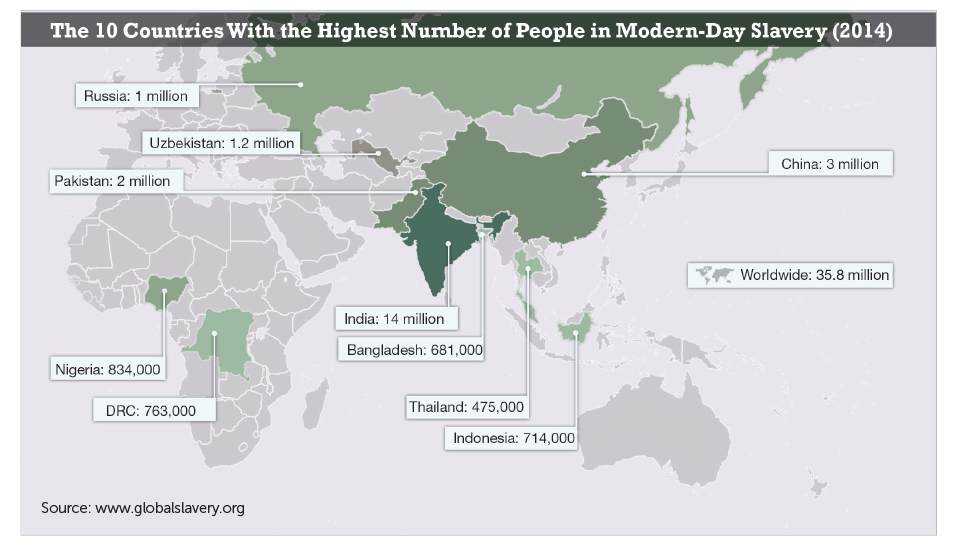

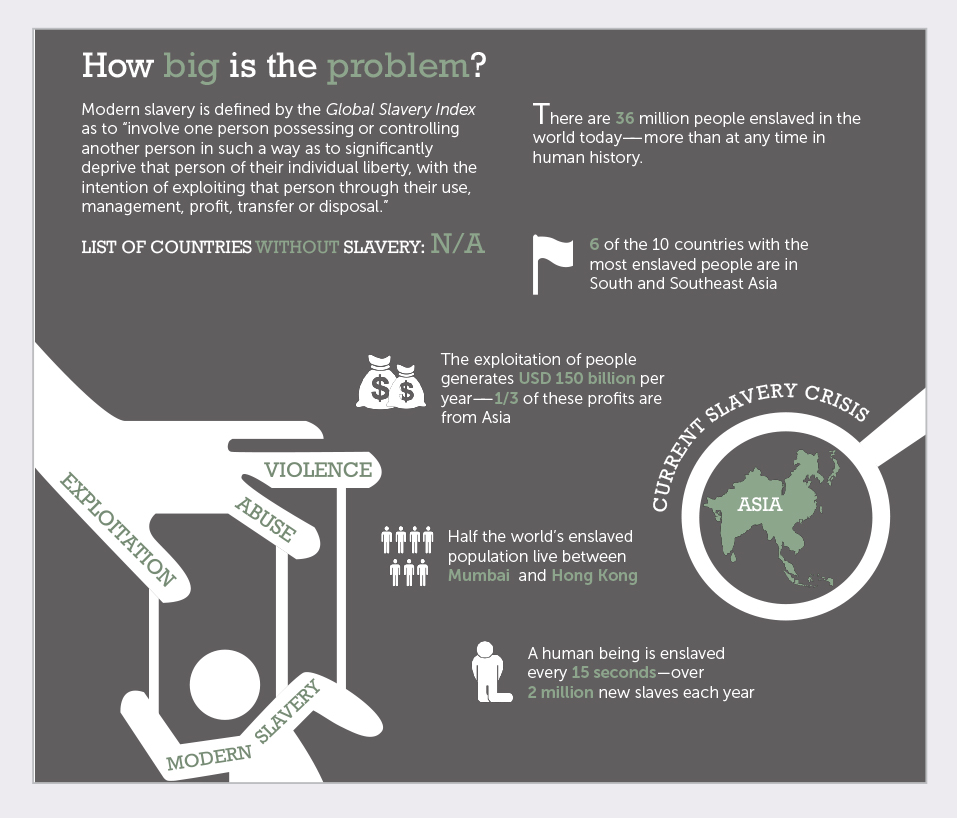

A surprisingly common misconception held by many is that slavery ended in the 19th century; however, it did not. At no time in human history are more men, women, boys and girls enslaved than now. In 2014, the Global Slavery Index estimated that 35.8 million men, women and children are trapped in modern slavery.1

