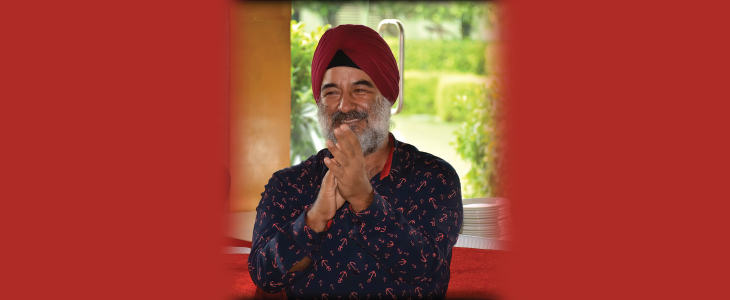

ACAMS Today spoke with Ranjit Malik, CAMS, regional director for business development in the Indian subcontinent at ACAMS, to discuss ACAMS' growth in India, the South India Chapter and what India’s anti-financial crime professionals can expect in 2019. Malik helped increase the ACAMS membership in the region from 500 in 2013 to nearly 4,000 five years later. Malik has experience in sales-related positions in the banking industry, spanning 20 years in institutions such as American Express, Citibank and Deutsche Bank. His most recent role was in 2010 as head of business development and sales for World-Check in India, and then for Thomson Reuters upon its acquisition of World-Check. His U.S. educational degrees include an MBA from the Tuck School of Business at Dartmouth College in New Hampshire.

ACAMS Today: How did you first become involved with ACAMS?

Ranjit Malik: While I had heard about it earlier, my first real interaction with ACAMS occurred in 2012 when Ms. Hue Dang, the head of Asia, met me in New Delhi over lunch and tried to convince me to move from Thomson Reuters, where I was working at the time, to ACAMS. It took us about a year of discussions, but I finally took the plunge in July 2013 and have been here ever since (and I have never looked back).

One other distinct memory I have of that lunch with Hue is that she tried to persuade me to take my CAMS exam quickly while I was still at Thomson Reuters, something that I never got around to doing at the time, and kept procrastinating on even after I had joined ACAMS. It took me nearly three more years before I finally became CAMS-certified in March 2016.

AT: What is the best part of your job?

RM: The best part of my job is that I never have to worry about the suitability or appropriateness of the products and proposition that I sell to any client. This was not always the case during my banking days and this has been a welcome change ever since I joined the compliance industry eight and a half years ago. There is a special feeling that goes with knowing that what you are doing has a positive impact on both the clients that I interact with as well as society as a whole.

AT: You have been with ACAMS for five years now. What are some substantial changes you have witnessed in both ACAMS and the compliance landscape?

RM: ACAMS has certainly undergone a change in the last five years in the sense that we are no longer a small, private, unlisted company but rather a division of a much larger, listed company. This is evident in the significant growth we have seen in the last five years, in terms of our membership, which has increased from around 15,000 members to 67,000 plus today. Our product range now includes a whole host of certificate courses in addition to our flagship CAMS certification, an increasing interest in Advanced Certification, and finally the exponential growth in our chapters all over the world.

In terms of the broader compliance landscape, we are witnessing a situation where compliance professionals are beginning to take charge of their career developments and are proactively signing up for our certifications and certificate courses rather than being “instructed” to do so by their companies. Most of the companies that I deal with now have a program in place whereby they encourage people to undergo certifications on their own and then reimburse them on successful completion rather than forcibly enrolling them in large groups. The other interesting fact that I have observed is that when I joined ACAMS five years ago, we used to highlight the benefits of the CAMS certification by pointing out that those who were CAMS-certified could command a salary that was 35 to 40 percent higher than those who were not certified. Now the narrative is that if you do not have CAMS (or an equivalent higher certification), you will no longer be able to have a meaningful career in the compliance industry. Five years ago, people used to differentiate themselves by getting the CAMS certification. Today, they differentiate themselves by pursuing Advanced Certifications (CAMS-Audit and CAMS-FCI).

AT: You work closely with the ACAMS South India Chapter. How does this chapter help bolster ACAMS membership in India?

RM: The ACAMS South India Chapter was set up in April 2016 to cater mainly to the outsourcing industry in India. The chapter is a bit unique in the sense that it started out as a request from one of our larger clients in Chennai. By the time it was actually launched, it encompassed the three large cities of South India, namely Chennai, Bangalore and Hyderabad. The unique feature introduced by this chapter was the concept of virtual attendance from the cities other than the host city (i.e., when Chennai was hosting an event, Bangalore and Hyderabad could join in by video conference and subsequent to the presentation, each of the cities would have a separate networking get-together with refreshments). With this unique model in place, we added Gurgaon—another outsourcing hub—to the list of cities this year.

Since the South India Chapter was set up to cater to the unique requirements of the outsourcing industry in India with an emphasis on global regulations, we are looking at starting a separate Mumbai Chapter in the first quarter of 2019 to cater to the requirements of the local Indian financial institutions with an emphasis on local regulations. The South India Chapter helped us move from a membership of 1,500 to 4,000 people in three years. We hope that the addition of the Mumbai Chapter will help us achieve a much larger membership number in the not-too-distant future.

AT: What obstacles will anti-financial crime professionals in India face in 2019?

RM: People working in anti-money laundering (AML) and in financial crime compliance (FCC) in India are going to face increasing pressure and scrutiny from the regulators ahead of 2021 when India will undergo its Financial Action Task Force mutual evaluation. In the background of some well-publicized financial scams and other AML lapses by some very large public sector banks in India, the regulators are going to become increasingly vigilant in the next couple of years and we are likely to see quite a few large penalties being handed out over the next year or so. Training and capacity building are going to be increasingly important for all financial institutions large and small in the next year. In short, AML and FCC professionals will be kept quite busy in the next couple of years.

AT: What do you like to do in your spare time?

RM: In my spare time, I like to spend time with my family, which consists of my wife, 20-year-old son and 17-year-old daughter, and we like traveling to different parts of the world and seeing new places. For the past three summer vacations, we have embarked on a Mediterranean cruise, a holiday on the west coast of the U.S., which included a short Mexican Riviera cruise, and a ten-day long holiday in Mauritius. My other passion is playing golf and I usually get in at least one round of 18 holes on the weekend.

For information on how you can join a local chapter to discuss and learn about region-specific issues, please visit http://www.acams.org/acams-chapters/.