The Fourth EU Anti-Money Laundering Directive (4AMLD) came into force in 2015 and was due to be implemented in all EU countries by June 26, 2017.1 However, some countries did not make the implementation deadline in June 2017 as they did not have the necessary legislation in place such as Austria, where the legislation is anticipated to take effect in January 2018. With the exception of Austria, there are 16 countries that failed to meet the implementation deadline: Netherlands, Portugal, Romania, Slovakia, Latvia, Malta, Bulgaria, Cyprus, Croatia, Poland, Ireland, Lithuania, Greece, Estonia, Finland and Luxembourg. While some member states are late in the transposing procedure and are still conducting public consultations, some countries (e.g., Portugal, Latvia, Lithuania, Croatia and Luxembourg) have since implemented the directive, whilst other countries seem inclined to wait for the amendments of the 4AMLD (often referred to as the 5AMLD) which are currently still under negotiation.

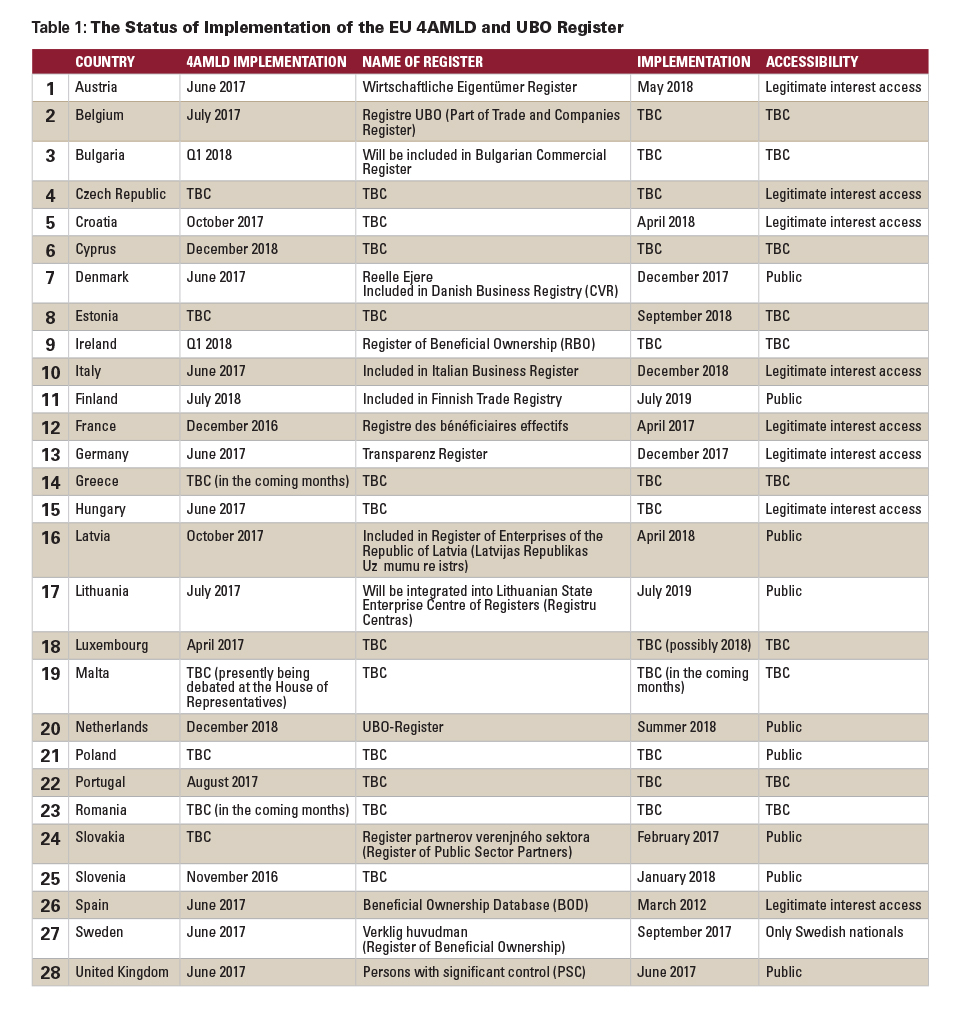

The following article sets out the current status of implementation of the 4AMLD and the launch of the ultimate beneficial ownership registry across the 27 EU member states as of October 2017.

Beneficial Ownership and the Drive for Increased Transparency

Besides increased focus on risk assessment and politically exposed persons, beneficial ownership has been one of the key topics of the 4AMLD. Article 30 of the EU 4AMLD “requires all EU [m]ember [s]tates to put into national law provisions around beneficial ownership information for corporate and legal entities,”2 which will enable the determination of the natural persons who are the real owners/controllers of a company.

Benchmarking activities assessing country performance on beneficial ownership transparency see the overall adequacy of national beneficial ownership transparency legislation within the EU overall as being strong and even very strong in some cases compared to non-EU countries. However, it should be noted that some countries, including Netherlands, Germany and Luxembourg, were listed as only being average.3

Beneficial Owner Definitions

The Financial Action Taskforce and the EU 4AMLD define the beneficial owner as “the natural person(s) who ultimately owns or controls a customer and/or the natural person on whose behalf a transaction is being conducted. It also includes those persons who exercise ultimate effective control over a legal person or arrangement.”

This includes, in the case of a corporate entity:

- A natural person who ultimately owns or controls the company through direct or indirect ownership of more than 25 percent of the shares or voting rights or ownership interest, or through “control via other means” or

- If no one is identified (having exhausted all possible means and provided there are no grounds for suspicion) or if there is any doubt that the person identified is the beneficial owner, then the natural person who holds the position of “senior managing official.”

The ultimate beneficial owner (UBO) requirements, as set out in the 4AMLD, are as follows:

- Companies and other legal entities must obtain and hold adequate, accurate and current information on their beneficial owners, including the name, date of birth, place of residence, and nature and extent of beneficial ownership.

- Information on beneficial ownership will be held on central registers in the relevant country and must be adequate, accurate and current.

- Information on the central registers will be accessible to competent authorities, financial intelligence units, entities required to undertake customer due diligence and any person that can demonstrate a “legitimate interest.”

The EU requirements have been or are in the process of being translated into local legislation and the way in which this is done varies considerably across the 27 EU member states. Typical variations include:

- The types of entities included in the register

- Sometimes trusts are included and sometimes they are not

- Some registers are available to the public free of charge and others require a fee for access

- Some registers are only accessible to those with a legitimate interest

Gaining an oversight of the differences in implementation requirements is a challenge in its own right.

Verification and sanctions mechanisms also vary considerably. Some “countries foresee mechanisms in their new legislation to ensure that the information in beneficial ownership registers is verified.”4 Some do not “provide for any sanction[s] applicable to the company and/or the beneficial owner for failure to report accurate beneficial ownership information to the central registers.”5

Table 1 sets out the current status of the implementation of the EU 4AMLD and of the UBO register. Some of the countries have not provided a clear timeline for implementation and some of the responsible ministries did not respond to my request at the time of writing.

Finding the Balance: Transparency and Data Privacy

One of the main drivers hindering the drive for more transparency is privacy rights, which is currently an important factor not least in relation to the implementation of the General Data Protection Regulation. “Fundamental rights of data and [the] data protection legislation in the EU allows making information available to the public when [it] is legitimate, necessary and proportionate.”6 Therefore, necessary safeguards, including adequate policies and procedures, must be in place to ensure that public beneficial ownership information of companies and trusts is in conformity with data protection legislation and privacy rights.

Combating Tax Evasion

“The EU has made significant progress in recent years to enhance tax transparency and to strengthen cooperation between member states’ tax authorities. Recent amendments to AML legislation recognize the links between money laundering and tax evasion, as well as the challenges faced in prevention.”7 A revised version of the Council Directive 2011/16/EU on administrative cooperation in the field of taxation came into force in 2016. This updated Directive (2014/107/EU) brings the EU rules in line with the global Standard for Automatic Exchange of Financial Account Information in Tax Matters developed by the Organisation for Economic Co-operation and Development and also meets the comprehensive automatic exchange of information in line with the U.S. Foreign Account Tax Compliance Act (FATCA) regime.

Even though for data privacy reasons, some EU member states have decided not to make ownership information relating to trusts publicly available, but instead have chosen to create separate registries with limited access. These registries will be accessible to those tax authorities, which have been granted access due to the mandatory automatic exchange of information starting from January 1, 2018. The directive will require member states to provide access to information on the beneficial ownership of companies and will enable tax authorities to access that information in monitoring the proper application of rules on the automatic exchange of tax information.8

Conclusion

It is of paramount importance that organizations go beyond identifying the immediate beneficial owner

Following the Paradise Papers scandal in early November 2017, one year after the Panama Papers, there will be even more pressure on countries to increase transparency linked to ownership structures in order to prevent tax evasion and other forms of financial crime, and to improve the framework governing our financial system as well as its integrity. Therefore, it is of paramount importance that organizations go beyond identifying the immediate beneficial owner, who when linked to offshore jurisdictions is often merely a frontman linked to an incorporation agent or a legal advisor. UBO registries will be helpful in this regard, but in many high-risk situations (especially in jurisdictions with limited transparency and disclosure requirements) will not be sufficient in order to identify the UBO and meet the necessary compliance and regulatory requirements needed to protect an organization’s reputation.

- Jennifer Hanley Giersch, “Europe’s Upcoming Fourth AML/CTF Directive,” ACAMS Today, December 2014-February 2015, http://www.acamstoday.org/europes-upcoming-fourth-aml-cft-directive/

- “Beneficial Ownership Register,” 2017, https://www.cro.ie/Registration/Company/Incidental-Obligations/Beneficial-Ownership-Register/mid/1612/dnnprintmode/true?SkinSrc=%5BG%5DSkins%2F_default%2FNo+Skin&ContainerSrc=%5BG%5DContainers%2F_default%2FNo+Container

- “Under the Shell: Ending Money Laundering in Europe,” Transparency International EU, 2017 https://transparency.eu/wp-content/uploads/2017/04/EBOT-REPORT-TIE-014-16_clean.pdf

- Ibid.

- Ibid.

- Ibid.

- “Taxation Council Adopts Directive on Access to Beneficial Ownership Information,” European Council, June 12, 2016, http://www.consilium.europa.eu/en/press/press-releases/2016/12/06-beneficial-ownership-information/

- Ibid.