Modern slavery2 is prevalent today—in one form or another—in every country in the world encompassing forced and compulsory labor and human trafficking.3 According to the National Crime Agency, “Traffickers and slave [drivers] coerce, deceive and force individuals against their will into a life of abuse, servitude and inhumane treatment. Victims may be sexually exploited, forced to work for little or no pay or forced to commit criminal activities against their will.”4 Whether it is “women and children forced into prostitution; children and adults forced to work in agriculture, domestic work, or factories and sweatshops producing goods for global supply chains, [or] entire families forced to work for nothing in order to pay off generational debts,” these illegal practices still blight the contemporary world.5

U.S. President Barack Obama stated the following about human trafficking: “It ought to concern every person, because it is a debasement of our common humanity. It ought to concern every community, because it tears at our social fabric. It ought to concern every business, because it distorts markets. It ought to concern every nation, because it endangers public health and fuels violence and organized crime. I’m talking about the injustice, the outrage, of human trafficking, which must be called by its true name—modern slavery.”6

Much of the current strategic efforts to fight slavery focus on victim identification, rescue and restoration, and the prosecution of the traffickers. The International Labour Organization estimates that slavery generates $150 billion into the global economy.7 It is strongly believed that much of that revenue—from sectors including agriculture, construction, manufacturing, entertainment, mining, forestry and fishing—is passing into and through the banking system undetected. According to a Thomson Reuters article on human trafficking, “A simple and logical deduction would infer that denying criminals this profit, or simply disrupting the flow of finances in this transnational trade, would significantly compromise illicit operations.”8 This is an area where banks and other financial institutions can play a key role.

Human Trafficking and AML

As part of the global financial system, banks and other financial institutions can become an effective instrument against facilitating the proceeds from slavery.

Although not every jurisdiction has a specified predicate offense for human trafficking yet, the Financial Action Task Force (FATF), which sets the de facto global standard in anti-money laundering (AML) and counter-terrorist financing (CTF) regulations, has included human trafficking, as well as associated crimes (i.e., sexual exploitation, kidnapping, illegal restraint, etc.) in its FATF Recommendations as designated categories of money laundering offenses for a number of years.9

The U.N. Convention against Transnational Organized Crime, adopted by General Assembly Resolution 55/25,10 entered into force on September 29, 2003, and was further supplemented by the Protocol to Prevent, Suppress and Punish Trafficking in Persons, especially Women and Children.11 The U.N.’s view on human trafficking, as an organized crime, is very clear.

The AML risk to the financial system from human trafficking resulted in FATF publishing a specific study in 2011 on “Money Laundering Risks Arising from Trafficking of Human Beings and Smuggling of Migrants.”12 The AML fundamentals are already in place.

The global financial system, under AML/CTF regulation has long precedence of systemic requirements, especially toward know your customer (KYC), customer due diligence (CDD) and transaction surveillance. Comprehensive KYC and CDD processes and procedures should identify clients that may be benefiting from or facilitating the funds from the proceeds of slavery.

In addition, financial institutions are required to conduct a risk-based approach (RBA)13 to their AML/CTF programs to identify, assess and understand the money laundering and terrorist financing risks to which they are exposed and take AML/CTF measures commensurate those risks in order to mitigate them effectively. RBAs should include the risk of handling the proceeds of human trafficking on behalf of their clients.

Tools and Resources to Assess Risk

There are a number of existing tools and resources that can be leveraged by banks and other financial institutions to help them form a strategy to include the risk of human trafficking into their decision making.

In assessing geographic risk, there are several indices of country risk:

- U.S. State Department’s Trafficking in Persons Report—This is an annual assessment of each country. Each country is placed onto one of three tiers based on the extent of their governments’ efforts to comply with the “minimum standards for the elimination of trafficking” found in Section 108 of the Trafficking Victims Protection Reauthorization Act (TVPRA).14

- Global Slavery Index—This index presents a ranking of 167 countries based on the percent of a country’s population that is estimated to be in modern slavery. The graph below highlights 10 countries with the highest number of people in modern slavery.15

In assessing industry/product risk, there are several sources of industry/product risk:

- U.S. Department of Labor List of Goods Produced by Child Labor or Forced Labor—This is a list of goods believed to be produced by child labor or forced labor in violation of international standards—as required under TVPRA—and their source countries. This list can be found on the U.S. Department of Labor website.16

- U.S. Department of Labor List of Products Produced by Forced or Indentured Child Labor—This is a list of products (and their source countries) produced by forced or indentured child labor, pursuant to Executive Order 13126. Executive Order 13126 is “intended to ensure that U.S. federal agencies do not procure goods made by forced or indentured child labor.”17

- Verite’s Research on Risk in 43 Commodities Worldwide—This report presents narratives on 43 of the world’s most important primary commodities, describes the connection, if any, between the commodity and forced labor and/or child labor, as well as documented instances of human trafficking in the industry.18

Tools and Resources for Surveillance

There are a number of resources on slavery red flag indicators and typology information that may assist banks when optimizing their client risk assessment and client transaction surveillance systems.

