapter