The ninth annual Anti-Money Laundering and Counter-Terrorist Financing Supervision Report 2019-201 issued by HM Treasury in the UK highlights notable changes in supervisory activity and fines that supervisors have issued. Civil penalties continue to rise year on year as the Financial Conduct Authority (FCA) exercises its power to curb breaches of money laundering regulations across financial institutions.

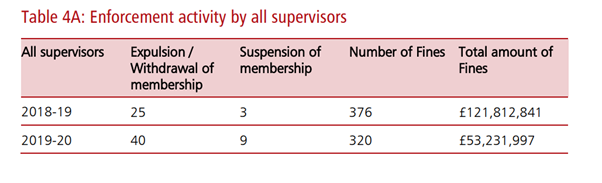

The report opens by commenting favourably on the improvements made in various areas of supervision. Table 4A below was extracted from this report, which shows that the number of expulsions and/or withdrawals of memberships and suspensions issued by the FCA have almost doubled when compared to that of the previous testing period. The report provides information about the performance of anti-money laundering/counter-terrorist financing (AML/CTF) supervisors between 6 April 2019 to 5 April 2020.

Notably, the table shows a decrease in the number of fines and the total monetary value applied when compared to the previous reporting period. The HM Treasury report states that ‘overall, the data suggests that enforcement action has slightly decreased since 2018-19, with the total number of fines issued dropping from 376 to 320. Approximately 32% of supervisors reported an increase in the total value of fines they issued, 36% supervisors reported an increase in the number of fines they issued. The total sum of fines has decreased from £121.8 million in 2018-19 to a total of £53.2 million in 2019-20. This year’s figure does not include the FCA’s second largest financial penalty ever imposed (£102 million) because this was mentioned in last year’s report, despite it being issued 9 April 2019 and so technically falling within the 2019-20 reporting period.’2 By excluding this fine from both sets of figures reported by HM Treasury, it shows that the total sum of the fines issued in 2019-20 has doubled when compared to the total reported for 2018-19, which would have stood at 19.8 million pounds.

The FCA fined Standard Chartered Bank 102,163,200 million pounds for AML breaches between November 2009 to December 2014, the second largest fine for AML control failings issued by the FCA.3 In the statement issued by the FCA: ‘Standard Chartered’s oversight of its financial crime controls was narrow, slow and reactive. These breaches are especially serious because they occurred against a backdrop of heightened awareness within the broader, global community, as well as within the bank, and after receiving specific attention from the FCA, US agencies and other global bodies about these risks. Standard Chartered is working to improve its AML controls to ensure all issues are fully addressed on a global basis. The FCA has taken into account Standard Chartered’s remediation work and its cooperation in assisting the FCA investigation, without which today’s financial penalty would have been even higher.’4

A more recent example is the 2021 criminal prosecution undertaken by the FCA against NatWest Bank. The bank reportedly pleaded guilty to three offences under the UK money laundering regulations, covering a period from November 2012 until June 2016. This was the first time a financial institution had faced criminal prosecution by the FCA, and it led to a fine of just over 264 million pounds being applied in December 2021. In a related press release the FCA stated ‘NatWest is responsible for a catalogue of failures in the way it monitored and scrutinised transactions that were self-evidently suspicious. Combined with serious systems failures, like the treatment of cash deposits as cheques, these failures created an open door for money laundering. Anti-money laundering controls are a vital part of the fight against serious crime, like drug trafficking, and such failures are intolerable ones that let down the whole community, which, in this case, justified the FCA’s first criminal prosecution under the Money Laundering Regulations.’5

It is also worth noting that all supervisors have a full range of enforcement tools at their disposal and are expected to investigate any failure to comply with the money laundering regulations, and to consider appropriate sanctions that are effective, proportionate and dissuasive. It also worth remembering that an enforcement action may not always result in fines. It is essential for financial institutions to proactively engage with their regulators at the earliest opportunity.

Although the report issued by HM Treasury concludes that the actions taken by UK supervisors have remained broadly consistent with the previous reporting period, it also notes that there is still more work to do to achieve greater consistency in their supervision and enforcement approach. The report further states that the UK government is working with supervisors to implement several actions as set out in their Economic Crime Plan to improve the AML/CTF supervisory regime. As part of the Economic Crime Plan, HM Treasury is undertaking a broad review of the money laundering regulations and the Office of Professional Body Anti-Money Laundering Supervision (OPBAS) regulations in 2022. This should further ensure that the system is as effective and as focused as it can be and aims to provide further clarity in areas for businesses and AML supervisors to enhance the UK’s AML/CTF supervisory regime.

The report highlights the strengthened position of the UK’s supervision regime through the FCA’s guidance and support to AML supervisors and businesses, as well as the robust and decisive actions it has taken, including appropriate enforcement measures applied.

Conclusion

Regulators across the globe remain committed to further strengthening their approach and tightening their AML/CTF defences and this is likely to further increase civil and financial penalties. For example, Seychelles is prosecuting its first major money laundering case for allegedly laundering 50 million dollars.6 The Federal Board of Revenue from Pakistan has won its first money laundering conviction based on tax evasion dating back to 2015.7 In Malaysia, a former bank officer has been charged with 14 counts for money laundering activities that took place between 2017 and 2019.8 Maintaining robust and effective AML/CTF controls is now more important than ever, and we all have a part to play to ensure that we do not end up at the wrong end of the civil penalty’s regime.

Sharon Sargeant, compliance consultant, Baker Regulatory Services, St Helier, Jersey, sharonsargeant@bakerregulatory.com, LinkedIn

- “Anti-money laundering and counter-terrorist financing: Supervision Report 2019-20,” GOV.UK, 19 november 2021, https://www.gov.uk/government/publications/anti-money-laundering-and-counter-terrorist-financing-supervision-report-2019-20

- Ibid.

- “FCA fines Standard Chartered Bank £102.2 million for poor AML controls,” Financial Conduct Authority, https://www.fca.org.uk/news/press-releases/fca-fines-standard-chartered-bank-102-2-million-poor-aml-controls

- Ibid.

- “UK: NatWest fined £264m in landmark criminal money laundering case,” IFC, 14 December 2021, https://www.ifcreview.com/news/2021/december/uk-natwest-fined-264m-in-landmark-criminal-money-laundering-case

- Scilla Alecci and Will Fitzgibbon, “Massive money-laundering probe heartens anti-corruption activists but fails to lift Pandora Papers’ pall over Seychelles,” International Consortium of Investigative Journalists, December 1, 2021, https://www.icij.org/investigations/pandora-papers/massive-money-laundering-probe-heartens-anti-corruption-activists-but-fails-to-lift-pandora-papers-pall-over-seychelles/

- “FBR uncovers money laundering of Rs 1.40 billion,” Dunya News, https://dunyanews.tv/en/Pakistan/561282-FBR-uncovers-money-laundering-1.40-billion

- Sofia Nasir, “Ex-bank officer charged with allegedly laundering RM3.41 mil,” The Vibes, December 13, 2021, https://www.thevibes.com/articles/news/49563/ex-bank-officer-charged-for-laundering-rm3.41-mil#:~:text=Sofia%20Nasir%20BUTTERWORTH%20%E2%80%93%20A%20former%20bank%20officer,were%20read%20out%20before%20judge%20Nor%20Aini%20Yusof.