- FinCEN—“Guidance on Recognizing Activity that May Be Associated with Human Smuggling and Human Trafficking: Financial Red Flags”19

- The Bankers’ Alliance Against Trafficking—“Human Trafficking: Customer and Financial Transaction Traits That May Present Risk”20

- Finance Against Trafficking—“Suspicious Financial Activity and Human Trafficking Red Flags”21

- FATF—“Money Laundering Risks Arising from Trafficking of Human Beings and Smuggling of Migrants”22

Banks should use human trafficking typologies from global, regional and domestic sources to refine their surveillance rules and strategies, as well as client risk assessment.

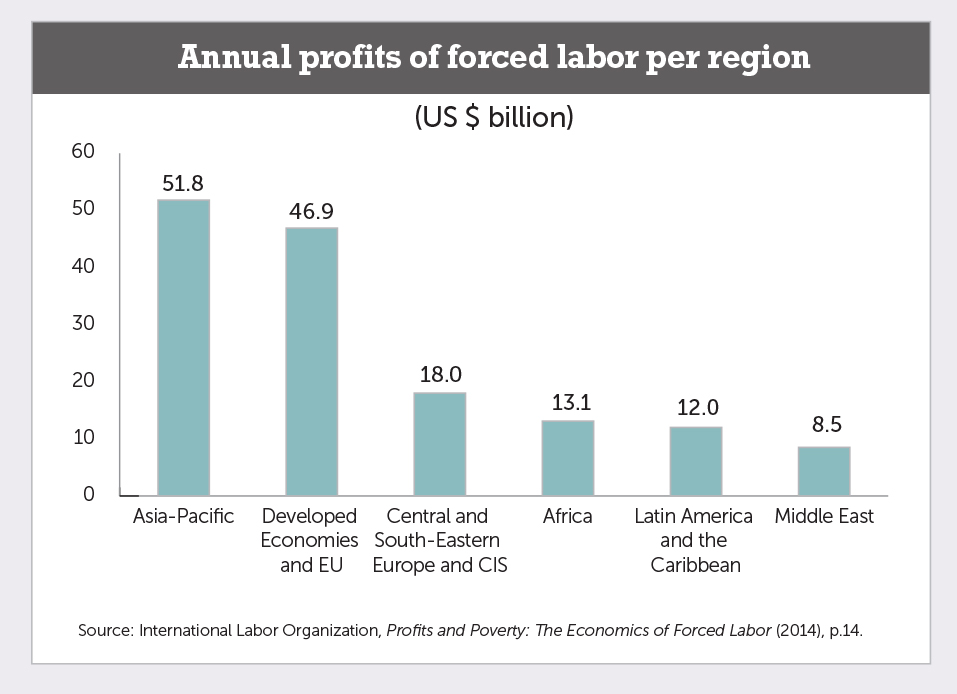

However, there is a shortage of typology information available, especially from the Asia/Pacific region. As shown in the graph below, the Asia/Pacific region accounts for the largest number of forced laborers in the world.

Although there are over 50 percent of the world’s slaves coming from Asia-Pacific and they have the largest annual profits of forced labor, there are very few typologies coming from this region. There is a significant need for typologies from Asia-

Pacific countries, local “on the ground” Asia-Pacific sources and current Asia-Pacific methodologies.

Tools and Resources for KYC/CDD

In order to assess whether clients are potentially involved in or at risk from facilitating or benefiting from the proceeds of slavery, it is imperative that banks include the need to screen for adverse keywords for slavery in their KYC/CDD processes.

For example:

- Internal staff handling client reviews at new-to-bank client onboarding and existing-to-bank client scheduled reviews should include adverse keywords for slavery in adverse media searches.

- External due diligence firms should be required to include adverse keywords for slavery in CDD research and reports.

- Third-party databases should be required to include coverage for human trafficking, forced labor and slavery content.

Lists of adverse words and phrases commonly used in reference to human trafficking and modern slavery can be obtained from http://www.humantraffickingsearch.net/glossary-and-definitions.

Conclusion

There is no doubt that the involvement of banks, to turn their powerful AML/CTF infrastructure to collectively focus on monitoring for payments and clients involved in or benefiting from the proceeds of slavery, will undoubtedly enhance efforts against slavery. There is little that needs to change from the existing AML/CTF processes and procedures already in place. What does need to be done is to incorporate the risk of human trafficking into the existing infrastructure.

What is needed is more information on typologies about slavery, made readily available from local financial intelligence units and from FATF regional subgroups in their regular typology working groups, and emphasis placed at all levels—global, regional, country, bank—to make the identification and mitigation of clients and proceeds from slavery a priority. The end game should always be to put slavery out of business before the numbers trapped in slavery grow further.

The author makes no representation as to the accuracy of the data from the various sources, nor the degree of weight that should be attributed to such sources, if any.

- The Global Slavery Index, http://www.globalslaveryindex.org/findings/

- “What is modern slavery?,” U.S. Department of State, http://www.state.gov/j/tip/what/

- “What is modern slavery?,” Anti-Slavery, http://www.antislavery.org/english/slavery_today/what_is_modern_slavery.aspx

- “Potential Indicators of Slavery and Human Trafficking,” National Crime Agency, December 2014, http://nationalcrimeagency.gov.uk/publications/631-potential-indicators-of-slavery-and-human-trafficking/file

- “What is modern slavery?,” Anti-Slavery, http://www.antislavery.org/english/slavery_today/what_is_modern_slavery.aspx

- “Office to Monitor and Combat Trafficking in Persons,” U.S. Department of State, http://www.state.gov/j/tip/

- “Forced labour, human trafficking and slavery,” ILO, http://www.ilo.org/global/topics/forced-labor/lang--en/index.htm

- Duncan Jepson and B.C. Tan, “The role of intelligence in the disruption of human trafficking, slavery and forced labor,” Thomson Reuters, December 2, 2015, http://thomsonreuters.com/en/articles/2015/disrupting-human-trafficking-slavery-forced-labor.html

- “The FATF Recommendations,” FATF, February 2012, http://www.fatf-gafi.org/media/fatf/documents/recommendations/pdfs/FATF_Recommendations.pdf

- United Nations Convention against Transnational Organized Crime and the Protocols Thereto,” UNODC, https://www.unodc.org/unodc/en/treaties/CTOC/index.html

- “Human Trafficking,” UNODC, https://www.unodc.org/unodc/en/human-trafficking/what-is-human-trafficking.html

- “Money Laundering Risks Arising from Trafficking of Human Beings and Smuggling of Migrants,” FATF, July 2011, http://www.fatf-gafi.org/publications/methodsandtrends/documents/moneylaunderingrisksarisingfromtraffickingofhumanbeingsandsmugglingofmigrants.html

- “Guidance for a Risk-Based Approach: The Banking Sector,” FATF, October 2014, http://www.fatf-gafi.org/media/fatf/documents/reports/Risk-Based-Approach-Banking-Sector.pdf

- “Trafficking in Persons Report,” U.S. Department of State, July 2015, http://www.state.gov/documents/organization/245365.pdf

- The Global Slavery Index, http://www.globalslaveryindex.org/findings/

- “List of Goods Produced by Child Labor or Forced Labor,” U.S. Department of Labor, December 1, 2014, https://www.dol.gov/ilab/reports/pdf/TVPRA_Report2014.pdf

- “List of Products Produced by Force or Indentured Child Labor, U.S. Department of Labor, http://www.dol.gov/ilab/reports/child-labor/list-of-products/index-country.htm

- “Strengthening Protections Against Trafficking in Persons in Federal and Corporate Supply Chains,” Verite, 2016, http://www.verite.org/sites/default/files/images/Verite-CommodityReports-2016%200229.pdf

- “Guidance on Recognizing Activity that May Be Associated with Human Smuggling and Human Trafficking,” FinCEN, September 11, 2014, https://www.fincen.gov/statutes_regs/guidance/pdf/FIN-2014-A008.pdf

- “Human Trafficking: Customer and Financial Transaction Traits that May Present Risk,” Bankers’ Alliance Against Trafficking, February 17, 2014, http://www.osce.org/secretariat/115618?download=true

- “Finance Against Trafficking Resources,” Finance Against Trafficking, http://financeagainsttrafficking.org/resources/?path=resources

- “Money Laundering Risks Arising from Trafficking in Human Beings and Smuggling of Migrants,” FATF, July 2011, http://www.fatf-gafi.org/documents/documents/moneylaunderingrisksarisingfromtraffickingofhumanbeingsandsmugglingofmigrants.html